Not too long ago, Cleveland-Cliffs (CLF +0.11%) didn't make steel -- it was just a supplier to the steel industry. Then a series of huge acquisitions changed the story. Now Cleveland-Cliffs is one of the largest and most important steel makers in North America. But is that enough to make it a no-brainer steel play? It depends on what you're looking for.

What does Cleveland-Cliffs do?

At this point, Cleveland-Cliffs is a vertically integrated steel maker. That means it owns steel mills, but it also owns the key inputs it requires to make steel, like iron ore. Although the company makes some fabricated and specialized products out of its steel, most of its production is really just commodity-based. So steel prices have a big effect on the top and bottom lines.

Image source: Getty Images.

The real key here, however, is that Cleveland-Cliffs' production is centered around blast furnaces. This is an older steel-making technology that involves high operating costs. When demand is strong and steel prices are high, Cleveland-Cliffs can have robust earnings results. However, when utilization rates fall and steel prices are low, the company can bleed red ink. Sometimes the losses are pretty painful to live through.

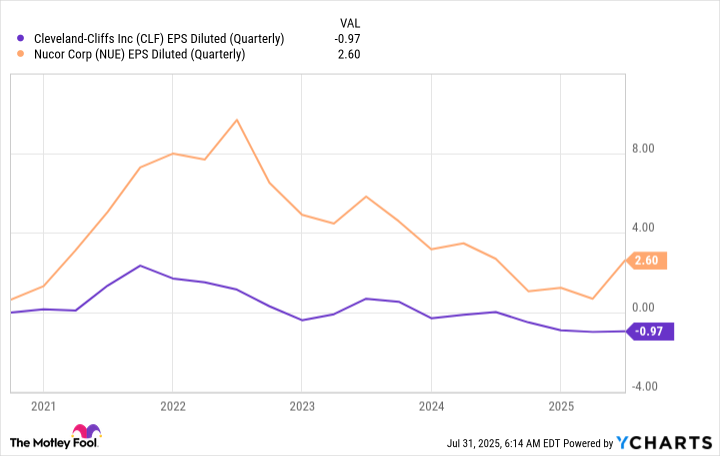

Peers like Nucor (NUE +1.86%) are centered around electric-arc mini-mills, a newer steel-making technology. To simplify things, Nucor's manufacturing assets can be ramped up and down more easily to adjust for changes in demand and steel prices. As such, it tends to have stronger margins through the entire steel cycle. Often Nucor will just have weaker earnings at a time when Cleveland-Cliffs will be losing money.

CLF EPS Diluted (Quarterly) data by YCharts. EPS = earnings per share.

For those looking to invest in the steel industry for the long term, Nucor is likely to be the better investment choice. Notably, Nucor is a Dividend King, with over five decades of annual dividend hikes speaking to its more consistent financial results.

Playing the swings in a cyclical industry

That said, steel is a cyclical business. If you're looking to buy Nucor for the long term, now could be a good time to jump aboard, because the sector is a bit out of favor at the moment. But what if you don't actually want to own a steel stock for the long term?

The caveat here is that trying to time market swings isn't the best idea for most investors. It's high-risk, and a bad call can leave you with a losing investment. Yet, the steel industry does reliably go through boom and bust cycles. Buying in the bust phase, as suggested above with Nucor, can get you in the door when steel stocks are cheap.

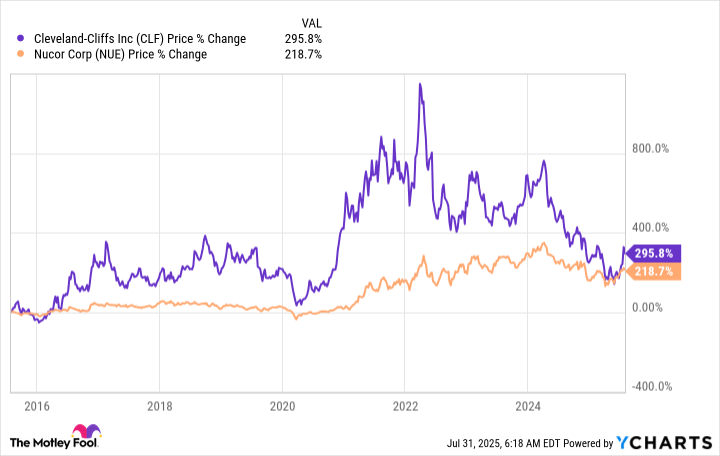

NYSE: CLF

Key Data Points

If you do that with Cleveland-Cliffs, you'd set yourself up for a larger rebound because of the boom-and-bust nature of its earnings. Indeed, when the steel market rebounds, Wall Street is likely to reward Cleveland-Cliffs' stock more than Nucor's -- at least, over the short term. The next bust will likely be more punishing for Cleveland-Cliffs' business than it will be for Nucor's, which will likely lead to a steeper drop when the steel industry shifts gears again. In other words, you'll want to get out of Cleveland-Cliffs before the drop if you're trying to time the steel cycle.

Is Cleveland-Cliffs stock a no-brainer steel play?

Cleveland-Cliffs is not a no-brainer investment. In fact, it requires a lot of brain power, because you need to understand the often volatile nature of its business and how that's affected by the broader trends in the steel industry. If you prefer simple investments that you buy and hold for the long term, Nucor will be a better steel choice. But if you like trading, you may prefer to ride the ups and downs in Cleveland-Cliffs' business. Just go in with an understanding of the risks you're taking on.