Predicting where a company will be in five years is impossible. However, that's exactly what investors are required to do, since they're buying a stock now with the expectation that it will be worth significantly more in the future.

It's even harder to do with a company in a rapidly innovating space like Nvidia (NVDA 4.42%). Five years ago, investors were in the middle of the pandemic, and generative AI was a term that almost nobody outside of the tech industry had heard of. Now, it seems like all anyone can talk about.

The question is, will generative AI still be a huge theme five years from now, or will it fade into the past? Its direction has a huge bearing on many stocks, but perhaps none as much as Nvidia.

Nvidia headquarters. Image source: Getty Images.

Nvidia's revenue is slated to grow even more over the coming years

Nvidia makes graphics processing units (GPUs), which excel at arduous workloads. GPUs were originally designed to process gaming graphics, which were some of the most demanding workloads in the late 1990s and early 2000s.

However, GPUs quickly found use in other areas, like engineering simulations, drug discovery, and cryptocurrency mining. Ultimately, that led to the largest computing workload humans have ever encountered: artificial intelligence (AI) training.

GPUs are perfectly suited for this task, because they can handle a wide variety of data sets, process multiple calculations in parallel, and be connected in clusters to scale up computing power. All of these traits make GPUs a smart choice to handle these workloads, and Nvidia has benefited from it.

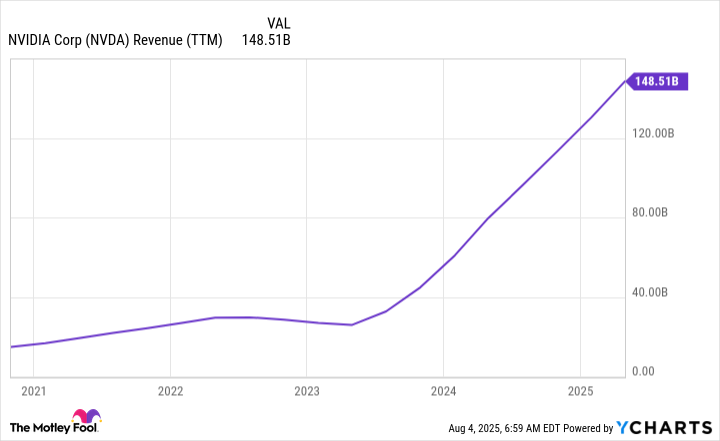

Since the AI race began in 2022, Nvidia's revenue has skyrocketed.

NVDA Revenue (TTM) data by YCharts; TTM = trailing 12 months.

At times, Nvidia's revenue was more than tripling year over year. While it has slowed in recent quarters, it's still projected to grow 50% during the fiscal 2026 second quarter.

However, that growth was hampered by the U.S. government's decision to revoke Nvidia's export license to China. If sales of its H20 chip (units designed specifically to meet old export regulations) had been included, that growth rate would have been 77%.

With Nvidia reapplying for its export licenses with assurances from the U.S. government that it will be approved, this faster growth could reappear as soon as next quarter. It's hard to imagine a company as large as Nvidia growing as fast as it is, but it has shown, quarter after quarter, that there's insatiable AI demand.

But will that last over the next five years?

A boom in data centers is a tailwind for Nvidia

At the start of 2025, most investors knew it was going to be a good year for Nvidia because the AI hyperscalers all announced record data center spending. However, beyond 2025, there were questions about the extent of the additional demand.

Investors are starting to get their answers. Most of the big tech companies have stated their initial 2025 capital expenditure (capex) forecasts were low and increased them during the latest quarterly results. Also, several companies have indicated that there will be substantial growth from 2025 levels.

NASDAQ: NVDA

Key Data Points

This bodes well for Nvidia, and it expects this trend to persist for some time. A third-party estimate Nvidia discussed during its 2025 GTC event stated that global data center capex totaled $400 billion in 2024. That same estimate also projected data center capex would rise to $1 trillion by 2028. That's huge growth, and if it comes to fruition, Nvidia will be a huge beneficiary.

Another factor that will help Nvidia is that GPUs have a limited lifespan. They are run nearly 24/7, 365 days a year, and can break down after a few years of use. Estimates vary widely, but their life can be anywhere from one to three years, all the way up to five to seven, depending on the estimate and their uses.

Because of the widespread deployment of Nvidia's products, this will create a replacement cycle that could emerge each year as the number of data centers increases. Once again, this bodes well for the chipmaker and cements it as a long-term investment option, because companies will need these GPUs to process AI workloads.

With GPUs continuously wearing out and more data centers being built to increase capacity, I wouldn't be surprised to see Nvidia grow to become a much larger company in the next five years. With its rapid growth and the widespread use of its GPUs, it will maintain its position as the largest company in the world by market cap for years to come.

Although I wouldn't expect market-crushing returns like Nvidia delivered over the past few years, I think it can solidly outperform the market over the next five years, making it a smart buy now.