Financial technology investors are all over hot names like Robinhood Markets and Coinbase Global, which dominate media conversations. But there is one financial player in the brokerage space flying under the radar, and it may present an opportunity for huge long-term returns: Interactive Brokers (IBKR +0.25%). This institutional brokerage platform that has turned into a global retail powerhouse is convincing investors to switch to its platform in droves, leading to huge revenue and earnings growth.

Is Interactive Brokers a millionaire maker stock? Or is the $100 billion company overvalued after shares soared 400% in the last five years? Let's investigate further and let the numbers tell the story.

Institutional trading for the masses

Interactive Brokers was born from a market-making company that wanted to use its trading technology to build a world-class brokerage. It first catered to wealthy traders and institutional investment firms but has since expanded to the masses with commission-free stock trading on its IBKR Lite accounts.

With automated systems and access to virtually every stock exchange and asset class worldwide, it is able to offer a greater supply of tradable assets compared to traditional brokerages.

NASDAQ: IBKR

Key Data Points

This is the key value proposition for Interactive Brokers versus other brokerage platforms, and why it has grown from a minnow with just 200,000 accounts in 2015 to 3.9 million accounts as of its latest update. For example, we can compare its services to Robinhood for investors who live in foreign countries and are looking to buy U.S. stocks.

On Interactive Brokers, any investor from around the world can buy assets in 200 countries, including stocks, bonds, options, and commodities. If you are a European trader, it is easy to buy a share of a U.S. "Magnificent Seven" company because of the decades of technology build in the far corners of the globe.

On Robinhood, overseas investors just got the opportunity to buy tokens of some U.S. stocks, which are not technically ownership shares of companies but derivative contracts with high fees. The contrast between what is available on Interactive Brokers versus Robinhood shows the breadth of offerings from Interactive Brokers for customers around the world.

It is no surprise, then, to see more and more people switching to the company's brokerage services because it provides a better value proposition than every other brokerage out there.

Image source: Getty Images.

Ongoing global expansion

What's so exciting about the company is the amount of market share it still has left to steal in stock, bond, and asset trading. Its 3.9 million customers as of last quarter, when compared to 26 million at Robinhood and 45.2 million at Charles Schwab, show its potential.

These are brokerages just in the United States, while Interactive Brokers is aiming for a global presence in all major trading markets worldwide, giving it an addressable market in the hundreds of millions. Even if it still maintains just a small percentage of the brokerage business by active customers, it can easily grow to 10 million total customers or more over the next decade.

On top of long-term growth prospects, it has some of the best profit margins in the business due to its lean employee count and automated trading technology. Last quarter, it posted a 75% pretax profit margin, generating $1.1 billion in earnings on $1.4 billion in revenue.

This puts Interactive Brokers in the upper echelons of business models around the world, along with payment networks such as Visa and Mastercard. Even if its revenue in its addressable market is not as high as some of the Magnificent Seven stocks, these insane profit margins will help it generate over $10 billion in earnings if it can keep adding more customers to its trading platform.

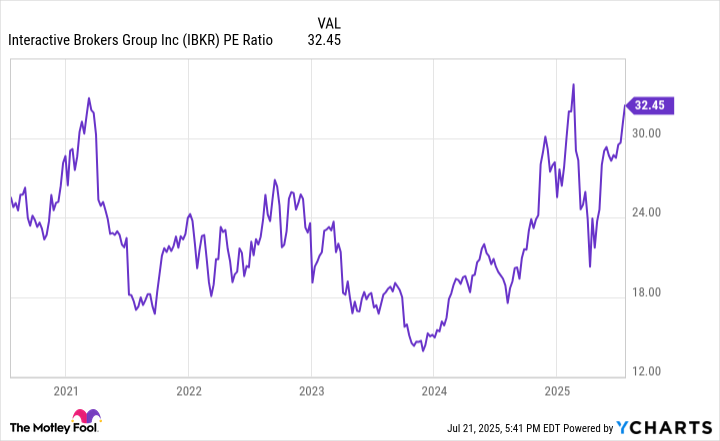

IBKR PE Ratio data by YCharts; PE = price to earnings.

Is Interactive Brokers a millionaire maker?

Shareholders of Interactive Brokers have been well rewarded in the last five years -- its cumulative total return is 412%, which has driven the stock to a market cap of over $100 billion and a price-to-earnings ratio (P/E) of 32.5.

These look like expensive figures for a niche stock brokerage, but I still maintain that the stock is cheap for those with a decade-long time horizon. This is a company with plenty of room to triple or quadruple its customer base over the next 10 years. More customers mean more trading, which means more revenue and earnings growth.

It wouldn't shock me if the company surpassed $10 billion in annual net income at some point in the near future, which would bring down its P/E to a much more reasonable level. Shares have already rocketed higher in the last five years and it has a market cap of $100 billion, so gains in the shorter term may not be as robust.

Based on my assumptions of growth over the next 10 years, it would take a sizable investment in Interactive Brokers for it to become a million-dollar investment by itself. That said, Interactive Brokers' growth potential over the next few years is a stock one could hold in a diversified portfolio that could help them reach millionaire status.