The stock market is arguably the most effective way for the average person to build wealth, mainly due to its compounding effect. Compound earnings reward consistency by taking small investments and growing them (and the interest you earn) over time. It's the gift that keeps giving.

One way to accelerate the compounding effect is by investing in dividend stocks. They may not provide the same thrill you receive from seeing a stock's price appreciate like some growth stocks, but the consistent income adds up, and in many cases, it's a win-win when combined with stock price growth.

If you're looking for reliable dividend income that can set you up for life, the following two options are worth considering for your portfolio. Both have time-tested businesses that are here to stay.

Image source: Getty Images.

1. Coca-Cola

Coca-Cola (KO +0.51%) is one of the most recognizable brands in the world, and for good reason. It has managed to get distribution in over 200 countries, and its flagship Coca-Cola soda is one of the most successful products ever created.

Coca-Cola has mastered the "we know what we are and we're sticking to it" mindset. Whereas competitors like PepsiCo have expanded into the food and snack space, Coca-Cola has remained true to its core beverage roots. This slim focus has allowed Coca-Cola to "perfect" its operations and focus on efficiency.

At its current scale, you probably won't see double-digit revenue and profit growth, but you can bank on consistency. And while Coca-Cola may sometimes lack volume growth, it makes up for it with its pricing power. This is partly why its dividend -- which is why most investors are attracted to the stock to begin with -- is here to stay and will remain one of the more attractive ones from an S&P 500 company.

NYSE: KO

Key Data Points

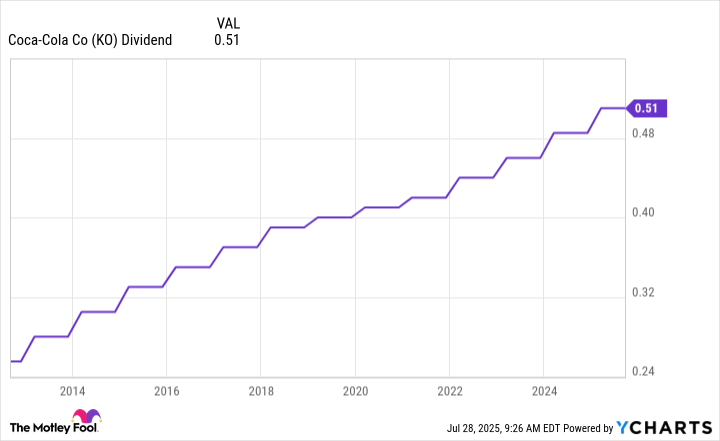

Coca-Cola is part of the heralded Dividend King club, having increased its annual dividend for 63 consecutive years. You can count on two hands the number of companies with a longer streak. It's one thing to invest in a company with an above-average dividend; it's another thing to invest in one with a dividend that you know will increase annually. Coca-Cola investors can be sure of the latter. Its dividend has doubled since 2012.

KO Dividend data by YCharts

Even with decades of success under its belt, Coca-Cola has continued to invest in expanding its portfolio to include various categories and adapt to changing consumer preferences. The lack of complacency is key to its long-term success and is why it's a dividend stock you can feel comfortable holding on to for the long haul.

2. AT&T

It hasn't been all peachy keen for AT&T's (T +4.40%) business since it acquired Time Warner in 2018 for over $85 billion, but the subsequent spinoff in 2022 and refocus on its core telecom business have been paying off.

AT&T's main business, postpaid phone subscribers (people who pay monthly), has been steadily growing. In the second quarter, it added 401,000 postpaid phone subscribers, helping to grow its mobility service revenue 3.5% year over year. Its total revenue also grew 3.5% year over year to $30.8 billion, which may not be wowing, but it's solid growth for a company of its size.

Much of AT&T's near-future growth will come from its Fiber (high-speed internet) business. Fiber is a higher-margin business than postpaid phones and is still in the earlier stages of what AT&T hopes it can become. It reached the 30 million fiber location mark in this past quarter, a celebration-worthy milestone. Its consumer fiber broadband revenue grew 18.9% year over year to $2.1 billion.

NYSE: T

Key Data Points

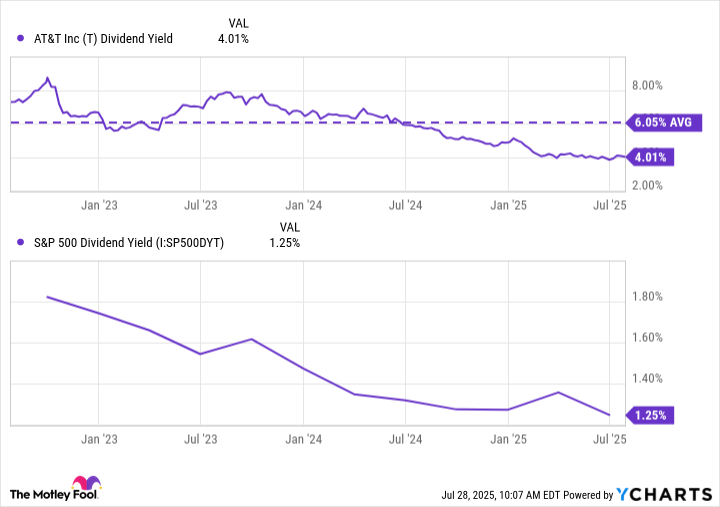

After cutting its dividend by nearly half in early 2022 after its WarnerMedia spinoff, these recent successes should make investors confident that AT&T's dividend is back and sustainable. Its current yield is around 4%, more than 3 times the S&P 500 average.

T Dividend Yield data by YCharts

The telecom industry is undoubtedly here to stay; it's way too important to daily life not to be at this point. As a leader in the industry and essential provider, AT&T is also here to stay. It should be one of the more reliable dividend stocks for quite some time.