Quantum computing is swiftly becoming one of the hottest new themes fueling the artificial intelligence (AI) revolution. Over the last year, companies such as IonQ, Rigetti Computing, D-Wave Quantum, and Quantum Computing Inc. have emerged as exciting opportunities seeking to make a splash in the quantum computing realm.

While IonQ and its peers are pursuing unique approaches to quantum computing, none has yet achieved the critical mass needed to suggest their products and services are truly disruptive at this stage. In the background, however, semiconductor powerhouse Nvidia (NVDA +6.80%) has been quietly making inroads in the quantum computing arena.

Let's explore how Nvidia stands to benefit from quantum computing and assess why the stock looks like a no-brainer buy for investors with a long-term time horizon right now.

NASDAQ: NVDA

Key Data Points

Does Nvidia have a quantum computing business?

In addition to its industry-leading chip empire, Nvidia has also built a budding software platform known as CUDA. CUDA serves as the software backbone for Nvidia's overall tech stack. In essence, software developers can run AI applications on CUDA and run these programs on top of Nvidia's hardware.

The combination of CUDA and graphics processing units (GPUs) has kept customers extremely sticky within the Nvidia ecosystem -- essentially providing the company with an ability to own both the software and hardware aspects of AI development.

As quantum computing continues to gain momentum, Nvidia is naturally looking to position itself at the forefront of this new movement. More specifically, the company offers an extension of the CUDA platform known as CUDA-Q, which is geared toward applications across both traditional computing and quantum processing.

The big idea here is that much like CUDA has become a foundational layer for modern AI development, CUDA-Q could serve as an essential layer for quantum computing -- once again positioning Nvidia as a central source across both hardware and software and strengthening the company's technological moat.

Image source: Getty Images.

Pay attention to quantum computing valuations

A common mistake investors make is viewing valuation through the lens of a company's stock price. Seasoned investors understand that share price is simply one variable in determining the value of a business.

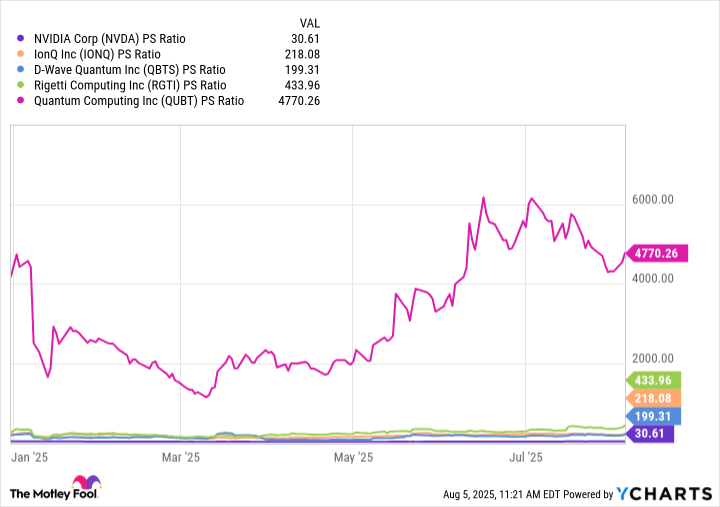

NVDA PS Ratio data by YCharts

In the chart above, Nvidia is benchmarked against IonQ and its smaller peers on a price-to-sales (P/S) multiple basis.

The main outlier in the peer set above is Quantum Computing Inc. (also called QCi), which boasts a P/S ratio of nearly 4,800. How could a valuation multiple balloon to such dramatic levels? The answer is quite simple, really. QCi boasts a market value of $2.6 billion, and yet the company has only generated $385,000 in sales over the past year.

In my eyes, QCi could be seen in the same light as a pre-revenue business with little product-market fit and yet somehow has garnered a billion-dollar valuation purely based on the narrative that its technology might one day be worth something. In addition, IonQ, Rigetti, and D-Wave each boast P/S multiples at levels that are eerily reminiscent of stock market bubbles.

These nuances are important to call out and understand because even though Nvidia may look "expensive," it's actually the cheapest quantum computing stock in this cohort based on P/S multiples.

Another way of looking at this is that much (if not all) of the long-run upside appears to be priced in to IonQ and the smaller speculative quantum computing stocks. By contrast, Nvidia's more appropriate valuation multiple could suggest that investors are not yet pricing in the upside of emerging AI applications such as quantum computing and still primarily view the company as solely a chip stock.

I think investors are discounting Nvidia's potential to parlay its core chip business to other pockets of the AI realm. For these reasons, I think Nvidia stock is a compelling buy-and-hold opportunity as more advanced AI applications such as quantum computing unfold over the next decade.