The market has soared to new all-time highs in a miraculous recovery from the April 2 "Liberation Day" tariff scare. That being said, the market certainly isn't out of the tariff woods, so to speak, and valuations have now rerated much higher than a mere three months ago.

That doesn't leave many "bargains" left in the market. However, the following three stocks have actually lagged the market's recovery because of unique company-specific circumstances. Yet each looks like a bargain at the moment from a longer-term perspective -- especially by today's valuation standards.

NASDAQ: ASML

Key Data Points

ASML Holdings

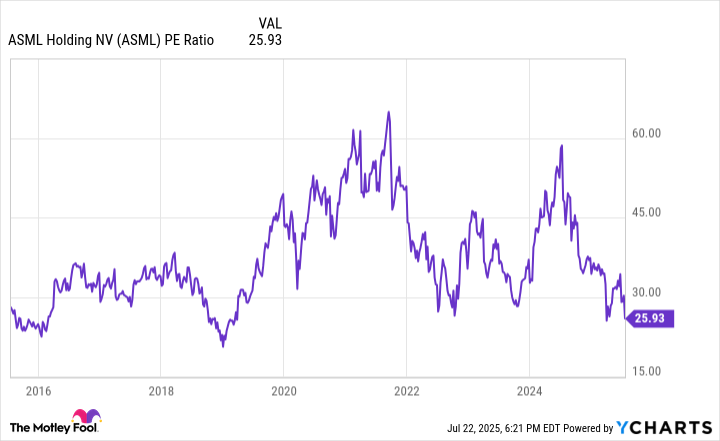

Semiconductor equipment giant ASML Holdings (ASML +8.85%) might not look "cheap" on the surface, but the stock is actually much cheaper than its recent history. In fact, at around 26 times earnings, the stock is now cheaper than it has been at any time over the past 10 years on a P/E basis except late 2018, just before extreme ultraviolent lithography (EUV) machine sales kicked off in earnest.

ASML PE Ratio data by YCharts

ASML has traded relatively expensively because it has a monopoly on that critical EUV technology, which is needed to make semiconductor chips with transistors 7nm apart and below. Those types of chips were first produced back in the 2019 time-frame, while the chip industry is currently producing 3nm chips and on its way to 2nm chips later this year or early next year.

But while ASML has typically traded at a premium, its valuation has fallen back relatively in line with other semicap equipment names. The most recent downturn in the stock happened this month after Q2 earnings, in which management withdrew guidance for 2026 being a "growth" year, because of tariff-related uncertainty in non-AI markets.

While management still projects a strong 15% growth this year, the prospect of a slowdown or decline in 2026 clearly spooked investors, sending the stock down some 15% from recent pre-earnings levels.

However, management didn't flag any decline in AI-related tailwinds, nor did it change its longer-term 2030 outlook for revenue between $44 billion and $60 billion, with gross margins between 56% and 60%. That compares with 2025 expectations of $32.2 billion in revenue and gross margins of just 52%.

While current tariff and geopolitical controversies may be causing a near-term pause or conservatism on the part of ASML's customers, it shouldn't make much of a difference in the stock's intrinsic value, as long as ASML's competitive advantages and AI-related growth tailwinds remain intact. As of now, those more important factors seem like they're holding strong.

Image source: Getty Images.

Booz Allen Hamilton

Consulting firm Booz Allen Hamilton (BAH +0.55%) remains more than 40% off its highs from last fall, on fears over the government's cost-cutting efforts. Booz Allen has become somewhat of an auspicious name in 2025, as the company essentially garners 100% of its business from the U.S. government. As such, investors have fled the stock because the company is the poster child for Department of Government Efficiency (DOGE) cuts.

However, Booz Allen is mostly involved in mission-critical, high-tech initiatives for the defense, space, and intelligence services, which encompass 65% of its revenue. That portion of the business is not only high-growth but should also be resistant to too much government austerity.

The other 35% of Booz's business is in civil services, and that is where recent DOGE cuts will hurt this year. On its last earnings conference call, Booz Allen management said it anticipates a low double-digit decline in the civil business this year in a one-time "reset."

Yet management still forecasts 0% to 4% growth for the whole company for the fiscal year, as the defense/intelligence segment continues to implement next-gen AI solutions into the government's arsenal. And if the civil business stabilizes next year, Booz Allen could see a reacceleration off of this new "base."

If that's the case, then Booz Allen's current below-market multiple of just 15 times trailing earnings seems way too cheap.

Booz also isn't pulling back from seeking out new tech-forward growth initiatives. The company recently committed $300 million to its Booz Allen Ventures portfolio, which invests in revolutionary defense and cyber-oriented tech startups. That's an increase from the prior $100 million commitment. Management believes it will invest in 20 to 25 new young companies over the next few years. If just one turns out to be a "home run" investment, that could make a big difference in this $14 billion stock, trading at its cheapest valuation in years.

Kulicke & Soffa

Technology chip packaging leader Kulcike & Soffa (KLIC +6.12%) has had a really rough run over the past year or so. After booming in the pandemic period, the company's core ball bonder business has been mired in a post-pandemic funk, as PCs, smartphones, and the auto industry all suffered from severe hangovers.

In addition, the company recently had to terminate and write off two significant projects. In 2024, K&S wrote off over $100 million from its advanced display business, after a large customer – supposedly, Apple -- ended its microLED initiative, to which K&S had invested resources. Then in May, K&S announced it would be winding down its money-losing electronics assembly business, resulting in yet another write-off of $87 million.

While these wind-downs are unfortunate, neither were in K&S' core chip packaging business, where K&S dominates. On that note, there was actually some positive commentary last quarter. After a long three-year digestion period, K&S management noted utilization of their tools in Taiwan and China -- where most non-auto electronics are assembled -- had reached 80% or more. That's about the rate at which one would expect customers to begin ordering more tools in earnest.

But K&S said that customers are holding off because of tariff-related fears. Still, they can only do so for so long if demand holds up. Given that this downcycle has been longer than the typical down-cycle, a strong recovery could be in the making.

Additionally, K&S also has a small but growing business in thermocompression bonding (TCB), which can be used in artificial intelligence logic and high-bandwidth memory advanced packaging. That business is expected to reach about $70 million this year, or just over 10% of this year's expected revenue. But management sees this growing fast on the back of AI demand to over $100 million in fiscal 2026, good for about 50% growth.

AI-related tailwinds in TCB combined with a recovery in the core ball bonding business could lead to significant upside, given that K&S stock is still a far 53% off its all-time highs.