For most investors, nothing is more telling about the health of Wall Street than earnings season. This is the six-week period where a majority of the market's most-influential businesses unveil their quarterly operating results.

However, this isn't the only way for investors to get a bead on which stocks and trends are making waves. Form 13Fs, which are required to be filed no later than 45 calendar days following the end to a quarter by institutional investors with at least $100 million in assets under management, are also invaluable. A 13F allows investors to track which stocks and exchange-traded funds (ETFs) Wall Street's brightest money managers have been buying and selling.

But hedge funds aren't the only big-time investors on Wall Street. The 13F requirement extends to businesses managing investment portfolios in excess of $100 million, such as Alphabet (GOOGL 0.16%)(GOOG 0.12%).

Alphabet is best known for Google, its globally dominant internet search platform that generates boatloads of operating cash flow. Alphabet is the parent company of the world's No. 3 cloud infrastructure service platform (Google Cloud), the second most visited social website (YouTube), and one of the most popular autonomous ride-hailing services (Waymo) as well.

Image source: Getty Images.

Something else you can add to the list is that Alphabet is an avid investor. Based on the company's newly filed 13F, it closed out June with more than $2.1 billion invested across 36 companies, nearly all of which Alphabet has partnered with in some fashion or another.

As of the midpoint of 2025, a bona fide moonshot stock that's brimming with potential has become Alphabet's No. 1 holding. Meanwhile, a trusted company that once comprised 15% of its invested assets has been sent to the chopping block.

Alphabet's new top holding has skyrocketed almost 2,000% in 15 months

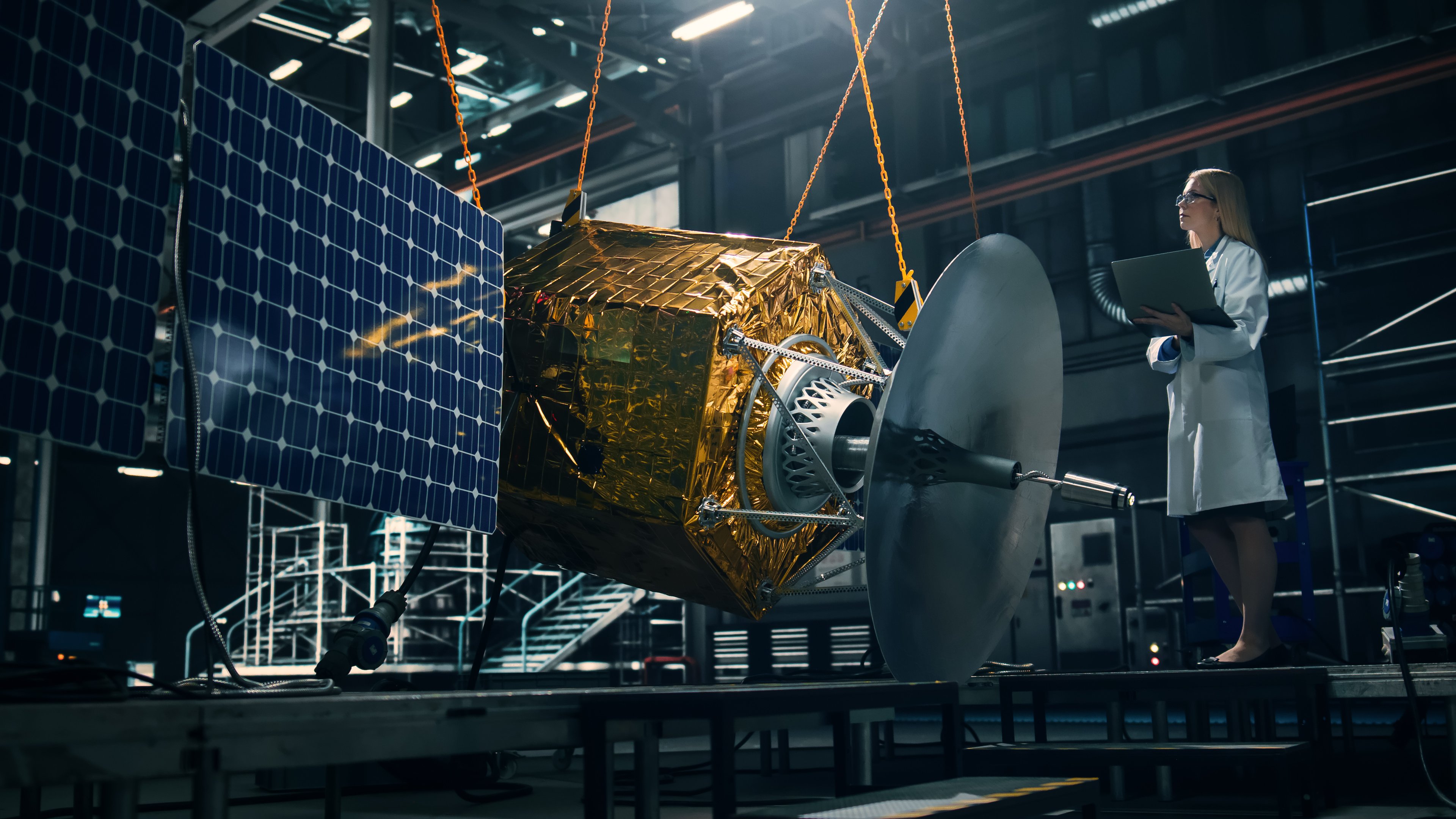

During the second quarter, Alphabet's investment wing didn't purchase a thing. But because of the ongoing outperformance of satellite-based cellular broadband services provider AST SpaceMobile (ASTS 2.83%), which has rallied close to 2,000% on a trailing-15-month basis, as of the closing bell on Aug. 7, this moonshot stock is now Alphabet's largest holding by market value (19.6% of invested assets).

Alphabet bought 8,943,486 shares of AST SpaceMobile during the first quarter. Aside from being one of AST's financial backers, Alphabet likely has a trio of reasons to be optimistic about its long-term prospects.

The biggest differentiator for AST SpaceMobile is that its satellite-based cellular broadband service is designed to work with existing smartphones. Whereas prior-generation attempts to create satellite-based cellular networks often involved the need to use brick-like phones, AST's BlueBird satellites rely on current smartphone technology.

NASDAQ: ASTS

Key Data Points

Removing this gigantic hurdle means AST SpaceMobile's management team can focus on getting satellites into space rather than convincing consumers they'll need new devices to access its network. The expectation is that four to six BlueBird Block 2 satellites will be launched monthly, with a target of 155 satellites in orbit by 2030.

The second catalyst that may have compelled Alphabet to pile in is AST SpaceMobile's ability to forge partnerships. By early 2024, it had secured agreements and understandings with more than 40 mobile network operators that collectively service north of 2 billion subscribers. Instead of going toe-to-toe with legacy telecom companies, it'll have a massive established customer base as its coverage ramps up.

Thirdly, Alphabet's investment team is likely intrigued by AST SpaceMobile's projected sales and profit growth. This year, Wall Street's consensus calls for roughly $62 million in sales and $1 in net loss per share. By 2028, analysts predict AST SpaceMobile will generate $1.93 billion in revenue and report in excess of $2.50 per share in earnings.

While AST SpaceMobile has made for an exciting story stock, it's also priced for perfection. With a market cap of nearly $17 billion, as of this writing, there's simply no room for error. If satellite launches are in any way delayed, or if the cost of goods used to build its satellites increases, AST SpaceMobile stock could struggle.

Image source: Getty Images.

Alphabet's former core holding is sent packing

On the other end of the spectrum, Alphabet reduced its stake in one existing holding and completely exited five others during the June-ended quarter. None of these sales stands out more than artificial intelligence (AI)-fueled cybersecurity solutions provider CrowdStrike Holdings (CRWD 1.44%).

Between June 1, 2023, and March 31, 2024, CrowdStrike was Alphabet's second-largest holding by market value and peaked at roughly 15% of invested assets. However, Alphabet's investment team persistently sold down this stake from a peak of 1,283,683 shares at the end of 2023 to just 74,230 shares by the end of March 2025. During the second quarter, Alphabet jettisoned all remaining shares of CrowdStrike.

The world's largest-ever IT outage, which was caused by a CrowdStrike software update in mid-July 2024, may be one reason Alphabet cashed in its chips. Customers of CrowdStrike's software-as-a-service solutions using the Windows operating system saw their platforms unable to boot up for an extended period of time. Even though CrowdStrike fixed its software update, there were concerns that customer retention and/or new customer creation would decline.

NASDAQ: CRWD

Key Data Points

Another possible concern for Alphabet, from an investment standpoint, is CrowdStrike's premium valuation. Though companies with sustained competitive advantages (a point I'll touch on a bit more in a moment) are deserving of a premium, CrowdStrike is valued at approximately 90 times forward-year earnings and more than 19 times forward-year projected sales. There's little margin for error and a built-in expectation that it'll consistently blow Wall Street's consensus forecasts out of the water.

But while short-term upside in CrowdStrike's stock may be minimal, its long-term growth trajectory remains as strong as ever. Despite having one of the costlier cybersecurity product portfolios, its clients have willingly paid more for its services. Remember, its mid-July 2024 screw-up was entirely self-inflicted, with the company's AI-driven Falcon security platform exhibiting a phenomenal track record of stopping and identifying potential end-user breaches.

CrowdStrike's operating results also show that its clients are expanding their services with the company. As of the end of April, nearly half (48%) of all its customers had purchased at least six cloud modules. A subscription-driven operating model has CrowdStrike targeting an 82% to 85% adjusted subscription gross margin.

When looking back a decade from now, Alphabet's investment team may regret their sale of CrowdStrike Holdings' stock.