After taking a tariff-induced breather for a few months earlier this year, the market is back in bullish form. Investors are enthusiastic about moderating inflation, potential interest rate cuts, and the ever-expanding potential of the U.S. economy. The S&P 500 is up nearly 8% year to date, and the growth-stock-heavy Nasdaq-100 is up 10%.

If you're looking to get in on the action today, and you have $1,000 to invest for the long term, Shopify (SHOP +0.18%) and On Holding (ONON 1.42%) are two great options.

Image source: Getty Images.

1. Shopify: The other e-commerce giant

Amazon garners a lot of attention thanks to its incredible hold on U.S. e-commerce, with a market share of around 38%. Walmart, in the No. 2 spot, only has a market share of about 6%. Shopify's share isn't usually factored in because it doesn't sell products -- it offers other sellers the tools to build and run their own e-commerce platforms. However, if you factor its gross merchandise volume (GMV) into the discussion, it's responsible for a tremendous portion of e-commerce that would put it close to Amazon. For example, in the 2025 first quarter, Amazon's online stores sales increased 5% over last year, and third-party sales increased 6%, with a total of $94 billion for both. Shopify's GMV increased 23% over last year to $75 billion. Since its GMV is growing at a faster rate than Amazon's e-commerce sales, it could get even closer to being the top e-commerce provider in the country.

E-commerce is also growing as a percentage of retail sales again, and more companies are either creating digital presences or expanding their existing ones. As the leading e-commerce services provider in the U.S., that's a natural growth driver for Shopify's business.

NASDAQ: SHOP

Key Data Points

But Shopify has become so much more than e-commerce. Today, it provides its clients with a full suite of commerce services that span omnichannel shopping. It's way past the days of just offering websites for small businesses; now, it offers single components as well as complete packages that include order management, payment processing, marketing, and analytics, and more. It's also inking partnerships with most of the major commerce providers, including Amazon, which offers Shopify merchants easy integration with an Amazon store and the ability to control both from one dashboard, as well as the option to use Buy With Prime on Shopify sites. Shop Pay has become one of the most popular shopping apps, with a 57% year-over-year increase in GMV in the first quarter. This full platform appeals to the large enterprise market, and clients in that category have big budgets, which is also driving the company's growth.

Shopify stock is up 20% this year, and it isn't cheap, trading at a forward 1-year P/E ratio of 71 and a price-to-sales ratio of 18. Investors are giving it that premium largely because they see its potential. That could be setting it up for a correction at some point, but nobody can reliably time the market, and it's not wise to try. If you buy Shopify stock now and hold it for many years, you're likely to see your investment reward you many times over.

2. On Holding: The new premium athletic uniform

On Holding is an up-and-coming luxury athletic apparel company that has become a real competitor in a field that has come to be dominated by a few top names. It's still relatively small, with just $2.8 billion in trailing 12-month revenue, but it's growing faster than the major players.

It began as a footwear company, launching a uniquely designed shoe with a sole full of holes that is supposed to be like walking on a cloud. In fact, it calls its flagship shoes "On Cloud," and most of its footwear has some sort of take on that theme, with shoes such as Cloudsurfer and Cloudmonster. It charges premium prices for its products, and it has built an almost cult-like following in many upscale communities.

NYSE: ONON

Key Data Points

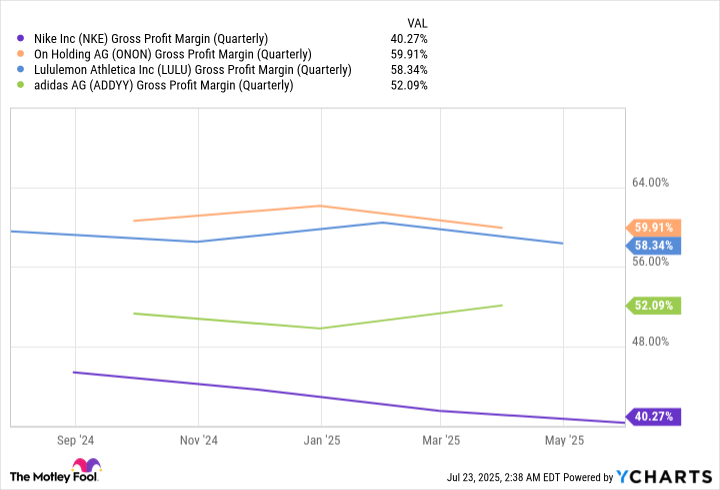

Its affluent target market is more resilient than the average mass-market consumer, which is why On Holding continues to churn out high sales growth even at a time when many of its competitors are feeling pressure on their sales due to macroeconomic headwinds. Its high pricing is also why it has the highest gross margins in the business. In the first quarter, its sales increased 40% year over year (on a currency-neutral basis), and its gross margin expanded from 59.7% to 59.9%. Compare that to similar premium athletic wear names like Nike, Lululemon Athletica, and Adidas.

NKE Gross Profit Margin (Quarterly) data by YCharts

On Holding stock isn't cheap, but trading at a forward 1-year P/E ratio of 33 and a price-to-sales ratio of 12, it looks well-priced considering its performance and potential. On Holding could be a massive market-beater over the next few years.