With its shares up an impressive 140% over the last 12 months, there is clearly a lot of momentum behind Archer Aviation (ACHR +0.00%), a California-based start-up tackling the burgeoning market for electric vertical takeoff and landing vehicles (eVTOLs). If things go as planned, this opportunity could mint plenty of millionaires, but will reality live up to the hype?

Let's dig deeper to see how Archer Aviation's story might play out.

Are eVTOLs the next big thing?

Improving battery technology turned electric cars from a fringe novelty purchase to a mainstream, multi-billion-dollar industry. But these innovations aren't limited to terrestrial use cases. With batteries now stronger, smaller, and lighter than ever, the value proposition for electric eVTOL helicopters will become increasingly compelling over time.

NYSE: ACHR

Key Data Points

The projections are tantalizing. According to analysts at Bloomberg, the eVTOL industry is already worth a billion dollars. Morgan Stanley believes it could soar to $1 trillion by 2040 as these aircraft disrupt the market for land-based taxis, gasoline-powered helicopters, and short-haul flights. But investors shouldn't see eVTOL adoption as a done deal.

These next-generation aircraft will have to pass through a rigorous testing and regulatory process with agencies such as the U.S. Federal Aviation Administration (FAA) and its global counterparts before they make it to primetime. This will probably be where most eVTOL firms wash out.

Archer Aviation's edge

Archer Aviation is one of the more promising eVTOL start-ups because of its unique business model. Instead of just making and selling the product, it aims to create a dual strategy where it sells some of its eVTOLs while also retaining others to build out its own air taxi service. If this strategy works, it will allow the company to avoid becoming just another low-margin original equipment manufacturer (OEM) in what already promises to be a competitive industry.

However, for investors, worrying about Archer Aviation's long-term strategy may be putting the cart before the horse. Right now, the company is at an extremely early stage in its lifecycle, and simply making it to any form of commercialization is the real challenge.

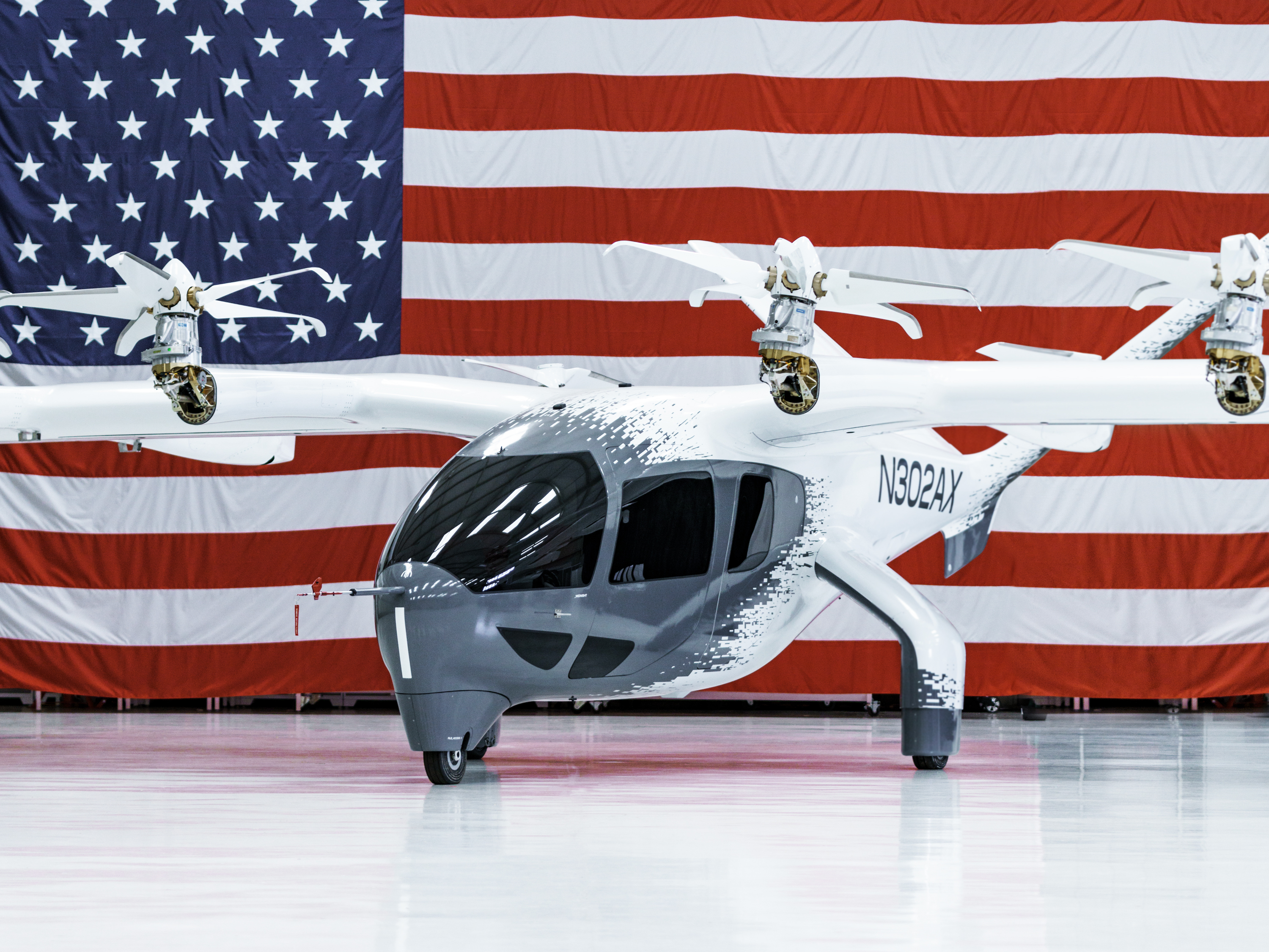

In the first quarter, Archer Aviation didn't even report any revenue. However, its operating losses grew slightly to $144 billion, mainly because of office salaries and the enormous expense needed to develop, research, and test its flagship eVTOL aircraft, Midnight.

Image source: Getty Images.

In the past, companies at such an early stage in their operations would not have been available to retail investors. However, a reverse merger with a special purpose acquisition company (SPAC) allowed Archer Aviation to go public while bypassing the stricter rules of a traditional initial public offering (IPO). Investors should be extra careful about these types of companies because, according to JP Morgan Asset Management, around 90% of SPAC-linked stocks underperform the broader market.

Is Archer Aviation a millionaire-maker stock?

While the vast majority of SPAC companies underperform, that doesn't mean they are "scams" or universally bad investments. They simply serve a radically different investment strategy than most retail investors are comfortable with: Boom or bust. Archer Aviation is a high-risk, high-reward bet on a totally uncertain opportunity. And if things work out, it will likely generate life-changing returns for many early shareholders.

That said, the market is already littered with SPAC-related stocks that have fallen flat. In fact, the space tourism and hypersonic travel company Virgin Galactic has some uncomfortable similarities to Archer Aviation. Its shares have fallen by over 99% because of constant delays in its aircraft program. Savvy investors will probably want to sit on the sidelines to make sure Archer Aviation doesn't meet a similar fate.