Norwegian Cruise Line Holdings (NCLH 4.91%) benefited from a significant bump following earnings, rising 9% in the following trading session. With record revenue and strength in all three of its cruise lines, one might think it is time to own Norwegian stock.

But is that the case? Norwegian's market share lags far behind its larger peers, Carnival and Royal Caribbean. Additionally, Viking Holdings has drawn significant attention since going public last year. Under such conditions, is Norwegian a buy, or should investors turn to other cruise line stocks instead?

Image source: Getty Images.

Norwegian's second-quarter results

Indeed, investors found a lot to like in Norwegian's report for the second quarter of 2025. In Q2, revenue came in at $2.5 billion, a 6% increase from year-ago levels. Although that missed the Wall Street estimate by $60 million, it was also an all-time record for the cruise line.

Moreover, the company backed off its cautious tone from Q1. It reported occupancy of 104% (100% occupancy is defined as two people in every cabin) and stated that all three of its brands have rebounded, and bookings are ahead of historical levels.

Also, the company kept operating expense growth flat, leading to significantly higher operating income. However, that was negated by higher interest costs, foreign exchange losses, and pension plan expenses. Consequently, the Q2 net income of $30 million is well below the $163 million in the year-ago quarter.

For all of 2025, the company forecasts revenue growth of 2.5%. Admittedly, that is a slowdown from the 11% revenue increase in 2024. Still, it shows that the company has fully recovered from the pandemic shutdown and revenue growth is more comparable to pre-COVID levels.

Also, given the 3% revenue decline in Q1, it is likely that Norwegian's revenue will continue to grow in Q3 and Q4. Amid that boost, Norwegian stock has outperformed the S&P 500 over the last year.

NYSE: NCLH

Key Data Points

Norwegian versus its competitors

Despite the improvement, investors can be forgiven for writing off Norwegian. Investors often gravitate to the first- or second-largest company in an industry, and Norwegian is a distant fourth in terms of revenue, lagging Carnival, Royal Caribbean, and Switzerland-based MSC Cruises.

Also, there's the massive debt burden that most cruise lines took on to survive the pandemic shutdown. Norwegian's current debt is approximately $13.8 billion. That significantly exceeds its shareholders' equity (book value) of $1.6 billion, and has not fallen significantly from 2022 levels. In comparison, Carnival has reduced its total debt from almost $36 billion in 2022 to below $28 billion as of its most recent quarter.

Moreover, Norwegian spent $805 million in interest over the past 12 months, which substantially reduced its income. Additionally, even though Norwegian does not have significant debt maturing soon, not reducing debt likely means it will have to refinance at higher rates, which would reduce profits over time.

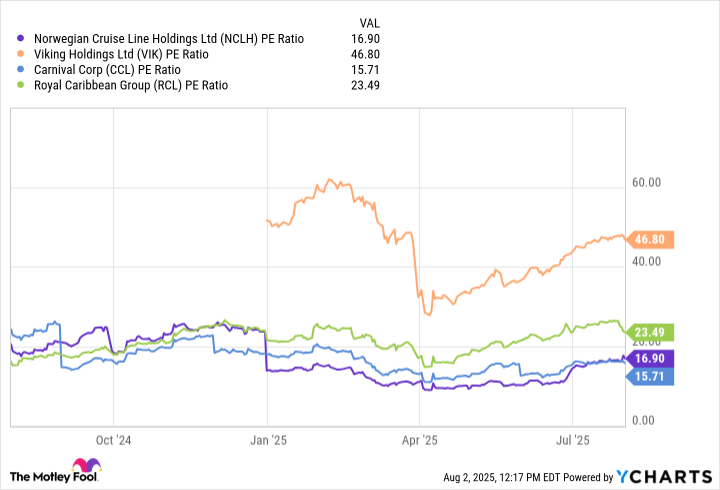

Furthermore, while many analysts perceive Norwegian as a higher-end cruise line, Viking has claimed much of the upscale market, leading to its 47 P/E ratio. Still, valuation could work in Norwegian's favor, as its 17 P/E ratio makes it one of the cheapest cruise line stocks, nearly as low as Carnival, whose P/E ratio is 16. The low earnings multiple could limit the downside in the stock, which could bode well for Norwegian's long-term investors.

NCLH PE Ratio data by YCharts

Is Norwegian stock a buy?

Norwegian stock is likely a buy amid its low valuation and improved outlook. The cruise line has fully recovered from the pandemic and has managed to prosper to the point that it can earn a profit despite a heavy debt load.

However, the bigger question is whether it is the best stock. Admittedly, when comparing Carnival's leading market share and efforts to lower debt, many investors will find it worthwhile to choose it, especially with Carnival's slightly lower P/E ratio.

Still, conditions have undoubtedly become more favorable for Norwegian. If you are set on owning Norwegian stock, you have a high probability of outperforming the indexes.