While not necessarily a big deal, stock splits can elicit strong interest from market watchers because they often indicate that something else is amiss. Rigetti Computing (RGTI +6.98%) has become one of the big winners over the last year, thanks to investors' interest in the high-flying quantum computing space. Many believe quantum computing has the potential to revolutionize society similar to the way artificial intelligence does. While it's difficult to predict exactly when a company will conduct some kind of stock split, Rigetti has been a volatile name this year. Is the company on stock-split watch?

What are stock splits and reverse stock splits?

Before we can examine whether Rigetti could be on stock-split watch, let's first look at what stock splits and reverse stock splits are. Stock splits allow companies to artificially change their share price and shares outstanding without changing their market cap. The important thing for investors to understand is that a stock split does not change an investor's equity position. Traditional stock splits bring the share price down and the outstanding shares up, while reverse stock splits do the opposite.

Image source: Getty Images.

Let's look at an example of a traditional stock split. Say a company is trading at $75 per share and an investor owns 10 shares for a total equity position of $750 right before that company conducts a 3-for-1 stock split. The company would essentially give investors three shares of every one share they own. So instead of having 10 shares, the investor would now have 30 shares. The share price would fall to $25 because the equity position stays the same ($750/30).

So why would a company do a stock split? Well, perhaps a stock just went on a big run and now the company wants to lower the price to make it more attainable for retail investors. Or perhaps management wants to grow the share count to make the stock more liquid.

A reverse stock split can be helpful if a company on the New York Stock Exchange (NYSE) or Nasdaq falls out of compliance. Both of these exchanges require that stocks trade for at least $1 per share for at least 30 days. So, if a company is struggling but thinks they can fix their issues and wants to stay on the largest exchanges, a reverse stock split can be a good tool to bridge the gap.

Could Rigetti undergo some kind of split?

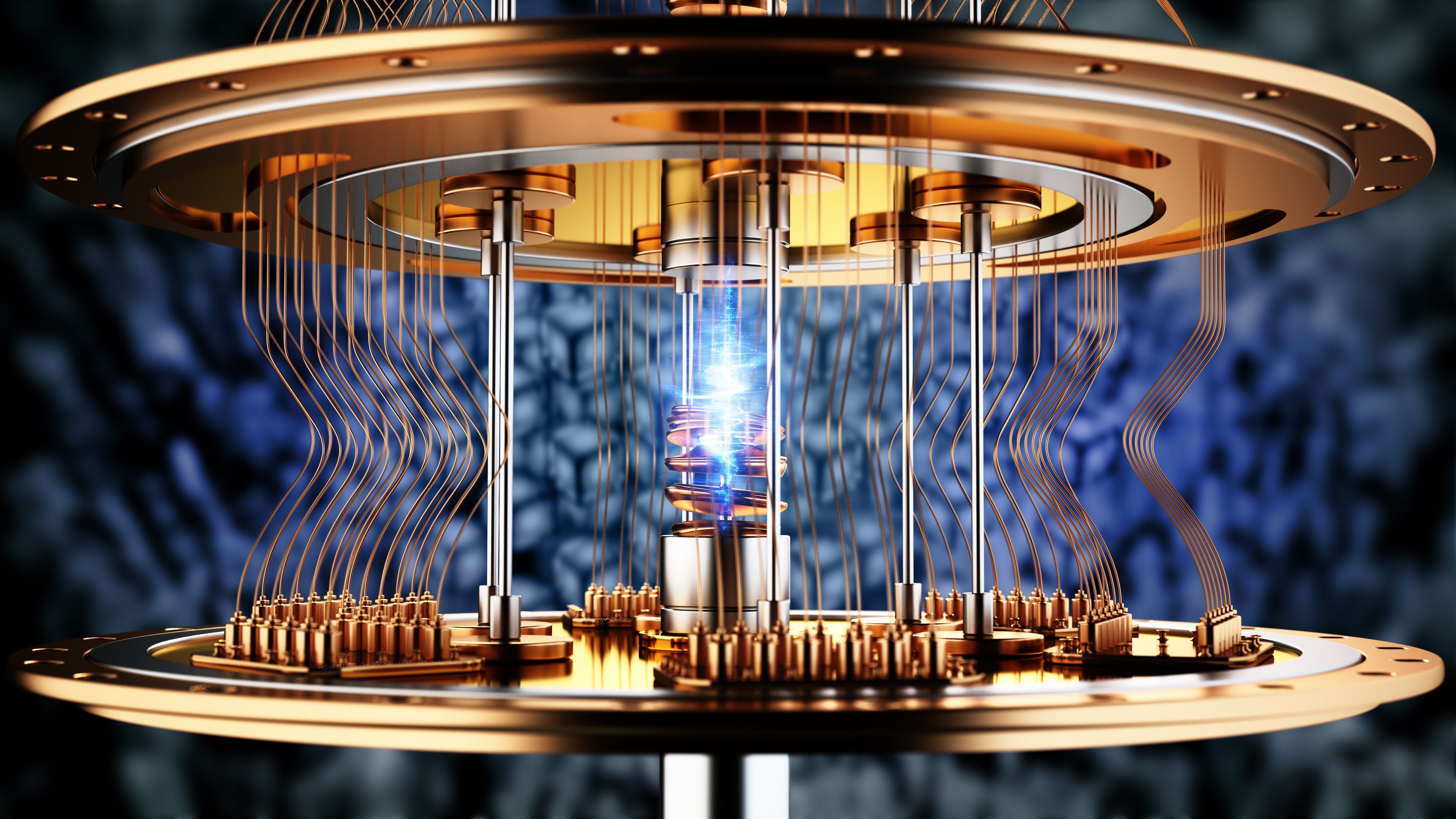

As a quantum computing company, Rigetti is essentially designing super computers that use qubits to compute much more complex equations and problems than can be done on regular computers today. While computers run on bits, the most basic unit of digital information, qubits make processing more complex info in a more efficient manner possible. Potential quantum computing use cases, according to IBM, include the ability to simulate molecular behavior and biochemical reactions, solutions to combat climate change, and even make groundbreaking innovations in machine learning.

NASDAQ: RGTI

Key Data Points

In mid-July, Rigetti announced that its 36-qubit system had achieved a two-times lower gate error rate, the best performance seen on one of its quantum systems yet. The company is hoping to pull off a similar accomplishment on its soon-to-be-released 100-qubit system. The more qubits, the more powerful the computing capacity on the quantum computer.

Interestingly, until late last year, Rigetti traded for less than $1 and did face potential delisting. Shareholders even approved a reverse stock split in 2024. However, it never came to pass. Huge interest in the sector led the stock to soar over 1,370% over the past year. The company now has a $4.7 billion market cap. After the big run, Rigetti could conduct a stock split. However, a $15 stock doesn't feel unattainable, and most of the company's outstanding shares are publicly traded on the Nasdaq, according to MarketWatch, so I doubt it has any liquidity issues.

Given that Rigetti is now safely in compliance with Nasdaq's rules, I also don't see any pressing need to conduct a reverse stock split. Quantum computing companies are still trying to perfect the technology, and really haven't commercialized quantum computers yet, so they don't generate a ton of revenue or earnings. Rigetti only generated $1.5 million of revenue in the first quarter of this year.

It's possible that if market conditions deteriorate, investors may not be willing to pay such a high price, which could trigger a big sell-off. However, given the interest in quantum computing and Rigetti's technological progress, it's hard to imagine a sell-off bringing the stock price below $1. For these reasons, I see no pressing need for the company to conduct any kind of stock split.