The "Magnificent Seven" is a term coined by CNBC's Jim Cramer that includes some of the leading tech companies in the market. The cohort consists of:

- Nvidia (NVDA -0.08%)

- Microsoft (MSFT -0.18%)

- Apple (AAPL -0.61%)

- Amazon (AMZN -0.74%)

- Alphabet (GOOG -0.19%) (GOOGL -0.16%)

- Meta Platforms (META -0.14%)

- Tesla (TSLA 3.79%)

All of these companies (except for Nvidia) have reported results, and investors may be curious as to which ones look like solid buys. I think all of these stocks are growing more interesting each day, but of the seven, I think five are a buy and two are to be watched.

Image source: Getty Images.

I'm keeping an eye on Apple and Tesla

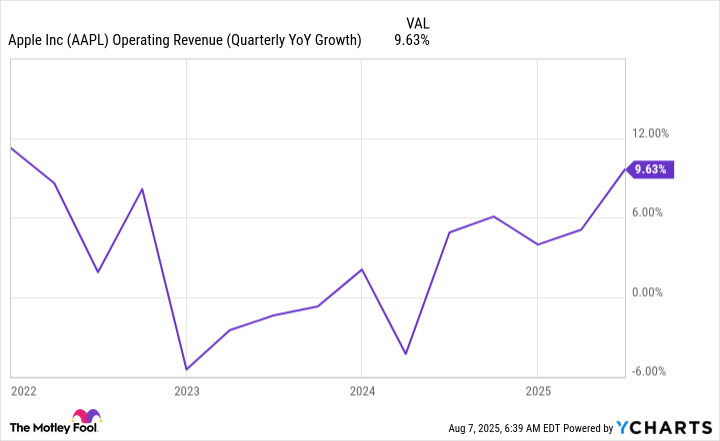

Over the past few years, many of these companies have delivered explosive revenue growth, except for Apple. Apple's growth finally returned in Q3 FY 2025, delivering double-digit growth (if you round up) for the first time since early 2022.

AAPL Operating Revenue (Quarterly YoY Growth) data by YCharts

Still, there are some questions about being behind in the AI arms race and what Apple's next big product is. I'm not ready to declare Apple a buy yet, but it's growing more intriguing with each quarter.

Tesla is in the worst shape of any Magnificent Seven company, with revenue falling 16% year over year in Q2. Additionally, with EV and regulatory credits getting eliminated, significant headwinds are popping up. However, Tesla's business has never been solely about EVs; otherwise, its valuation wouldn't make sense. An investment in Tesla is a bet that its humanoid robots, AI, self-driving, and rob-taxis will all be successes eventually. But for right now, I'm comfortable waiting on Tesla's situation to improve.

I'm a buyer of the remaining five

The other five members of the Magnificent Seven all look promising to me, as they're all experiencing strong growth.

Meta Platforms delivered a shocking Q2 report that delivered 22% revenue growth despite only guiding for 13% growth. That strength is expected to continue through Q3, with 20% revenue growth expected.

Meta's advertising business is second to none, and the improvements it's making with AI to aid in ad creation and engagement are starting to pay off.

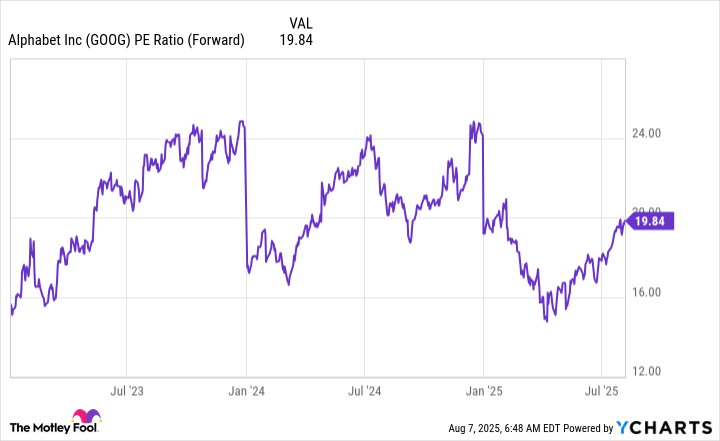

Alphabet similarly had a strong advertising quarter, despite many investors being worried about Google Search potentially being left behind by generative AI. Google Search's revenue rose 12% year over year, showcasing its strength and silencing doubters about its longevity.

Companywide, Alphabet's revenue rose 14% year over year, with diluted earnings per share rising 22%. That's an impressive result from a company that is supposed to be struggling. Additionally, Alphabet is the cheapest stock on this list, trading for 20 times forward earnings.

GOOG PE Ratio (Forward) data by YCharts

All of this combines to make Alphabet one of the best stocks to buy right now.

Despite Microsoft being the second-largest company in the world, it delivered monster growth in Q4 FY 2025 (ended June 30). Revenue was up 18% year over year, but the biggest shock in its report was Azure. Azure is Microsoft's cloud computing product and is a leading platform for building AI models. Azure's revenue was up a jaw-dropping 39% this quarter, showcasing strong demand for computing power.

This tailwind will persist for some time, making Microsoft an excellent stock to scoop up now.

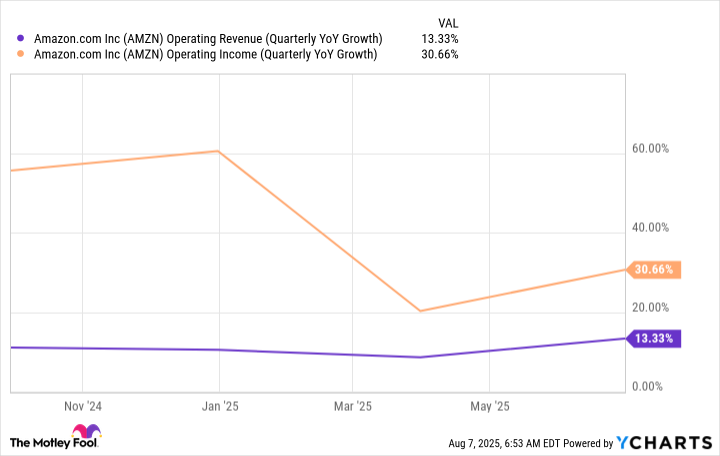

Amazon (AMZN -0.74%) investors had a negative reaction to its report, which caused shares to sink following earnings. However, I don't think they were as bad as the market thought, and the long-term outlook is still positive for the company.

Amazon's profit growth continues to outpace revenue growth thanks to the strength of high-margin businesses like advertising and Amazon Web Services (AWS).

AMZN Operating Revenue (Quarterly YoY Growth) data by YCharts

As long as this trend continues, Amazon will be a strong long-term pick. With both advertising and AWS being Amazon's fastest-growing segments by far, this trend looks primed to continue for the foreseeable future.

Last is Nvidia, which hasn't reported earnings yet. However, all of the companies involved in building out AI infrastructure on this list stated that their capital expenditures will be rising next year due to increased data center spend. This bodes well for Nvidia, as it receives a huge chunk of this spend. Additionally, Nvidia has reapplied for its export license to begin shipping H20 chips to China again, which will provide another growth tailwind for its business.

I expect Nvidia to report blowout earnings on Aug. 27, making the stock a smart stock to scoop up before then. Nvidia may be the world's largest company, but I expect it to get even bigger with increased AI buildout.