Lockheed Martin (LMT +0.79%) shares fell a whopping 10.8% this past Tuesday in response to the defense contractor's second-quarter 2025 earnings and updated guidance. Lockheed badly missed analyst earnings estimates for the quarter due to a flurry of (mostly) one-time charges.

Despite the sell-off, here's why Lockheed is a no-brainer dividend stock to buy now.

Image source: Getty Images.

More losses for Lockheed Martin

Lockheed reported pre-tax losses on programs of $1.6 billion and other charges of $169 million, which dragged down its earnings per share (EPS) by $5.83 -- leading to net EPS of just $1.46. If program losses sound familiar, that's because Lockheed reported a similar quarter in January, when the stock fell 9.2% in a single session after Lockheed incurred $1.72 billion in write-offs.

The company does the vast majority of its business with the U.S. government, and to a lesser extent, approved allies. As such, investors can be left in the dark regarding classified national security programs. One-off charges usually don't impact a long-term investment thesis unless they signal prolonged challenges. Lockheed is testing investor patience because two out of its last three quarters drastically underperformed expectations due to one-off charges.

In its second-quarter press release, Lockheed attributed the program losses to its new review process, which is causing the company to reevaluate legacy programs and address associated risks. However, Lockheed believes that the review process is a necessary step to improve execution.

Results are still decent despite ongoing challenges

Lockheed Martin is a stodgy company with long-term contracts spanning fighter jets and other aircraft, missiles, weapons, combat systems, helicopters, space systems (primarily satellites), and more. Not every program is a high-margin cash cow. And that's been known in Lockheed's results for a while, given its slow growth. So while its program losses jump out in headline EPS figures, they are really just symptoms of a bigger problem.

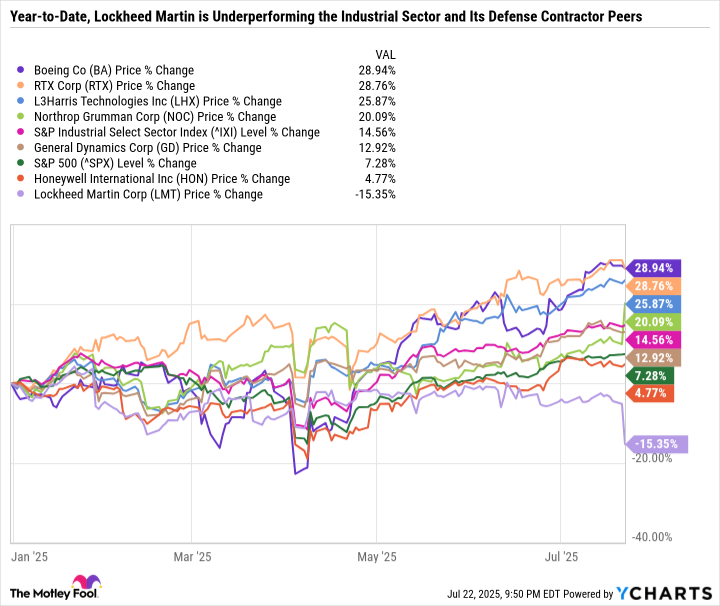

Long-term investors would prefer a company address issues instead of letting them fester. But for now, Lockheed's stock is selling off while many of its peers are up big year to date and making all-time highs. To make matters worse, industrials have been the best-performing sector so far in 2025.

Lockheed's underperformance in a hot sector is akin to a software company missing the boat on artificial intelligence. Earlier this year, Boeing beat Lockheed Martin for a major fighter jet contract that could be worth tens of billions of dollars over an extended period of time.

Growth at Lockheed has stagnated, as evidenced by a paltry 12% increase in revenue in the last five years and lower operating margins. Meanwhile, its peer, RTX, continues to generate solid organic growth. Northrop Grumman just hit an all-time high after beating earnings expectations and raising its full-year guidance.

It would be one thing if other major defense contractors were experiencing similar challenges as Lockheed, but this is far from the case. Lockheed isn't in a full-blown turnaround. Rather, it is addressing weaker areas of its business to return to growth.

The good news is that Lockheed is maintaining its full-year 2025 guidance for sales, cash from operations, capital expenses, free cash flow (FCF), and share repurchases -- illustrating that these changes aren't impacting its long-term investments or plans to return capital to shareholders.

Granted, Lockheed's low-single-digit revenue guidance and high-single-digit FCF guidance is far from exceptional. But it still has a healthy backlog to rely on to support its targets.

A value stock with a high yield

Lockheed isn't at the top of its game, but it is addressing program losses across its segments to improve its processes and operations going forward. In the meantime, the stock's dividend yield has pole-vaulted to the top of the industry. In fact, Lockheed is the only major defense contractor with a dividend yield above 2%.

LMT Dividend Yield data by YCharts

Lockheed's valuation will appear more expensive in the near term due to program losses dragging down EPS. But if the internal review leads to higher margins over time, the stock will look dirt cheap.

Management is guiding for 2025 sales of $73.75 billion to $74.75 billion and free cash flow of $6.6 billion to $6.8 billion. Based on the midpoint of those forecasts, and Lockheed's market capitalization of $96.2 billion at the time of this writing, the company would have a price-to-sales ratio of just 1.3 and a price-to-FCF ratio of 14.4.

For context, Lockheed's 10-year median is 1.7 for the P/S ratio and 19.2 for price-to-FCF ratio -- illustrating just how beaten-down the stock is right now. Lockheed arguably deserves to trade at a discount to its historical averages, given the company isn't delivering on shareholder expectations. However, the stock could be a great option for value investors who are willing to give the company time to recover.

NYSE: LMT

Key Data Points

Lockheed is a buy for patient investors

Unlike some one-off impairment charges, Lockheed's program charges are indicative of a larger issue at the company. Therefore, a sell-off was warranted. However, investing is more about where a company is going, rather than where it has been. And with Lockheed now beaten down, investors are getting an opportunity to scoop up shares at their lowest valuation in years.

Lockheed's discounted valuation and 3.2% dividend yield make it one of the best choices in the defense industry for value investors looking to boost their passive income. The mounting program losses quantify the extent of issues at the company, but at least Lockheed is ripping off the proverbial bandage and reviewing these issues rather than letting them persist.

Given Lockheed's diversified business model and strong cash flow, the stock appears to be a safe bet for income investors seeking to add stability to their passive income stream.