AMD (AMD +2.29%) has taken a back seat to its peer Nvidia (NVDA +1.60%) as it doesn't have nearly the data center dominance. AMD has often seemed to play second fiddle to its competitors, but sometimes this second-place position can still deliver market-crushing returns.

On Aug. 5, AMD will release its quarterly earnings, and if it presents the right key points, AMD stock could experience a parabolic rise, increasing rapidly in a very short time frame. But is this realistic? Or has the growth already been priced into AMD's stock?

Image source: Getty Images.

AMD's diversity is also its weakness

Compared to its peers, AMD is a much broader business. While Nvidia focuses solely on GPUs and products that support them, AMD manufactures GPUs and a wide range of other products, including CPUs and embedded processors. This product diversity limits upside, as AMD can't fully take advantage of the AI buildout because its technology is inferior to Nvidia's. However, if AI spending were to stop suddenly, AMD would be less harmed because it has other business units that might be performing well at the same time.

With that in mind, AMD may be viewed as a "safer" investment; however, the chip industry is notoriously cyclical, so it still has a large potential for decline if the market sours.

NASDAQ: AMD

Key Data Points

However, the market remains strong, and AMD projects robust growth for the second quarter. It expects revenue to be approximately $7.4 billion, representing 35% growth. That's incredibly strong growth compared to what the average company is putting up, but it's nowhere near what Nvidia is expected to grow for Q2, 50%.

Once again, AMD's diversity is holding it back, which makes it appear to be a poor choice during periods when products like GPUs are in high demand.

But, if the stock is priced right, a solid guidance beat could be enough to send AMD shares soaring.

AMD's stock doesn't trade at a discount despite being in second place

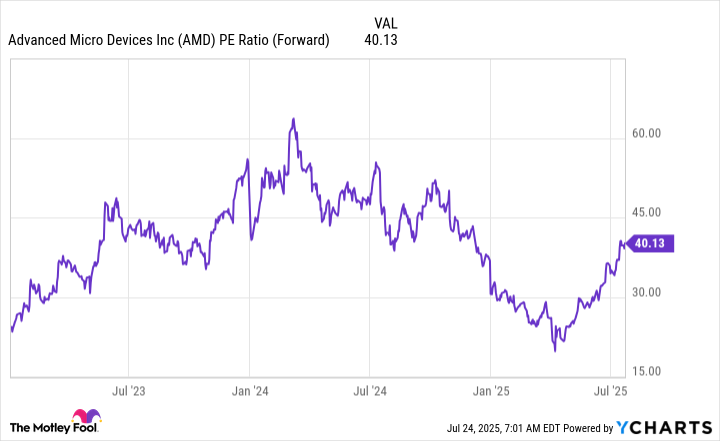

Currently, AMD's stock trades at 40 times forward earnings.

AMD PE Ratio (Forward) data by YCharts

That's a premium price tag for any business, regardless of whether it's expected to put up 35% growth in the quarter. This valuation is essentially the same as Nvidia's, which might lead investors to wonder why they would want to purchase shares of AMD when they can invest in a company in a nearly identical industry that's growing more quickly.

I think it's a great question for investors to ask themselves, as I don't see the upside in owning AMD shares over Nvidia. Yes, if the data center buildout party comes to a screeching halt, AMD's sales would fall less than Nvidia's, but considering that data center revenue accounts for about half of AMD's total, it's not going to be much safer.

Although I don't know how the market will react to AMD's earnings on Aug. 5, I think there's a far better chance that Nvidia will outperform AMD over the long term. As a result, I think investors are better off buying Nvidia at these levels, because if AMD reports a blowout quarter on Aug. 5, there's a good chance Nvidia will also rise significantly, given that they are two adjacent companies.

Second-place AMD isn't close enough to first-place Nvidia to warrant owning shares, and investors should consider alternatives before buying AMD shares.