PTC (PTC +0.26%) investors were treated to a flurry of excitement in July as, according to reports, its larger peer Autodesk (ADSK +0.21%) took a serious look at acquiring the company only to appear to back off any such large undertakings by issuing a regulatory filing stating it was "allocating capital to organic investment, targeted and tuck-in acquisitions." Is the fun over, or are there more surprises to come?

PTC doesn't need Autodesk

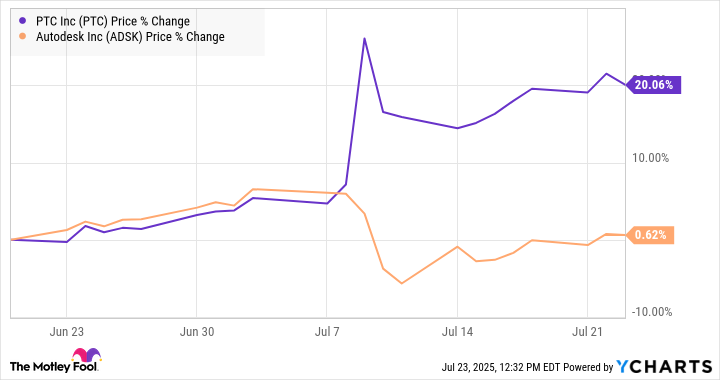

The market had no doubt about its opinion on the speculation. Autodesk shares tumbled on the day Bloomberg discussed the potential bid, while PTC stock naturally soared. This is somewhat common in such situations, and is often driven by hedge funds engaging in so-called merger arbitrage. Hedge funds often look to sell shares in the acquiring company short while buying shares in the target company, and then make money when the spread between the two stocks closes when the deal is completed.

However, the interesting thing about the price action is that Autodesk's stock has somewhat recovered after the SEC filing was issued on July 14, but PTC's stock has remained relatively high.

Perhaps I've been spending too much time with the Oracle at Delphi, but it looks like the market is asking the question of "who's next to try and buy PTC?"

NASDAQ: PTC

Key Data Points

Why PTC is a highly attractive asset

It's a valid question, not least because there's been significant consolidation in the industrial software space over the last year. For example, German industrial and software giant Siemens bought Altair Engineering for $10 billion earlier this year to add Altair's strength in simulation and analysis software (computer-aided engineering, or CAE) to its core product lifecycle management (PLM), computer-aided design (CAD), and electronic design automation (EDA) strengths.

Not to be outdone, Synopsys (the market-leading EDA company) recently completed the acquisition of CAE company, and Altair rival, Ansys.

At which point readers are no doubt tired of the acronyms and wondering what it all means to PTC investors.

Image source: Getty Images.

Why PTC can be part of the industrial software consolidation

A combination of Autodesk and PTC makes obvious sense, as it marries Autodesk's leadership in CAD with PTC's expertise in PLM to create an American champion better able to compete with France's Dassault Systèmes and Germany's Siemens. The two Europeans are leading players in the CAD/PLM/CAE space.

It's not just about adding acronyms; it's a reflection of the increasingly important interaction between design (CAD) and the digital management of a product through PLM, CAE, in the so-called digital loop.

For example, CAE modeling data can be fed back into PLM, and actionable conclusions can be drawn from it that lead to adjustments in a product's design using CAD, such as improving factory productivity or enhancing a product's reliability and quality.

As such, even if Autodesk/PTC is off the table, a larger software company looking to enter the industrial space can be interested, and there's always the possibility that an automation company -- like PTC's partner and former stakeholder, Rockwell Automation, or, thinking longer-term, Honeywell (not least as Honeywell Automation will be a separate company in future) or Emerson Electric (a company focusing on automation and industrial software) -- might consider making a move.

Image source: Getty Images.

PTC is an excellent buy anyway

In any case, PTC doesn't need takeover speculation to be an attractive stock. Despite headwinds in its industrial end markets, the company has consistently generated double-digit growth in its annual run rate of software subscriptions. Moreover, it's likely to continue growing in the future as customer adoption of digital technology increases and the volume of valuable data created expands (through the use of digital twins, CAE, service lifecycle management software, etc.).

All of that data needs a hub and a repository, which is where PLM comes in. As such, PTC's solutions are an integral part of the modern manufacturing world. With Wall Street expecting ARR improvement to drop into double-digit free cash flow growth for the foreseeable future, PTC is an excellent option for a diversified growth portfolio, whether it receives a bid or not.