Things are going from bad to worse for UnitedHealth Group (UNH +0.44%). Investors were already enduring a tough year in 2025, with the company facing myriad bits of bad news, including poor financial results, a change in CEO, and an investigation involving the Department of Justice. Then, the company reported its latest earnings numbers last Tuesday, and shares fell again.

As of the close of trading on July 31, the stock had lost half of its value in 2025. And worst of all, it may not have bottomed out just yet. After the company's recent earnings report, which featured even more bad news, investors shouldn't be surprised to see this struggling stock fall even lower in the weeks and months ahead. Are you better off simply avoiding it, or could UnitedHealth actually make for a good contrarian investment?

Image source: Getty Images.

UnitedHealth's forecast badly missed expectations

On July 29, UnitedHealth reported its latest earnings numbers, and while the business was growing, its bottom line wasn't. Revenue for the period ending June 30 totaled $111.6 billion and rose by a modest 2% from the same period last year. But what was concerning was that its earnings (the bottom line), which totaled $5.2 billion, were down a staggering 43%.

A big problem for the health insurer is rising medical costs. Its medical care ratio rose from 85.1% a year ago to 89.4% this past quarter, which signifies that it's paying out a higher amount of medical expenses relative to the premiums it collects. The higher the ratio, the less profitable the company. In recent years, patients have been resuming treatments and electing to take surgeries that they put off during the earlier days of the pandemic, which has contributed to this increase.

Earlier this year, the healthcare company suspended its guidance amid uncertainty around healthcare costs. But under CEO Stephen Hemsley, who took over from Andrew Witty a few months ago, it has released new guidance. The problem is, it's far below what analysts were expecting. UnitedHealth's adjusted earnings per share is projected to come in at $16 or better this year, but Wall Street was expecting $20.91 in adjusted per-share profit. Unsurprisingly, amid such a drastic shortfall, the stock proceeded to drop yet again after the news.

How cheap is UnitedHealth stock right now?

Shares of UnitedHealth haven't been trading this low since the COVID-19 crash of 2020. Its five-year return is now -16% before factoring in dividends. Based on analyst earnings estimates, the stock is trading at a forward price-to-earnings multiple of 13. But if analysts reduce their expectations for the stock, then that earnings multiple could end up rising.

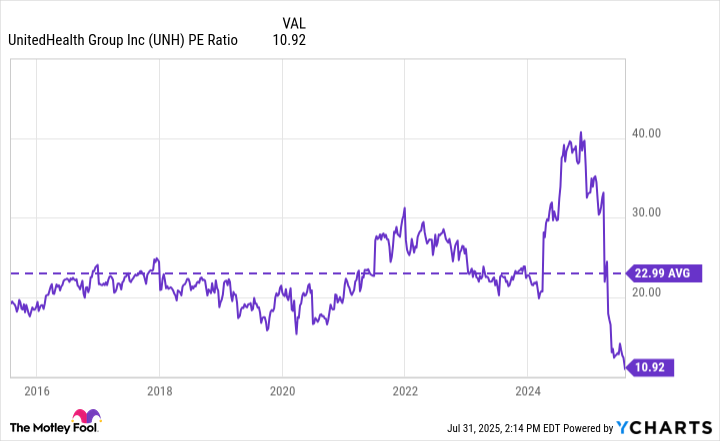

Based on the company's trailing earnings, investors are paying a multiple of around 11. The chart below shows just how extremely low that is compared to where UnitedHealth stock has traded in the past.

UNH PE Ratio data by YCharts. PE Ratio = price-to-earnings ratio.

The stock is trading at a significant discount and could potentially make for an intriguing investment option.

Should you avoid UnitedHealth stock, or take a chance on it?

Things look bleak for UnitedHealth's stock as the bad news just keeps coming. But if you're willing to take a contrarian position in the company, be patient, and plan to hang on for multiple years, it may not be a bad move to invest in the business today. Given how significantly discounted it is, there's a good margin of safety here for investors. Consider that the average stock on the S&P 500 trades at a price-to-earnings multiple of 25 -- UnitedHealth is nowhere near that.

NYSE: UNH

Key Data Points

It could take time for the business to turn things around, but it is working on improving profitability, including exiting some Medicare Advantage markets to curb costs. And with an attractive dividend that yields more than 3% as I write this, there's plenty of incentive just to buy and wait. There's some risk with the stock, but I think the sell-off is a bit overblown. While I wouldn't expect a quick turnaround, UnitedHealth can be a good long-term stock to buy on weakness.