Tariff effects are still front and center in many investors' minds. As we approach Aug. 1, the date when many reciprocal tariffs take effect, the entire economic landscape could shift. Although deals are being announced, many questions remain regarding their impact.

However, there is one company that stands out by saying it hasn't seen any effect: Taiwan Semiconductor (TSM +0.25%). Taiwan Semiconductor's CEO C.C. Wei stated on its Q2 conference call that they "have not seen any change in our customers' behavior so far" regarding tariffs.

This is a significant development for TSMC, but does it suggest that the rest of the market is overreacting to tariffs?

Image source: Getty Images.

Semiconductors aren't subject to reciprocal tariffs

There are a few key points to understand regarding tariffs and semiconductors. First, semiconductors are currently exempt from all reciprocal tariffs. Additionally, they're excluded from the base 10% blanket tariff.

However, that could shift as the Aug. 1 reciprocal tariff date arrives. If those tariffs are implemented, other goods could be subject to higher tariff rates than semiconductors. This means investors need to be cautious about drawing conclusions about how tariffs are being applied to one industry versus another. Still, it shows that the end users of products with their chips in them aren't slowing down purchases.

NYSE: TSM

Key Data Points

A second critical factor is Taiwan Semiconductor's unique position within the chip industry. There aren't many choices when it comes to chip foundries with high-end technology. Intel (INTC 2.81%) has failed to launch many of the cutting-edge chip nodes, and low chip yields have plagued Samsung. This leaves TSMC at the top of the high-end semiconductor fabrication pyramid, making it a critical partner for tech giants like Nvidia (NVDA 0.29%) and Apple (AAPL 0.93%).

As a result, these companies are somewhat compelled to deal with the tariffs rather than seeking an alternative. But this is only temporary. TSMC is working to avoid tariffs by accelerating the build-out of its U.S. chip production facilities in Arizona. This will allow U.S. clients to avoid any tariffs on foreign goods.

While Taiwan Semiconductor may not be experiencing any effects from tariffs, investors need to be cautious about drawing conclusions from its experience to the broader market. It's in a unique position that essentially requires its clients to deal with any tariff levies that come up, but it's actively working on increasing U.S. chip production capabilities to sidestep any tariffs.

With TSMC's strong position, the company also becomes an intriguing stock to consider, as few companies hold a more powerful position than TSMC.

Taiwan Semiconductor looks like an excellent buy at these prices

Taiwan Semiconductor's bull case is fairly straightforward: Its clients will use more chips and increasingly advanced chips over the next few years. This seems like a no-brainer investment thesis, and management's bold five-year growth projections back it up.

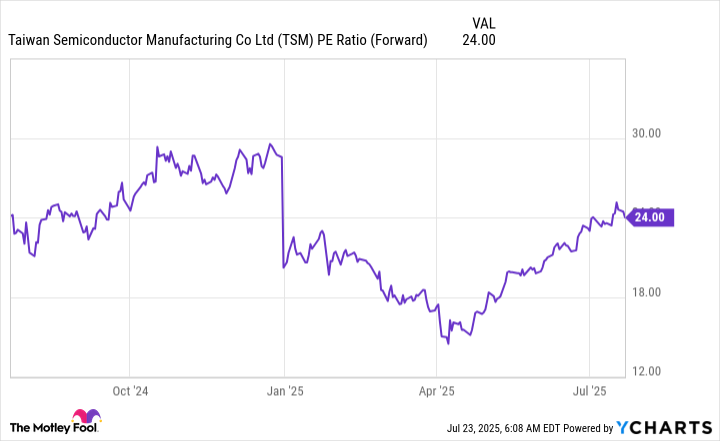

Starting with 2025, management projects that AI-related revenue will grow at a 45% compound annual growth rate (CAGR) over the next five years, with total revenue increasing at nearly a 20% CAGR. That's easily market-beating growth, yet Taiwan Semiconductor's stock trades at nearly a market-average forward price-to-earnings (P/E) ratio.

TSM PE Ratio (Forward) data by YCharts

Taiwan Semiconductor's 24 times forward earnings is nearly identical to the S&P 500's (^GSPC 0.06%) 23.8 times forward earnings. However, with market-beating growth expected, this makes the price well worth paying, and I think Taiwan Semiconductor's stock looks like a great buy right now due to its projected growth, reasonable price, and strong position in the chip fabrication industry.