Autonomous vehicles represent a critical chapter in the broader artificial intelligence (AI) narrative. Unlike chatbots or recommendation algorithms, autonomous vehicles portray a confluence of more nuanced, sophisticated protocols -- sensory processing, smart control systems, and dynamic logic converging into a single platform.

In essence, the rise of self-driving vehicles represents a shift from reactive tools with specific -- and sometimes limited -- applications to full-blown intelligent robotics systems integrated with the physical world.

While Tesla and Alphabet's Waymo receive much of the attention in autonomous vehicle technology development, I see Nvidia (NVDA 2.84%) as the company with the most upside in this space.

Let's explore how Nvidia is quietly playing a role in the autonomous driving landscape, and detail just how big of an opportunity this is for the king of the chip realm.

NASDAQ: NVDA

Key Data Points

How does Nvidia fit into the autonomous driving equation?

Nvidia offers a variety of AI infrastructure platforms that can be deployed across autonomous vehicle applications. Through its DGX platform, software developers can train neural networks to better understand a variety of real-world driving scenarios.

From there, these models can be stress tested through Nvidia's Omniverse platform, which allows developers to build detailed virtual environments and create vivid driving-related simulations. This is a critical service, as it allows companies to tweak and validate their autonomous vehicle systems prior to deploying services in the real world.

Nvidia already has a number of strategic partnerships in its autonomous vehicle ecosystem, including General Motors, Rivian Automotive, Toyota, BYD, Nuro, Lucid Group, Polestar, and Nio.

Image source: Getty Images.

How big of an opportunity is autonomous driving for Nvidia?

Estimates surrounding the total addressable market (TAM) for autonomous vehicles vary greatly. This is due to the fact that autonomous vehicles have a variety of different use cases, many of which are yet to reach a critical mass at this point in the AI revolution.

According to Markets.us, the global autonomous vehicle market is expected to expand at a compound annual growth rate (CAGR) of 41% through 2032 -- reaching a size of $4.2 trillion by early next decade.

If that sounds overzealous, consider that Nvidia CEO Jensen Huang has even projected a multitrillion-dollar opportunity at the intersection of robotics and automobiles.

Image source: Nvidia Investor Relations.

Per the chart above, Nvidia's automotive segment is still quite small compared to the company's data center business, which generates well in excess of $100 billion in annual revenue.

With the automotive business generating less than $2 billion in sales over the last year, Nvidia hasn't even captured 1% of the autonomous vehicle market. And yet, given the company's existing relationships with so many leading automobile manufacturers, I remain optimistic that the commercialization and wider adoption of autonomous vehicles will represent a transformative tailwind for Nvidia's business beyond data centers and chips.

Is Nvidia stock a buy?

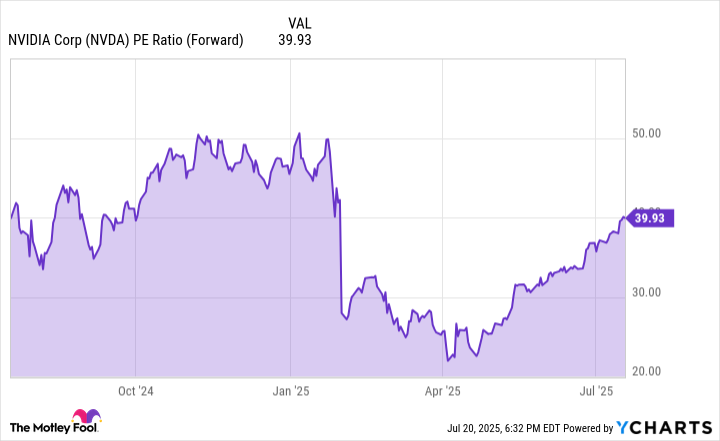

As of this writing, Nvidia trades for a forward price-to-earnings (P/E) multiple of 40. On the one hand, the chart clearly illustrates that this is well below the levels that Nvidia has previously witnessed. But on the other hand, trading at 40 times forward earnings is far from cheap.

NVDA PE Ratio (Forward) data by YCharts

Nevertheless, I tend to think that investors are largely valuing Nvidia based on its dominance in the AI data center market. In other words, I think that most investors are not accounting for long-term opportunities such as autonomous driving when it comes to Nvidia.

In my eyes, Nvidia is largely viewed as a chip designer and less as a full-stack software and hardware ecosystem spanning across myriad machine learning applications. In reality, Nvidia is far more prolific and ubiquitous than a semiconductor business.

While autonomous vehicles are not yet a mainstream AI application, Nvidia is uniquely positioned for growth as the technology scales. Moreover, given its agnostic approach to autonomous vehicle systems, I see Nvidia as less risky than betting on one horse, such as Tesla or Waymo, to win the race.

For these reasons, I think Nvidia is a no-brainer buying opportunity for investors with a long-term time horizon.