If you have a child in their teenage years or younger, there's a good chance that you have heard of Roblox (RBLX +3.11%). The metaverse gaming platform has been a hit among young folks since it was created in 2004 and reached its first 1 million registered users in 2006.

Roblox went public in March 2021, and the stock has been on a rollercoaster ride since then. Its IPO price was $45, but the stock surged to $134 by November 2021. Nearly seven months later, it had lost around 80% of its value, dropping to $27 in June 2022. However, in the past 12 months, the stock is up more than 250% and flirting with its all-time high (as of Aug. 4).

There's a lot to like about Roblox and its direction, but there's also one key red flag that investors should be aware of. Let's take a look at what those are before you make an investment decision.

Image source: Getty Images.

Roblox's user growth and engagement are picking back up

Unsurprisingly, Roblox's platform was a major hit during the COVID-19 pandemic, with so many people at home and filling their time in various ways. During this time, Roblox's user base surged, but soon cooled as the world began to reopen. Roblox usage is now picking up more steam.

In the second quarter (Q2), Roblox had 111.8 million daily active users (DAUs), up 41% year over year (YOY). Its users engaged with the platform for a total of 27.4 billion hours, nearly 10 billion more hours than in Q1 2024.

NYSE: RBLX

Key Data Points

For Roblox, more DAUs is obviously a good thing, but the hours these users engage on the platform are just as important because it leaves more opportunities for people to spend money via Robux (its virtual currency), participate in sponsored content (like luxury brand Gucci's Gucci Town), and engage with ads.

Bookings on Roblox's platform are picking up steam

While most people give a lot of attention to a company's revenue, Roblox's most meaningful top-line metric is its bookings because it reflects the actual cash coming in from user spending on the platform (mainly through Robux purchases).

Roblox's revenue, on the other hand, is typically recognized gradually over time. This gradual recognition means it may not be reflected in Roblox's financial statements in real-time and doesn't accurately reflect the immediate financial impact of Roblox's users' activity.

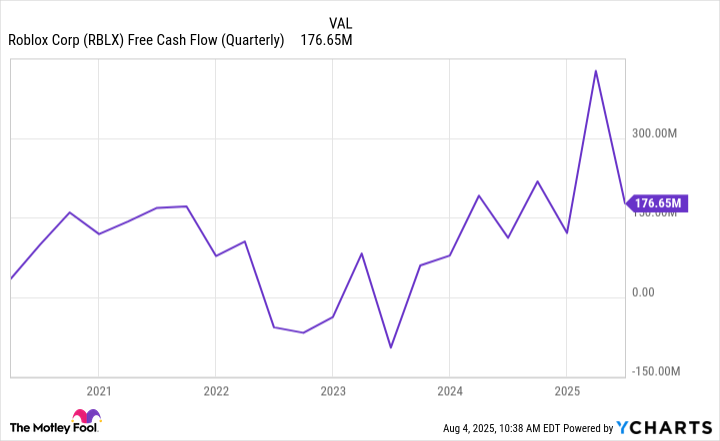

In Q2, Roblox's bookings reached $1.44 billion, up 51% YOY. This helped boost its free cash flow to $177 million, up 58% YOY. It's less than its Q1 free cash flow, but some of that can be attributed to a $30 million payout that was delayed from Q1 to Q2.

RBLX Free Cash Flow (Quarterly) data by YCharts

Roblox estimates its full-year bookings to fall between $5.87 billion and $5.97 billion, which would be a 34% to 37% YOY growth.

Roblox's red flag to watch

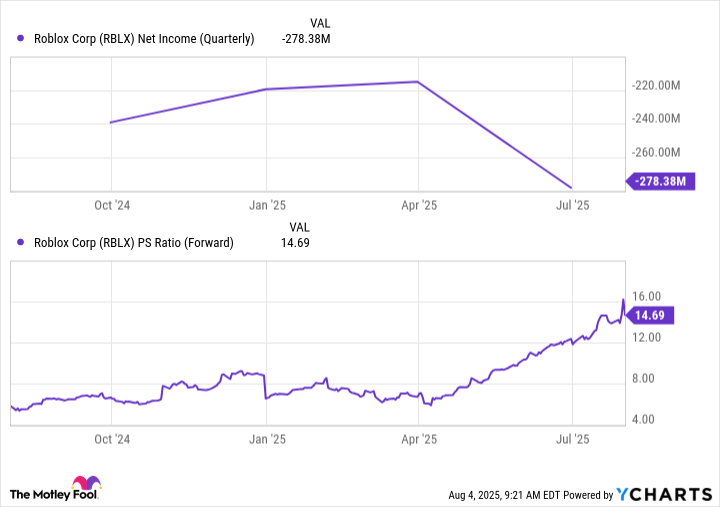

The issue with Roblox's stock right now is its high valuation while still being unprofitable. In Q2, Roblox recorded $278.4 million in net losses, bringing its total net losses in the first half of the year to $493.5 million. It forecasts net losses for the year to be between $1.20 billion and $1.26 billion.

Even still, the stock is trading at nearly 14.7 times its forward sales estimates.

RBLX Net Income (Quarterly) data by YCharts

It's not unusual for a relatively new growth stock to put profitability on the back burner while the company focuses on growing and capturing market share. In fact, it's a fairly common practice nowadays. However, to justify its valuation, Roblox would need to maintain at least 40% to 50% bookings growth over the next several years.

It's doable with the company's current momentum, but there's no guarantee that this momentum continues for years -- especially with increased competition from games like Fortnite and Minecraft.