Over the next several weeks, companies will report financial and operating results for the second quarter of 2025. As usual, technology investors will be focused on one thing: artificial intelligence (AI).

"Magnificent Seven" member Alphabet kicked things off earlier this week, reporting robust results across its search, advertising, and cloud computing divisions.

While Alphabet shareholders should be encouraged by the internet giant's strong performance, I saw Nvidia (NVDA 0.54%) as the real winner from the company's second-quarter performance.

Let's dig into some of the important moves Alphabet is making and assess how Nvidia is benefiting from them.

NASDAQ: NVDA

Key Data Points

Alphabet is picking up the pace on AI infrastructure construction

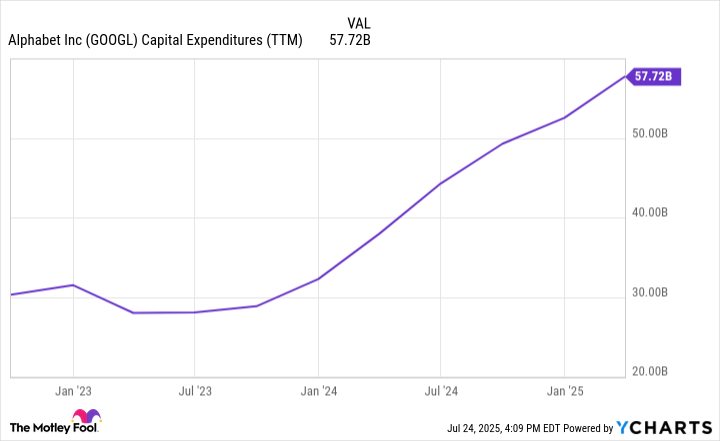

During the Q2 earnings call, Alphabet's management updated some details of its financial guidance. Alphabet now plans to spend around $85 billion on capital expenditures (capex) in 2025. Of note, this is a $10 billion increase over the company's prior guidance.

And there's more. "Looking out to 2026, we expect a further increase in capex due to the demand we're seeing from customers as well as growth opportunities across the company," said Chief Financial Officer Anat Ashkenazi.

Despite its increasingly aggressive spending on AI infrastructure over the last few years, Alphabet has stated that it doesn't plan on slowing down anytime soon. This should be music to Nvidia's ears.

GOOGL Capital Expenditures (TTM) data by YCharts.

Why is this good for Nvidia?

Management consulting juggernaut McKinsey & Company is forecasting that AI infrastructure spending could reach $6.7 trillion by 2030. And its research suggests that almost half of that money will be allocated toward AI hardware for further data center construction.

In addition, research from Goldman Sachs and JPMorgan indicates that generative AI could add between $7 trillion and $10 trillion to global gross domestic product in the long run.

From a macroeconomic perspective, these secular trends bode well for Nvidia's compute and networking empire. Moreover, I think that Alphabet's decision to bump up its AI infrastructure spending again adds some credibility to those industry forecasts.

Alphabet's management specified that it is raising its planned capex in order to accelerate the construction of data centers and position itself to fill the rising demand for capacity on the Google Cloud Platform.

Increased spending on network equipment, servers, and cloud infrastructure should lead to rising demand for graphics processing units (GPUs). I see this as a major positive development as Nvidia is still scaling up production of chips made using its latest Blackwell architecture.

Considering Nvidia holds an estimated 90% share of the data center GPU market, I see Alphabet's investments in AI infrastructure as a major tailwind for the chip king and further propels the company's momentum over competition in the chip space.

Image Source: Getty Images.

Is Nvidia stock a buy right now?

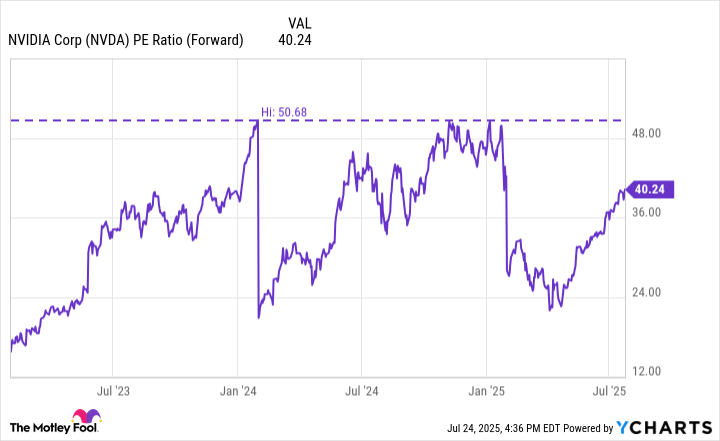

With a market cap north of $4.2 trillion, Nvidia is currently the most valuable company in the world. While this might lead one to assume that the stock is expensive, its underlying valuation trends tell a different story.

NVDA PE Ratio (Forward) data by YCharts

Nvidia currently trades at a forward price-to-earnings (P/E) multiple of 40. While this isn't "cheap" by traditional benchmarks, it is notably lower than the peak levels Nvidia has witnessed during the AI revolution.

What makes these dynamics interesting is that Nvidia's growth trajectory is arguably far stronger today than it was 18 months ago when its forward P/E valuation peaked. The company remains at the center of the AI revolution, providing massive amounts of fast parallel-processing power to hyperscalers and accelerating AI workloads.

To me, buying Nvidia stock at its current price is a no-brainer, and I see Alphabet's rising AI infrastructure spending as a long-term catalyst that should not be overlooked by growth investors.