While there are several major players fueling the artificial intelligence (AI) movement, perhaps none is more important than Nvidia. The company's industry-leading chipsets and sophisticated CUDA software application provide an end-to-end, tightly integrated ecosystem for many of the world's largest AI developers. The company's visionary CEO, Jensen Huang, has metaphorically referenced the rise of AI to that of an industrial revolution -- paving the way for a vast, ongoing runway of upside.

Within the AI realm, a new pocket known as quantum computing is beginning to receive quite a bit of attention. While it's not commercially scaled today, quantum computing is believed by many technologists to contain transformative potential -- from accelerating drug discovery to enhancing machine learning capabilities.

One company that has benefited greatly from the bullish rhetoric surrounding quantum applications is a company fittingly called Quantum Computing (QUBT -1.59%). With shares up nearly 3,000% over the last year, could Quantum Computing be the next big moonshot to pay off during the AI-themed industrial revolution?

Quantum computing could completely revolutionize the AI storyline, but...

Global management consulting firm McKinsey & Company categorizes quantum technology across three major applications: quantum computing, quantum communication, and quantum sensing. According to its forecasts, the quantum computing market could be worth up to $72 billion by 2035, while the total quantum technology market could reach closer to $200 billion by 2040.

With the potential to disrupt end markets across robotics, climate tech, cybersecurity, healthcare, and cryptography, it's not entirely surprising that AI's leading developers, such as Nvidia, Microsoft, Amazon, Alphabet, and IBM, are all exploring quantum computing in various ways -- from developing next-generation chips to supercomputers.

Image source: Getty Images.

... investors should be very careful as to which companies deserve attention

Anytime a stock rises as sharply as Quantum Computing's has -- and seemingly out of nowhere to boot -- it's usually a good idea to investigate why.

Earlier this year, I wrote a deep dive on Quantum Computing's corporate history. To summarize, the company was once doing business as Innovative Beverage Group Holdings (IBGH). At the risk of stating the obvious, this has nothing to do with quantum computing. After an unsuccessful venture in the beverage market, which was later followed by lawsuits from investors, IBGH rebranded as Quantum Computing.

While such a transformation may appear odd, it's actually not as uncommon as you might think.

Back in 2017, a relatively unknown beverage company known as Long Island Iced Tea Corp. rebranded as Long Blockchain. The rebrand was marketed as a strategic shift in the company's business -- transitioning from a beverage company to one focused on Bitcoin mining. These efforts never panned out, and Long Blockchain was delisted from the Nasdaq exchange.

Along similar lines, companies struggling with growth such as GameStop and Strategy (formerly known as MicroStrategy) have managed to stay relevant and win investor enthusiasm by adding Bitcoin to their balance sheet.

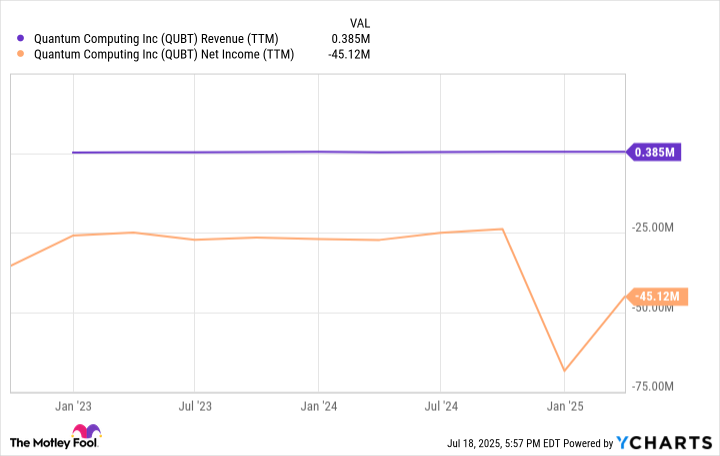

QUBT Revenue (TTM) data by YCharts

Over the last year, Quantum Computing has generated less than half a million dollars in sales. And yet the company managed to burn through $45 million. This is an upside-down financial profile, regardless of its industry.

I have serious doubts over Quantum Computing's technological foundation and its ability to compete in such a sophisticated, capital-intensive industry against the likes of big tech.

Is Quantum Computing stock a buy?

The reason I highlighted these examples is that changes in corporate narratives can be more performative than strategic to the underlying business. In other words, companies such as GameStop, Strategy, and Quantum Computing are using hot trends to capitalize on hype narratives as opposed to actually developing a concrete plan rooted in long-term value creation.

Quantum technology could be seen as a venture capital-style investment opportunity -- one that carries asymmetric upside relative to its risk profile.

Given how little traction Quantum Computing (the business) has generated so far in combination with its seemingly directionless roadmap, I do not see the stock as a moonshot opportunity. Instead, I view Quantum Computing stock as a highly speculative opportunity masquerading as an innovative play on one of AI's next megatrends. For these reasons, I would pass on investing in Quantum Computing stock.