When ChatGPT was released to the broader public on Nov. 30, 2022, Nvidia had a market capitalization of just $345 billion. As of the closing bell on July 25, 2025, its market cap had eclipsed $4.2 trillion, making it the most valuable company in the world -- by a pretty wide margin, too.

Given these historic gains, it's not entirely surprising that for many growth investors, the artificial intelligence (AI) movement revolves around Nvidia. At this point, the company is basically seen as a barometer measuring the overall health of the entire AI sector.

It's hard to bet against Nvidia, but I do see another stock in the semiconductor realm that appears better positioned for long-terms gains.

Let's explore what makes Taiwan Semiconductor Manufacturing (TSM 0.66%) such a compelling opportunity in the chip space right now, and the catalysts at play that could fuel returns superior to Nvidia's over the next several years.

The AI infrastructure wave is just starting

I like to think of the AI narrative as a story. For the last few years, the biggest chapter revolved around advanced chipsets called graphics processing units (GPUs), which are used across a variety of generative AI applications. These include building large language models (LLMs), machine learning, robotics, self-driving cars, and more.

These various applications are only now beginning to come into focus. The next big chapter in the AI storyline is how infrastructure is going to play a role in actually developing and scaling up these more advanced technologies.

NYSE: TSM

Key Data Points

Global management consulting firm McKinsey & Company estimates that investments in AI infrastructure could reach $6.7 trillion over the next five years, with a good portion of that allocated toward hardware for data centers.

Piggybacking off of this idea, consider that cloud hyperscalers Amazon, Microsoft, and Alphabet, along with their "Magnificent Seven" peer Meta Platforms, are expected to devote north of $330 billion on capital expenditures (capex) just this year. Much of this is going toward additional servers, chips, and networking equipment for accelerated AI data center expansion.

To me, the aggressive spending on capex from the world's largest businesses is a strong signal that the infrastructure wave in AI is beginning to take shape.

Image Source: Getty Images.

This is great for Nvidia and even better for TSMC

Rising AI infrastructure investment is a great tailwind for Nvidia but also a source of growth for Advanced Micro Devices, Broadcom, and many others.

Unlike AMD or Nvidia, though, growth for Taiwan Semiconductor (TSMC for short) doesn't really hinge on the success of a particular product line. In other words, Nvidia and AMD are competing fiercely against one another to win AI workloads, which boils down to which of them can design the most powerful, energy efficient chips at an affordable price.

The investment case around TSMC is that it could be seen as more of an agnostic player in the AI chip market because its foundry and fabrication services stand to benefit from broader, more secular tailwinds fueling AI infrastructure -- regardless of whose chips create the most demand.

Think of TSMC as the company actually making the picks and shovels that Nvidia, AMD, and other chip companies need to go out and sell while competing among one another.

TSMC's "Nvidia moment" may be here

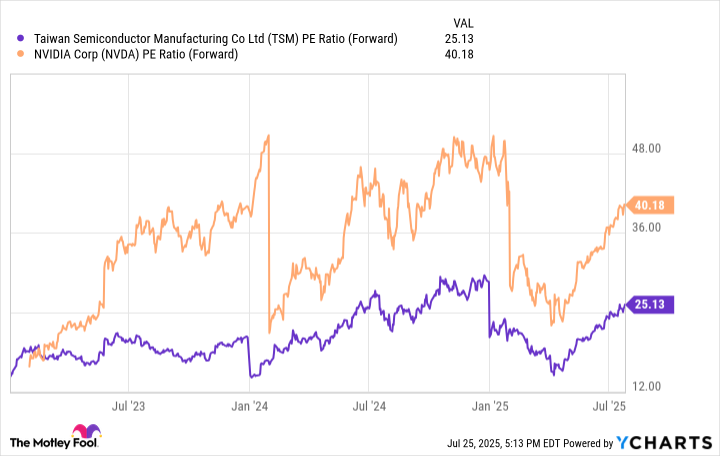

The valuation disparity between Nvidia and TSMC says a couple of things about how the latter is viewed in the broader chip landscape.

TSM PE Ratio (Forward) data by YCharts; PE = price to earnings.

Companies such as Nvidia and AMD rely heavily on TSMC's foundry and fabrication services, which are essentially the backbone of the chip industry. While some on Wall Street would argue that Nvidia has a technological moat thanks to its one-two punch of chips and software, I think that TSMC has an underappreciated moat that provides the company with broader exposure to the chip industry compared to its peers.

Over the next five years, I think use cases of AI development increase as businesses seek to expand beyond their current markets in cloud computing, cybersecurity, enterprise software, among others.

Emerging applications such as autonomous driving and quantum computing will drive demand for GPUs and data center capacity even further. For this reason, TSMC may be on the verge of an "Nvidia moment" featuring prolonged, explosive growth.

TSMC's modest forward price-to-earnings multiple (P/E) of 25 puts it in a unique position compared to Nvidia (with its forward P/E of 40) for considerable expansion as the infrastructure chapter of AI continues to be written.

I think Taiwan Semiconductor Manufacturing's valuation will increasingly become more congruent with the company's growth over the next several years, and so I predict that the stock will outperform Nvidia by 2030.