C3.ai (AI 2.16%) and Palantir (PLTR +2.23%) are two of the most prominent AI stocks on the market today, each benefiting from substantial tailwinds in the AI space. Each is posting solid growth and doesn't appear to be slowing down anytime soon, which could bode well for investors looking to scoop up shares today.

But of the two, is there one that stands out as a better buy? Let's find out.

Image source: Getty Images.

The business models

Both Palantir and C3.ai provide data analytics software powered by AI to provide clients with actionable insights on what decisions should be made. They also allow users to implement AI automation through AI agents, further increasing their usefulness.

As for their customer bases, both Palantir and C3.ai have a significant presence in both government and commercial markets. In their latest quarters (C3.ai's Q4 FY 2025 ended on April 30), each had a fairly even split between these two sectors. For C3.ai, 31% of bookings came from government entities. For Palantir, 55% of its revenue came from the government.

NASDAQ: PLTR

Key Data Points

However, Palantir's edge comes from its customization. Palantir's platform enables users to build various AI applications, allowing them to be deployed in non-traditional ways. C3.ai focuses on pre-built applications that are more plug-and-play focused. The plug-and-play market is incredibly crowded, and several companies offer products similar to C3.ai. However, Palantir is on a different level when it comes to flexibility, which is why I think its business model stands out.

Winner: Palantir

Growth

Palantir's superior business model is also leading toward impressive growth. In Q1, its revenue rose an outstanding 39% year over year to $884 million. Additionally, it's expected to grow at a 38% pace in Q2. While this may appear to be a slowdown, Palantir's management consistently outperforms internal guidance, so its actual growth rate may be a couple of percentage points higher than this figure.

C3.ai's growth isn't slow by any means, but it's not experiencing the same level of growth as Palantir. In Q4 FY 2025, revenue rose by 26% year over year to $109 million. However, its growth is projected to trend in the wrong direction, with management expecting 20% revenue growth for FY 2026.

NYSE: AI

Key Data Points

Despite C3.ai's smaller size, it cannot match Palantir's superior growth. As a result, it's another win for Palantir.

Winner: Palantir

Profitability

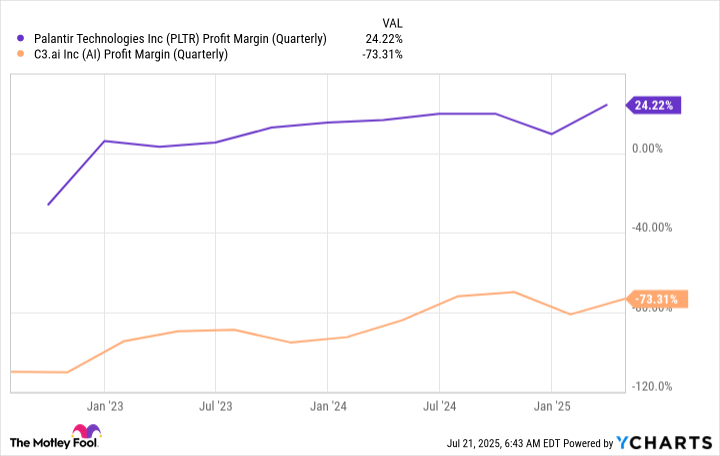

I really only need to put up one chart to declare a winner in the profitability space.

PLTR Profit Margin (Quarterly) data by YCharts

C3.ai is nowhere close to breaking even. It's burning an incredible amount of cash, and it will take years of growth before it's remotely profitable. Palantir boasts a healthy 24% profit margin in its most recent quarter, showcasing its commitment to growth and profitability.

Winner: Palantir

Valuation

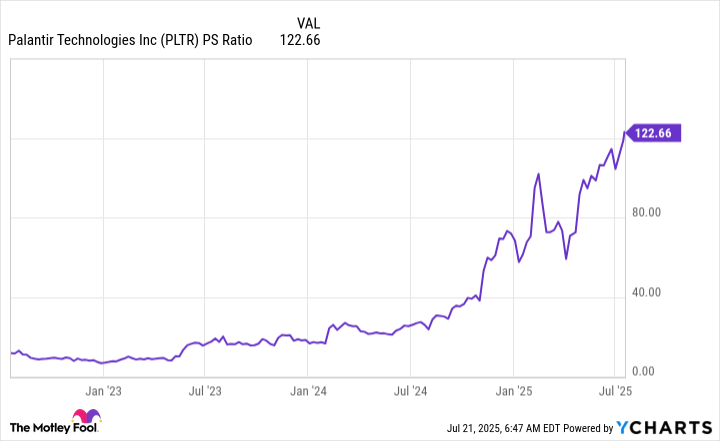

Right now, it's three points to zero in Palantir's favor. Considering this is the last attribute I'm evaluating, it may be easy just to assume that Palantir will win this analysis. However, it's probably the most important consideration in Palantir's investment thesis at the moment.

Yes, Palantir is growing rapidly, profitable, and has a fantastic business model. However, its stock has become so expensive that there's no room to make a profit.

PLTR PS Ratio data by YCharts

At over 120 times sales, Palantir's stock has reached a valuation level that few companies ever achieve. That's for good reason, as it will take years of growth to make the price tag look reasonable again. At Palantir's current 39% growth rate, this will take several years to achieve.

On the other hand, C3.ai's stock appears undervalued at 9.5 times sales.

AI PS Ratio data by YCharts

However, it's deeply unprofitable, so it has earned this cheap valuation.

So, which stock is the better buy between the two? I can say, without a doubt, that the better company to buy is Palantir. However, Palantir's stock has become so expensive that it will be difficult to make a profit in the future. Additionally, I don't want to buy C3.ai's stock just because it's cheap.

As a result, I think investors should look elsewhere for AI stocks. Many promising companies are succeeding in this landscape, and these two are not among the best ones to buy now.