Coca-Cola (KO +2.18%) is doing something this year it doesn't usually do: beating the market. There are several reasons investors have been enthusiastic about the stock this year. It generally draws interest when the market is down because it provides protection in its stability, and investors choose it for its safety.

This year in particular, it's creating optimism because it's well protected against tariffs. However, as the tariff issue doesn't seem to be having the expected negative effects due to trade deals (or talk of them), the market is rising while the stock is starting to teeter.

Let's see what's happening at Coca-Cola and whether or not it can continue to beat the market.

Image source: Getty Images.

Warren Buffett's favorite

Let's be clear: Coca-Cola is not a growth stock. It's the largest beverage company in the world, with $47 billion in trailing-12-month sales and has been around since 1886. There are many advantages to its position, but generating high sales growth is not one of them.

In general, stocks like this one offer value and protection, as well as an incredible dividend, which I'll get to. But investors don't buy them to beat the market.

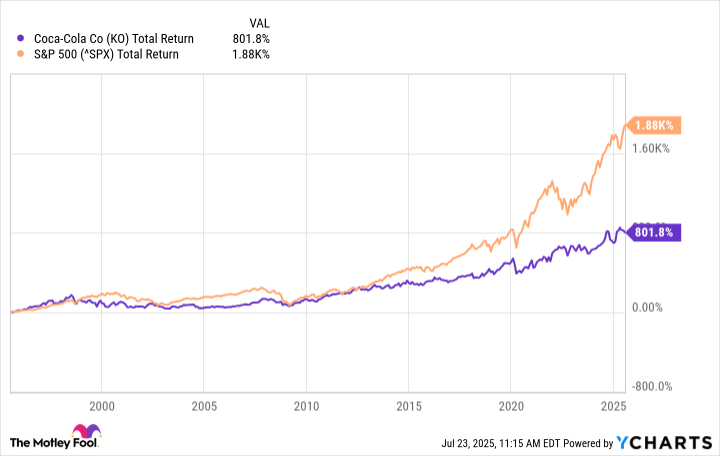

Over the past 30 years, Coca-Cola stock has seriously trailed the market, with a few moments of market-beating performance interspersed. You can guess when those moments were; like today, they were predominantly times when the market pulled back, and the shares benefited from the flight to safety.

KO Total Return Level data by YCharts.

Despite its market underperformance, which started not long after Warren Buffett bought it for Berkshire Hathaway, he isn't selling. There are features that he loves, including the company's capital-light model, brand name, and dividend -- all of which he has mentioned over the past few years.

Could things be changing?

That brings us to what's happening at the company today. It's actually in a much better position than it was a few years ago after some tightening and restructuring, and it's well on its way to meeting its long-term goals. Management has built its business back up to where it was 10 years ago, and it's finally reporting records again.

In the 2025 second quarter, revenue increased 1% year over year, but organic revenue, which adjusts for acquisitions, divestures, and the like, increased 5%. Operating margin was 34.1%, up from 21.3% last year, and adjusted operating margin was 34.7%, up from 32.8% last year. Comparable earnings per share (EPS) increased 4% to $0.87, beating Wall Street's expectations of $0.84.

NYSE: KO

Key Data Points

Revenue growth came within its long-term goal of 4% to 6%, but EPS fell below the long-term goal of 7% to 9%. Adjusted operating income was up 15%, though, well above its 6% to 8% long-term goal.

Even if the company continues on this trajectory, it may not be enough to move the needle to market-beating stock performance. Growth in the low to mid-single digits can't move the stock much higher without raising the valuation significantly.

At the current price, the stock trades at a price-to-earnings ratio (P/E) of 27, slightly higher than its three-year average. It would have to report some serious growth to get much higher or warrant a higher valuation.

It may not matter

Coca-Cola stock is still beating the market this year, up 13% versus 8%. But the gap is narrowing as the market makes a comeback. While a chance exists for Coca-Cola to keep it up, that's not the reason for most investors to buy it; that would be an added plus.

Its attractions are its security and value. Part of that comes from its storied dividend, which has been raised for the past 63 years straight and yields 2.9%. It's as reliable as payouts come. If you need that slot filled in a diversified portfolio, Coca-Cola stock could be worth buying whether it beats the market or not.