There's plenty of doom and gloom to pass around the automotive industry right now. There's strategic planning uncertainty due to tariffs, the world's largest automotive market (China) is engulfed in a brutal price war, the electric vehicle (EV) industry has gained traction more slowly than anticipated, and driverless vehicles are incredibly complex and will face regulatory hurdles.

While those developments may have slowed General Motors (GM 1.71%) down, the company has been firing on all cylinders over the past few years. Is it finally time to buy this Detroit auto?

Brand power

General Motors has been riding sales momentum through most of 2025, and its brands are flexing their brand power and gaining ground. Consider that both Chevrolet and GMC have seen a boost in demand with a record first half of the year for GMC and the best since 2019 for Chevrolet. Meanwhile, GM also notes that Cadillac has become the luxury leader in EVs.

Image source: General Motors.

Much of GMC and Chevrolet's success is driven by full-size pickups -- the bread and butter of the Detroit auto industry -- and SUVs. Those vehicles are more profitable than sedans, and with strategic decisions facing long-term uncertainty with tariffs and policy, the company was still confident enough to add more U.S. manufacturing capacity for both.

Another driving force of GM's success is that Chevrolet and GMC are both coming off a fresh product wave over the past few years. That product wave brought updated crossovers, SUVs, and a wider range of new EVs. In fact, with the new selection of EVs, Chevrolet became the No. 2 EV brand in the second quarter, trailing only Tesla, which is struggling to maintain its market share amid declining sales.

General Motors' brands and sales are doing well, and it's gaining market share, but there's more to the automaker's investment thesis, including its massive share buyback programs.

NYSE: GM

Key Data Points

Returning value to shareholders

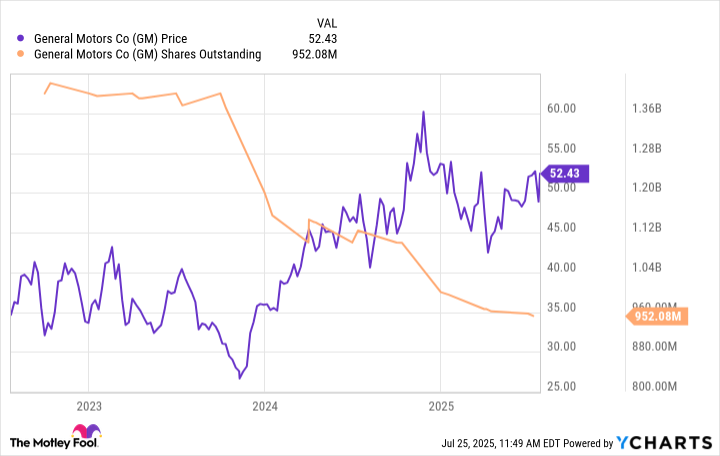

GM's stock has risen 51% over the past three years, a respectable gain compared to the S&P 500's 61% gain over the same period. But there's a problem -- it's still too cheap! It trades at a modest price-to-earnings ratio of 8 times. General Motors' solution to this was simple: Buy back truckloads of its stock.

GM has spent nearly $25 billion on share repurchases over the past three-plus years, which substantially dropped its shares outstanding from 1.5 billion down to 950 million. Better yet, as you can see in the graphic above, it helped drive GM's stock price higher.

"We think GM is significantly undervalued, [which] provides an opportunity to enhance shareholder value by repurchasing...shares," Oakmark investment analyst Joe Pittman told Barrons. "It's a great use of cash for them."

Big China problems

Beyond returning value to shareholders and thriving brands, GM is also working on weaknesses, including its operations in China. China's market is in rough shape. With a shaky economy, production overcapacity, and a brutal EV price war, it's been increasingly challenging for foreign automakers to compete and sustain profits.

Determined not to leave the region -- remember, China used to deliver billions in profits for GM -- the automaker went to work taking a $5 billion charge to restructure its business operations in China. The good news is that it's paying off, and the progress is notable.

Thanks to the performance of its new energy vehicles (NEVs), which include hybrids, EVs, and other alternatives, GM just posted its second consecutive quarter of year-over-year sales growth and gained the most market share of any foreign automaker, and it posted its third straight quarter of positive equity income after previously losing money.

What it all means

In my opinion, tariffs covered up what was an otherwise impressive second-quarter performance from General Motors, and the automaker is simply trading too cheap -- so much so that it's put up billions of its own money to buy back shares at these rock bottom prices.

The low valuation feels short-sighted for a company that has been making sound decisions since the dark days of the financial crisis in 2008. GM is buying its stock, and it might be time for investors to start doing the same.