The S&P 500 (^GSPC +0.19%) is on track to have an above-average year in 2025 after a rapid recovery from a steep sell-off in April. The impressive performance comes on top of back-to-back gains of more than 20% in 2023 and 2024.

Needless to say, the S&P 500 is running hot, so investors may want to take extra care to ensure they are targeting quality companies that can justify their valuations with future earnings growth.

Here's why these three Motley Fool contributors think WM (WM 0.60%), International Business Machines (IBM 1.59%), and Delta Air Lines (DAL 0.49%) stand out as top dividend stocks to double up on in August.

Image source: Getty Images.

WM is as reliable as it gets when it comes to generating passive income

Daniel Foelber (WM): You may be wondering how WM, formerly known as Waste Management, can be classified as a growth stock. But the industrial giant has outperformed the S&P 500 over the last five-year and 10-year periods despite a good chunk of S&P 500 gains being driven by megacap tech stocks.

The company isn't delivering groundbreaking innovation in artificial intelligence (AI) or cloud computing. But you could say it is literally turning trash (and recycling) into treasure thanks to its stable and predictable business model.

NYSE: WM

Key Data Points

As the population and economy expand, the need for trash and recycling collection, transportation, and processing grows. WM has an integrated business model covering the entire waste management value chain, which gives it more control over its operations and opportunities to increase efficiency. And since WM is the U.S. leader, it has the size needed to take market share through organic growth and acquisitions.

The company is steadily growing its operating margins and free cash flow, which is a sign that the business continues to get better. In the second quarter, it reported a 29.9% total company margin under adjusted operating earnings before interest, taxes, depreciation, and amortization (EBITDA); 7.1% growth in its legacy business, and 19% overall revenue growth factoring in its acquisition of Stericycle.

The Stericycle deal was completed in November 2024, giving WM a play on the growing healthcare waste market, which is more specialized than general residential, commercial, or industrial waste services. The $7.2 billion deal follows up the $4.6 billion acquisition of Advanced Disposal in October 2020, which expanded the company's geographic coverage in the eastern half of the U.S.

At 29.9 times forward earnings, WM is far from a cheap stock. It's actually fairly expensive. But it backs up its premium valuation with stable free cash flow that it uses to grow its dividend, repurchase stock, and reinvest in the business.

The company has 22 consecutive years of raising its dividend. Despite many sizable dividend increases (the most recent being a 10% bump), the stock only yields 1.5% due to its outperforming stock price.

WM's dividend is highly affordable. It costs the company about $669 million per quarter or $2.676 billion per year, but it plans to earn $2.8 billion to $2.9 billion in 2025 free cash flow.

Add it all up, and WM stands out as an ultra-high-quality dividend stock that is best suited for investors not looking to maximize their passive income, but rather to collect a dividend as the cherry on top of a strong underlying growth story.

With ample AI exposure, IBM is over a century old but still qualifies as a growth stock

Scott Levine (International Business Machines): I know, I know: It's hard to look at a company like IBM that was incorporated in 1911 and characterize it as a growth stock, but considering its strong exposure to AI, the potential for outsize growth in the coming years is exactly something that's within the realm of possibility for Big Blue.

Add to this the fact that the stock offers an attractive 2.6% forward-yielding dividend, and it emerges as a great opportunity to sit back and get paid for doing nothing while the AI market evolves.

Of the many achievements that IBM celebrated when it reported second-quarter 2025 financial results recently, one of the most notable is the company's strong generative-AI book of business -- more or less a running total of active contracts and orders it has secured -- that represented $7.5 billion from its inception in 2023 to date.

NYSE: IBM

Key Data Points

For another perspective on how robust its AI exposure is, consider the fact that, according to research from The Motley Fool, the company has the most generative AI patents among American companies.

From watsonx, a suite of AI tools that help customers manage data, to Red Hat, which offers generative AI and predictive AI tools, IBM provides customers with a sophisticated set of AI applications that is expected to grow at a steeper rate than previously thought.

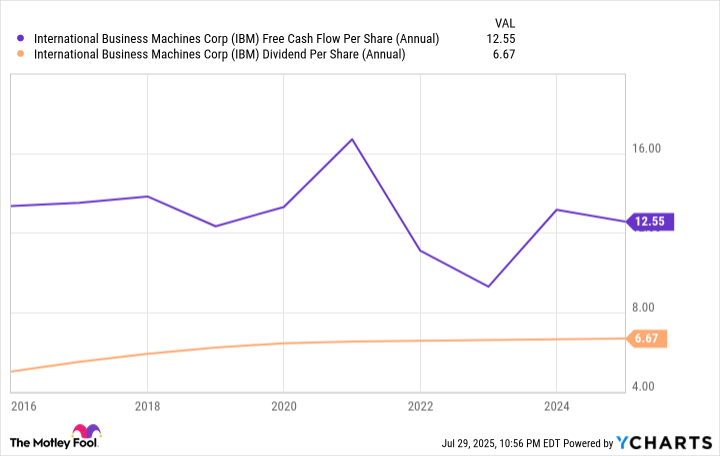

As for the dividend, IBM's five-year average payout ratio of 156% may set off alarm bells for some, but after taking a breath and recognizing how the company's strong free cash flow more than covers it, investors will find their concerns assuaged.

IBM Free Cash Flow Per Share (Annual) data by YCharts.

For those interested in bolstering their AI exposure with a rock-solid dividend play, IBM is a great option right now.

A long-term growth story with a dividend in tow

Lee Samaha (Delta Air Lines): I have two surprises for you in this section. First, Delta Air Lines pays a dividend (current yield: 1.4%), and second, it's a genuine contender for a place in the growth end of a balanced portfolio.

The first point might surprise you because airlines are seen as being highly cyclical businesses whose earnings collapse in a slump (making sustaining a consistent dividend challenging). Still, the reality is that the industry is changing, and Delta's focus on growing more-sustainable premium cabin revenue, combined with its loyalty programs and remuneration from co-brand credit cards with American Express, is reducing its earnings cyclicality.

The second might also be surprising because, again, Delta is traditionally seen as a cyclical stock, not a growth stock per se. That assumption remains true; however, the argument here is that the long-term trend line -- that growth oscillates about -- is heading upward for Delta for the reasons outlined above.

And network operators like Delta are in a favorable position to deal with rising airport costs because they account for a smaller portion of their business compared to, say, a low-cost carrier. Furthermore, airlines are behaving in a much more disciplined manner than they historically have. It all adds up to make Delta an attractive stock for growth investors.