Few stocks have defied expectations the way Palantir (PLTR 5.56%) has.

After going public in Sept. 2020, the stock nearly quadrupled in just a few months' time. However, by the end of 2022, it had plummeted over 80% from its peak as part of a broad sell-off that dragged down much of the tech sector.

Since hitting its all-time low of $5.92 per share in late 2022, Palantir has delivered unbelievable returns. The stock was the top performer on the S&P 500 last year, jumping 340%, and it's on track to be the leader this year with a 105% gain year to date. The stock trades at more about $154 as of this writing.

Along the way, Palantir has continued to buck the claim from bears that it's overvalued. Indeed, the artificial intelligence (AI) stock currently boasts a price-to-sales ratio of 120, which is nearly 40 times higher than the S&P 500 index overall.

While Palantir is certainly expensive, the massive premium has yet to restrain the stock's rise. Let's take a look at what continues to drive the stock higher and higher.

Image source: Getty Images.

1. Its results back it up

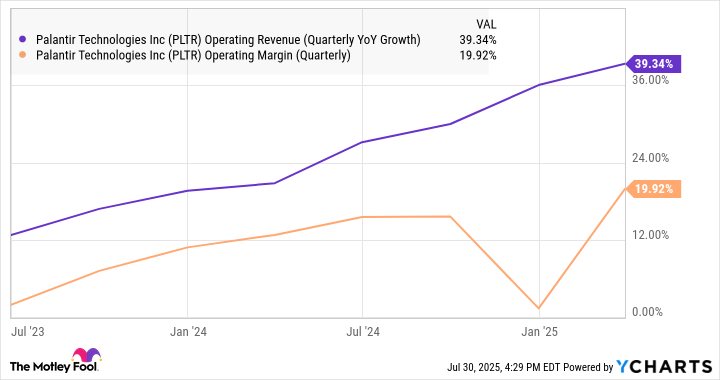

Palantir's surge has followed major improvements in its business. Over the last two years, since it launched its Artificial Intelligence Platform (AIP), revenue growth has steadily accelerated, and its operating margin has expanded as well.

The chart below shows how far the business has come during that time (the drop in operating margin in Q4 2024 was due to a one-time stock-based compensation award).

Data by YCharts,

As you can see, Palantir has gone from a slow-growth, barely profitable company to a fast-growing, high-margin business in just two years, and a closer look at the business shows its key segments are outgrowing the company overall.

U.S. revenue jumped 55% year over year in the first quarter as its deep data analytics products are catching on with private-sector clients. Revenue from the commercial sector was up 71%.

As CEO Alex Karp noted in the recent report, the company's Rule of 40 score, which is based on a combination of revenue growth and operating margin, increased to 83%, which exceeds the conventional standard for an investable software stock by a wide margin.

2. It's become a favored provider in the Trump administration

Palantir got its start signing deals with government agencies, and the federal government remains its biggest source of revenue today.

In the first quarter, U.S. government revenue rose 45% to $373 million, which made up more than 40% of total revenue. Support from the Trump administration seems likely to continue driving its growth over the next few years.

President Trump signed an executive order in March requiring the federal government to share data across agencies, and Palantir is poised to play a major role in that process. The company has also been asked to help Immigration and Customs Enforcement (ICE) develop a new surveillance platform called "ImmigrationOS," and Palantir appears to be at the heart of similar pushes from the Department of Government Efficiency to streamline federal spending.

Overall, the Trump administration's push for increased immigration enforcement, Palantir's history as a high-tech defense contractor, and co-founder Peter Thiel's status as a deep-pocketed Republican donor all mean the company is likely to see increased business from the government during the current administration.

NASDAQ: PLTR

Key Data Points

3. It's a risk-on environment again

The April sell-off stemming from Trump's "Liberation Day" tariffs seems like a distant memory now, and the S&P 500 is back to setting fresh all-time highs again.

AI stocks like Nvidia and Palantir have followed that trend with investors bidding them up to capitalize on what might be the most disruptive new technology since the internet.

There are other signs the market is getting frothy as well. Development-stage companies with little or no revenue in emerging industries like quantum computing and electric vertical takeoff and landing vehicles have seen their stocks surge. Investors also seem to have given up any concerns they had over Trump's new trade policies.

That risk-on sentiment won't last forever, though, and when the market turns defensive, high-flying stocks like Palantir will see the most volatility. Investors got a glimpse of that reality earlier this year when the stock plummeted over 40% between mid-February and early April.

For now, the business is racking up win after win, and its government contracts make it more recession-resistant than most software stocks. However, its eye-watering valuation still makes it vulnerable to even slight changes in market sentiment or to the trajectory of its business. Any further stretching of its valuation will be difficult to sustain.