For more than three decades, investors have been privy to no shortage of next-big-thing trends and game-changing innovations. Pie-in-the-sky addressable markets assigned to new innovations often lead to premium valuations for the companies leading the charge.

While the development and eventual bursting of bubbles is something of a common theme on Wall Street, when examined over the long run, some bubbles have proved easier to spot than others.

Image source: Getty Images.

As someone who's been putting their money to work in the stock market for 27 years, I've seen my fair share of expensive companies on the leading edge of next-big-thing trends. While some of these powerhouses have proved me wrong and sustained some of their premium, most eventually succumb to historical headwinds.

At the moment, artificial intelligence (AI) is the hottest thing since sliced bread on Wall Street -- and AI-data-mining specialist Palantir Technologies (PLTR 3.45%) is, without a shadow of a doubt, the most overvalued megacap stock (i.e., companies with market caps north of $200 billion) I've ever witnessed.

Palantir's sustainable moat has made it one of the tech sector's most important companies

Let me be clear that my issues with Palantir (which I'll discuss in detail in a moment) are prominently valuation-based. Palantir's ascent from a $15 billion market cap at the end of 2022 to a $352 billion market cap, as of this writing on July 22, wasn't an accident. It's a reflection of investors being excited about the company's sustainable moat, growth rate, and ideal positioning under the Donald Trump administration.

There are few things investors value more on Wall Street than irreplaceability. If your business offers something that no other businesses can deliver at scale, it often results in investors bestowing a premium valuation on your stock.

NASDAQ: PLTR

Key Data Points

Palantir's two operating segments -- Gotham and Foundry -- certainly fit this mold. Gotham is an AI- and machine learning-fueled software-as-a-service platform that collects and analyzes data, as well as assists with military mission planning and execution. There's nothing comparable to Gotham, which ensures the multiyear contracts this segment lands generate highly predictable annual sales and operating cash flow.

Meanwhile, Foundry assists businesses by helping them make sense of their big data, which can entail optimizing supply chains and automating certain aspects of the decision-making process. Foundry is a relatively newer subscription-based segment that's growing like a weed.

Speaking of growth, Palantir has pretty consistently maintained an annual sales growth rate in the 25% to 35% range. A number of sizable government contracts, many of which stretch over four or five years, have helped it sustain this robust top-line growth rate.

Furthermore, Palantir made the shift to recurring profitability well ahead of Wall Street's consensus expectation. Generating a recurring profit validates Palantir's dual-platform operating model and affords the faster-growing Foundry a lengthy runway to get up to speed.

Lastly, investors appreciate Palantir's positioning as a key defense stock under a unified Republican government. President Trump has made national security a key focus of his second term, which ties in perfectly to Palantir's Gotham platform.

Image source: Getty Images.

Palantir is the priciest megacap stock of the century

Among the stock market's thousands of publicly traded companies, I can pinpoint quite a few whose valuations make no sense whatsoever. But among the very select class of industry leaders and Wall Street's most-influential businesses, there hasn't been a megacap stock this century that's rivaled Palantir from a valuation standpoint.

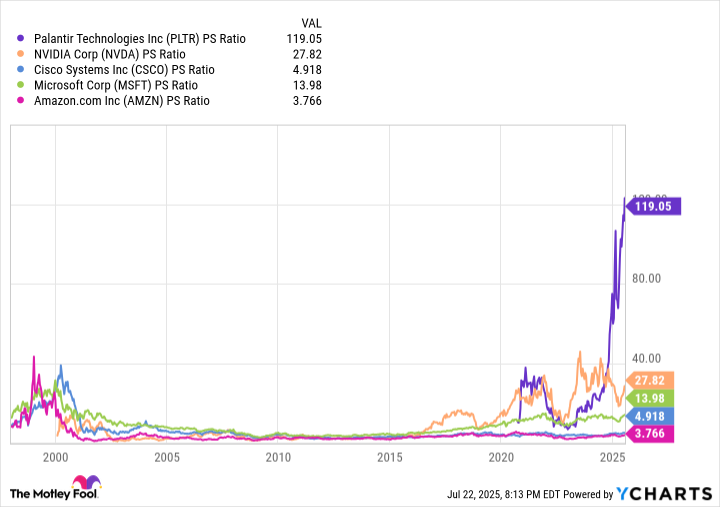

When looking back three decades, there have been quite a few instances where cutting-edge businesses topped out at price-to-sales (P/S) ratios in the neighborhood of 30 to 40. Prior to the bursting of the dot-com bubble, networking solutions provider Cisco Systems, e-commerce giant Amazon, and software legend Microsoft all topped out at trailing-12-month (TTM) P/S ratios ranging from 31 to 43.

More recently, AI graphics processing unit goliath Nvidia peaked at a P/S ratio of more than 42 last summer. Although its current TTM P/S ratio of 28 is still inordinately high, it's nowhere close to Palantir Technologies.

As you'll note, Palantir's TTM P/S ratio of 119 makes the prior P/S peaks from the likes of Cisco, Amazon, Microsoft, and Nvidia look more like blips.

PLTR PS Ratio data by YCharts.

Regardless of addressable market size or investor hype, no megacap stock has ever been able to maintain a TTM P/S ratio of 30-plus over an extended period. What's wild is that Palantir's stock is valued at four times this line-in-the-sand level, which demonstrates just how far outside of historic norms its valuation has ascended.

There are other concerns with Palantir that should be taken into consideration -- especially with its stock trading at 119 times TTM sales. For instance, there's not much clarity on defense spending beyond early 2027. Although President Trump is in office through January 2029, midterm elections have the potential to shake-up Congress in 18 months. It's not clear if defense spending will remain a top priority beyond the next six quarters.

Investors should also be aware that while Gotham has been nothing short of a superstar for Palantir, its addressable market is quite limited. Its platform is only available to the U.S. and its immediate allies, which takes quite a bit of potential revenue opportunity off the table.

Another worry is that next-big-thing innovations have always endured early stage bubble-bursting events. Though Palantir's multiyear government contracts and subscription revenue would help it avoid an immediate fall-off in sales, poor investor sentiment during a bubble-bursting event would almost certainly make Palantir stock a target.

The final puzzle piece, which makes Palantir's overvaluation even more egregious, is the quality of the company's profits. Ideally, Gotham and Foundry should be driving close to 100% of Palantir's income. However, 40% of its pre-tax income in 2024 came from interest earned on its cash, which isn't innovative or sustainable.

Let me be clear: I'm not trying to precisely call a top in Palantir stock. But I have little doubt in my mind that a substantial pullback is coming at some point in the not-too-distant future.