Nvidia (NVDA 2.95%) recently made history by becoming the first company to reach a market capitalization of $4 trillion -- and it's quickly racing toward the $5 trillion milestone. That one may even be easier to achieve, as Nvidia's stock needed to rise by 33% to go from $3 trillion to $4 trillion, but would only have to gain 25% to go from $4 trillion to $5 trillion.

Indeed, Nvidia is currently valued at around $4.2 trillion, so it only needs to rise an additional 19% to hit the next trillion-dollar valuation threshold. I think it could achieve that by the end of 2025. Here's the path it could take to do so.

Image source: Getty Images.

Nvidia getting approval to sell chips to China again will be a huge deal

Nvidia designs graphics processing units (GPUs), as well as a range of hardware and software that support its chips. The Nvidia ecosystem in the GPU and AI-accelerator sphere is second to none, and has enabled it to gain a 90% market share in the data center GPU space.

GPU demand has risen massively over the past few years due to unprecedented new demand for processing power to train and operate artificial intelligence software. Because GPUs are parallel processors, they are capable of rapidly handling the specific types of computing that make up the largest share of AI workloads. They are, simply, the right tools for the job.

NASDAQ: NVDA

Key Data Points

While Nvidia has put up jaw-dropping growth numbers for a few years, there are still plenty of growth catalysts on the horizon.

First, Nvidia is likely going to be allowed to sell its H20 chips in China again. The company specifically designed those Hopper architecture chips to be less powerful than the H100 design they were based on to avoid running into U.S. restrictions on exporting high-powered GPUs to China. Then, President Trump revoked Nvidia's licenses to sell H20s to China in April. However, thanks to CEO Jensen Huang's lobbying efforts, Nvidia is reapplying for an export license and has been given assurances from the U.S. government that it will be approved. This is a bigger deal than most investors realize, as it would allow Nvidia's already fast growth to reaccelerate.

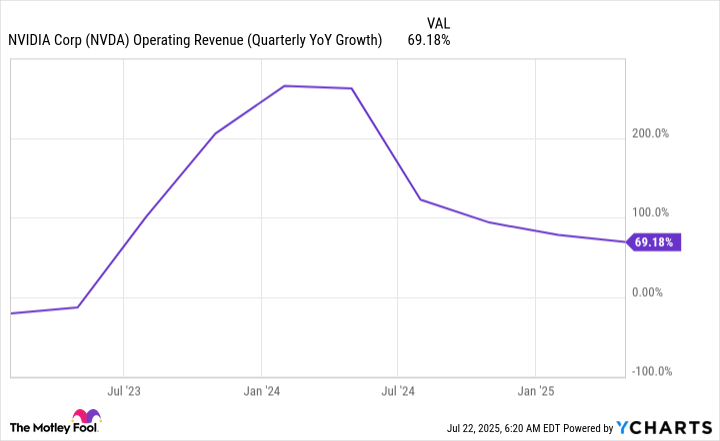

For its fiscal 2026 second quarter (which ends late in July), Nvidia is projecting 50% year-over-year revenue growth to $45 billion. However, the company indicated that $8 billion in revenue would not be realized due to export restrictions. If it had been able to make those sales, that would have given Nvidia a projected 77% growth rate for the second quarter. That would have surpassed what it experienced in Q1 or nearly matched the result from Q4 of fiscal 2025.

NVDA Operating Revenue (Quarterly YoY Growth) data by YCharts.

While there isn't any time left for sales and exports of H20 chips to make an impact on its fiscal Q2, they could benefit the company in its fiscal Q3. If Nvidia's revenue growth reaccelerates through the end of the year, this could cause the stock to skyrocket at least the remaining 19% to cross the $5 trillion threshold. But Nvidia's growth won't stop there.

Data center growth will drive Nvidia's stock higher for years

For 2025, AI data center hyperscalers announced record-setting capital expenditures -- money that will primarily go toward expanding their data center capacity. Building a data center is a multiyear process, so investors shouldn't be surprised if these companies announce further increased capital expenditures next year, or at least match 2025's levels.

This bodes well for the company, but the wins won't stop in 2026. During its 2025 GTC event, Nvidia execs cited a third-party analysis that looked at data center capital expenditure trends. In 2024, data center capital expenditures globally were about $400 billion. That figure is expected to rise to $1 trillion by 2028.

Clearly, the data center buildout trend can be expected to continue driving Nvidia's revenue higher, as many of these data centers will house enormous numbers of its GPUs. So even if its market cap doesn't hit the $5 trillion mark by the end of this year, it's well on its way to achieving it sometime in 2026. With the long-term annualized average gain in the market at about 10%, Nvidia is a no-brainer buy right now.