If you're like most people, you may be investing brick by brick, a little at a time. You may have a nice round number, say $1,000 in cash, and want to add the next brick to your portfolio.

Where do you look? That's a personal decision, but it doesn't hurt to have a default choice, a stock that's always a good buy.

That go-to stock probably shouldn't be an individual company because they can be too expensive at times. I'm thinking more along the lines of exchange-traded funds (ETFs), which are diversified baskets of stocks. You can add additional money each month, which is called dollar-cost averaging.

There are many to choose from, but the Vanguard S&P 500 ETF (VOO +0.33%) might be the best among them. Below, I'll explain why it's the best Vanguard ETF in which to invest $1,000 right now.

Image source: Getty Images.

The S&P 500 is historically reliable

Simply put, the Vanguard S&P 500 ETF mimics the S&P 500 stock market index. You've probably heard of it or read about it at some point. The S&P 500 is arguably the world's most famous index. When people ask, "How is the stock market doing today," they're often referring to it.

The S&P 500 is famous for good reason -- it represents 500 of America's most distinguished corporations, which must meet specific criteria to join the index. The companies in the S&P 500 are weighted by market cap, so it skews more toward the largest and most successful businesses.

The United States is the world's largest economy and stock market, and the S&P 500 essentially represents the best, where the cream rises to the top over time. The index pulls from each market sector to create a diverse offering of the best businesses America has to offer.

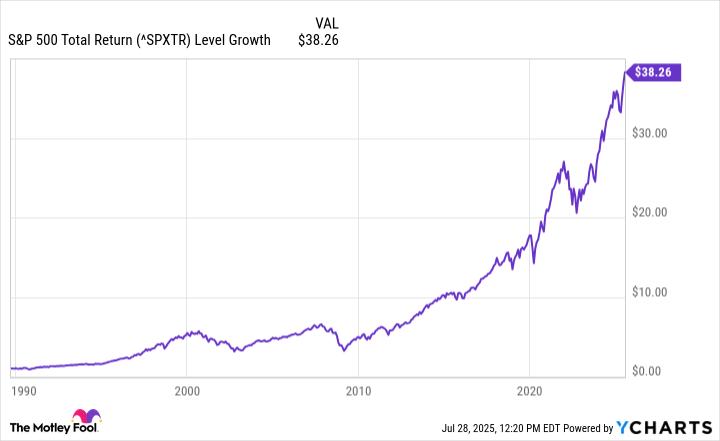

It's been a remarkably successful formula. The S&P 500 has historically returned approximately 10% per year, on average, spanning decades. That adds up to tremendous wealth over time. Every dollar invested since 1989 has grown by over 38 times since then. Even professionals struggle to consistently outperform the index.

As you may know, the stock market goes up and down, and sometimes it goes down by quite a lot. While past results don't guarantee future outcomes, the S&P 500 has historically overcome adversity to reach new all-time highs.

Why this fund?

You can't invest directly in the S&P 500 index, which is where the Vanguard S&P 500 ETF comes into play.

NYSEMKT: VOO

Key Data Points

Why this fund? Numerous ETFs track the index. However, there are several reasons to choose Vanguard.

First, The Vanguard Group is the largest provider of mutual funds and the second-largest ETF company in the world. It's been around since 1975, so it has a trusted name and a decades-long resume.

Second, the Vanguard S&P 500 ETF charges very low fees, just 0.03%, or $0.30 out of each $1,000 investment. That means you keep the vast majority of your money and the returns it earns over time.

Lastly, the fund is widely accessible, with a minimum investment of just $1. You can consistently build up your investment, even if you don't always have a lot of cash on hand.

Why invest right now? Time in the market beats timing the market

You may hear people discuss the stock market on television or read about it being up, down, cheap, or overvalued. That can tempt people into trying to predict what the market might do next or hold onto their cash, waiting for a steep drop to invest at lower prices.

All of this guesswork is just different versions of market timing. Unfortunately, studies have shown that even if you had a crystal ball and could invest at the absolute best point every year, it would still make little difference over a long enough time frame.

The people who fare the worst, by far, are those who don't invest at all. Why? The S&P 500 tends to go up over time, so even bad timing is better than not getting on the train.

While the S&P 500 won't make you rich overnight, it's probably the surest way to get there over time. This makes the Vanguard S&P 500 ETF a fantastic investment just about anytime you have money available, whether it's $1,000 or a different amount.