The acronym DORKs was selected by some Wall Street "comedians" because that term probably brings to mind middle school memories. It's a win from a marketing perspective and much better than, say, KORDs would have been. But catchy acronyms don't make good investments, good stocks do. Which is why investors might want to be cautious before buying the DORKs.

What are the DORKs?

The term DORKs is a shorthand way to refer to the stocks of Krispy Kreme (DNUT 1.76%), Opendoor Technologies (OPEN +5.87%), Rocket Companies (RKT 0.85%), and Kohl's (KSS 3.32%). In case you don't see it, the first letter of each of these companies' tickers spells DORK. This looks like a new round of what were called meme stocks a few years ago. Indeed, the DORKs have seen shocking price moves despite the fact that they are facing often material difficulties as businesses.

Image source: Getty Images.

Before getting into three specific reasons for avoiding the DORKs today, investors need to understand that these are risky investments. Unless you can afford to lose every penny you invest, you shouldn't buy the DORKs hoping to win the Wall Street lottery. Here are three reasons to be skeptical of the DORKs.

1. Wall Street loves to sell hot ideas

The Nifty 50, the BRICS, the "Magnificent Seven", and now the DORKs. These are all quick and catchy terms used to describe some investment trend -- or perhaps it would be better to say fad. There are reasons behind the creation of each term. And, in many cases, the reasons have merit. But, at the end of the day, these are all terms that sell an idea or a dream. The fun acronym or nickname makes the idea seem more real or official.

NYSE: KSS

Key Data Points

It is amazing how quickly Wall Street jumps on things that will help increase trading or that will help promote a product. Indeed, it wasn't long until there was a Magnificent Seven exchange-traded fund (ETF), such as Roundhill Magnificent Seven ETF (MAGS 0.29%). There's even a more aggressive option, the Roundhill Daily 2X Long Magnificent Seven ETF (MAGX 0.43%). The DORKs grouping is new, but there's probably someone on Wall Street looking to capitalize on this with a product.

But don't mistake what's happening now: The DORKs acronym helps to popularize the idea of investing in Krispy Kreme, Opendoor Technologies, Rocket Companies, and Kohl's, and that increases trading volume. More trading volume means more money for a host of Wall Street firms. Any time you see a catchy name used to identify a stock investment idea, you should worry because you are being marketed to either directly or indirectly. Wall Street wants you to trade, trade, trade -- and it doesn't matter if you make money or not.

NYSE: RKT

Key Data Points

2. Investment fads don't last

There's a saying, or better a warning, on Wall Street that trees don't grow to the sky. Essentially, even good investment ideas can't rise in price forever. All stocks go up and down over time. Well-run companies go through good times and bad times. And, thus, investors have to be prepared for zigzags when they buy a stock and not simply a rocket ship to the moon.

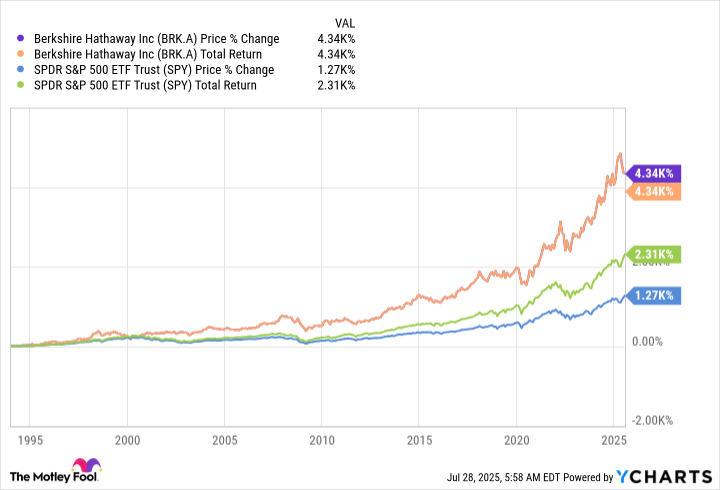

This is the basis behind buy-and-hold investing. But it only really works if, like Warren Buffett of Berkshire Hathaway, you start off with buying good companies (hopefully at attractive prices) and then hold for the long term so you can benefit from their growth. Just because a stock is caught up in an acronym or some investment fad does not mean it is a good company. But it does suggest that the price of the stock is probably on the expensive side, at least while the fad is still running.

NASDAQ: OPEN

Key Data Points

But eventually a mercurial Wall Street always seems to get bored with investment fads. And then it moves on to something new. The old fad usually flames out. Be forewarned: Fads, no matter how exciting, don't last.

3. Nobody is perfect, particularly on Wall Street

So let's bring the first two points together. Something on Wall Street has caught the attention of investors and has been turned into a marketable concept, either directly or just via a media frenzy. The goal is to make you feel like you are missing out on something. But the fad that spawned the marketable concept, in this case the DORKs, isn't likely to be a sustainable long-term trend. However, you are still watching as it seems like other investors are making millions while you stand on the sidelines and do nothing!

NASDAQ: DNUT

Key Data Points

Resist the urge to jump on fads like the DORKs. First off, how will you know when to sell? It is difficult, if not impossible, to time the broader market or individual stocks with any sustainable regularity. Buying into risky investment themes increases the likelihood that you will end up buying late and holding too long. After all, if it already has an acronym, you aren't the first one in the door. Always remember that someone is buying that stock at the top, that's how the price got so high. The last person in the door tends to lose money.

And here's the unfortunate part of investment fads. People love to talk about how much money they made, but few if any will discuss how much money they lost. So you get positive comments when things are going well and then virtual silence when things go poorly. The financial pain that fads inflict on investors who are lured in late simply leaves the latecomers with private emotional duress.

Investing should be fun; don't destroy that for yourself

I wish I could claim to have never bought into a fad on Wall Street. Maybe it's a rite of passage or just human nature. But I can tell you from experience that hot Wall Street themes like DORKs are not great investment ideas. Maybe there's a kernel of truth in the mix, but the long-term outcome is highly likely to be bad for you if you get sucked in with the crowd. And losing money, particularly early in your investment life, can lead you to shy away from Wall Street, which is truly a powerful wealth building tool if you are careful and thoughtful about your investments.

Unless you can afford to lose every penny you invest, you are better off avoiding the DORKs. If you are still tempted, I suggest you go read the annual reports for Berkshire Hathaway instead. Buffett's folksy investment wisdom will entertain and educate. And it will help you go down the same slow and steady path that led to Berkshire Hathaway outperforming the market over the long term even as investment fad after investment fad (like the DORKs) eventually imploded.