Palantir Technologies (PLTR 3.45%) has been the highest-performing S&P 500 stock over the past 12 months, and there isn't even a close second. Its stock is up around 550% -- more than 30 times the S&P 500's gains in that span.

Much of Palantir's recent stock price success can be attributed to the artificial intelligence (AI) boom that consumed the stock market and business world over the past couple of years.

On Aug. 4, Palantir reported its second-quarter earnings, with the results causing an after-hours 4.5% jump. Below are the biggest takeaways from its earnings report.

NASDAQ: PLTR

Key Data Points

Palantir's commercial business is picking up steam

Palantir is a software company that builds tools that make analyzing and gaining insight from large and complicated data sets much easier. Historically, its software has been geared toward governments, holding large contracts with U.S. government agencies like the CIA and the Department of Defense.

However, with the introduction of its Artificial Intelligence Platform (AIP), Palantir's commercial business has been growing at a much faster pace and is gaining ground in its government segment.

In Q2, Palantir's U.S. commercial revenue grew 93% year over year to $306 million, while its U.S. government revenue grew 53% year over year to $426 million. This performance helped the company achieve its first-ever $1 billion quarter.

Palantir is progressively closing larger deals

Palantir isn't a consumer-facing business like other big tech companies like Microsoft, Alphabet, and Apple. The focus on institutional clients means it routinely closes multiyear six- and seven-figure deals.

Below is how many large-value deals Palantir has closed in Q2 2024, Q1 2025, and Q2 2025.

| Deal Value | Q2 2024 | Q1 2025 | Q2 2025 |

|---|---|---|---|

| At least $1 million | 96 | 139 | 157 |

| At least $5 million | 33 | 51 | 66 |

| At least $10 million | 27 | 31 | 42 |

Data source: Palantir.

The above represent deals from all of Palantir's segments, but it's worth noting that its U.S. commercial deals of at least $1 million doubled from Q2 2024, and U.S. commercial deals of at least $5 million increased fivefold.

Being able to close these large deals is critical to Palantir's business because companies don't simply buy the software and put it to use; Palantir's tools are deeply ingrained in these institutions' operations.

Image source: Getty Images.

Palantir is increasing its margins at an impressive pace

A company's operating income is its profit from its core operations. In Q2, Palantir's adjusted operating income was $464 million, up from $254 million in Q2 2024. Adjusted operating income typically excludes expenses like one-time charges and stock-based compensation (a huge expense for Palantir), which is why it's higher than Palantir's operating income under generally accepted accounting principles (GAAP).

What's arguably more impressive about Palantir's adjusted operating income growth is that it has been able to expand its margins while simultaneously making investments to grow AIP and its other U.S. operations. Below are its margins from the past five quarters:

- Q2 2025: 46%

- Q1 2025: 44%

- Q4 2024: 45%

- Q3 2024: 38%

- Q2 2024: 37%

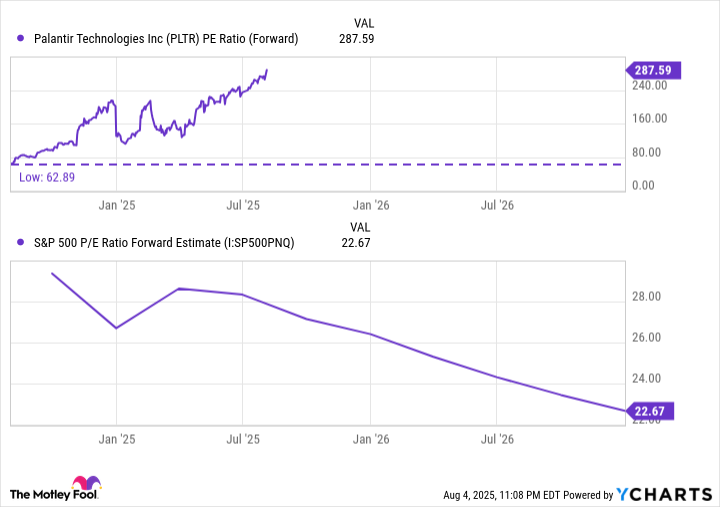

Investors shouldn't ignore the company's high valuation

With Palantir's recent stock price explosion has come a valuation that is well beyond "expensive" by even the most relaxed of standards. As of its Q2 earnings report, the stock is trading at a jaw-dropping 287 times its forward earnings. There's expensive, and then there's that.

PLTR PE Ratio (Forward) data by YCharts

This high valuation doesn't mean that investors should steer clear of the stock, but it does mean the stock has a bright yellow caution sign attached to it. Historically, even companies that traded at high levels -- but much cheaper than Palantir -- have experienced sharp pullbacks.

Of course, past events aren't guaranteed to repeat for Palantir, but it's not far-fetched to think the company could fail to meet up to its lofty expectations at any point.