Palo Alto Networks (PANW +0.44%) is the world's largest cybersecurity vendor, but with competitors like CrowdStrike (CRWD 0.77%) nipping at its heels, the company is investing heavily in innovations like artificial intelligence (AI) to deliver the best possible protection for its 70,000 enterprise customers and maintain its position at the top.

This strategy led to an acceleration in Palo Alto's revenue growth during its fiscal 2025 third quarter. The company is scheduled to release its operating results for its more recent fiscal 2025 fourth quarter (which ended on July 31) on Aug. 18, which will give investors a valuable update on its expanding portfolio of AI products. Is it a good idea to buy Palo Alto stock ahead of the report? Read on to find out.

Image source: Getty Images.

Palo Alto offers an expanding portfolio of AI products

Palo Alto operates three cybersecurity platforms covering cloud security, network security, and security operations. Each one includes a growing number of individual products, and the company is weaving AI into as many of them as possible to automate everything from threat detection to incident response.

Palo Alto believes human-led cybersecurity processes are too slow and inefficient to deal with modern-day threats, which results in more critical incidents. Cortex XSIAM is one example of how Palo Alto is using AI to solve this problem. It's a security operations platform that relies on AI and machine learning to autonomously identify, investigate, and eliminate threats, shifting critical workloads away from human cybersecurity managers.

One customer -- a healthcare provider -- now resolves 90% of incidents with automation, compared to just 10% before adopting XSIAM. Palo Alto said the platform's annual recurring revenue (ARR) tripled year over year during the fiscal 2025 third quarter. Moreover, it had already accumulated over $1 billion in bookings despite launching just three years ago.

XSIAM is one of Palo Alto's fastest-growing products, so investors should look for an update on its progress on Aug. 18.

NASDAQ: PANW

Key Data Points

Palo Alto is seeing accelerating revenue growth

Palo Alto generated $2.3 billion in total revenue during the third quarter. It was a year-over-year increase of 15%, which marked an acceleration from the 14% growth it delivered during the second quarter three months earlier.

AI played a major role in the strong result. The company's ARR from its next-generation security (NGS) segment -- which is where it accounts for sales of its AI products -- soared by 34% to $5.1 billion. This is one of the key numbers investors will watch on Aug. 18.

A trend called "platformization" also contributed to the solid Q3 result. The cybersecurity industry is quite fragmented, meaning businesses typically use multiple vendors to build a complete security stack. Palo Alto is becoming a one-stop shop that protects the entire enterprise, so it's encouraging customers to consolidate their spending and ditch other vendors, and it's offering them fee-free periods to make the transition affordable.

Palo Alto believes this strategy will make each customer far more valuable over the long term. Around 1,250 of its top 5,000 customers were platformed at the end of Q3, which rose by a whopping 39% year over year. This is another important number for investors to watch on Aug. 18, because a high growth rate is a sure sign that Palo Alto's strategy is working.

Should you buy Palo Alto stock before Aug. 18?

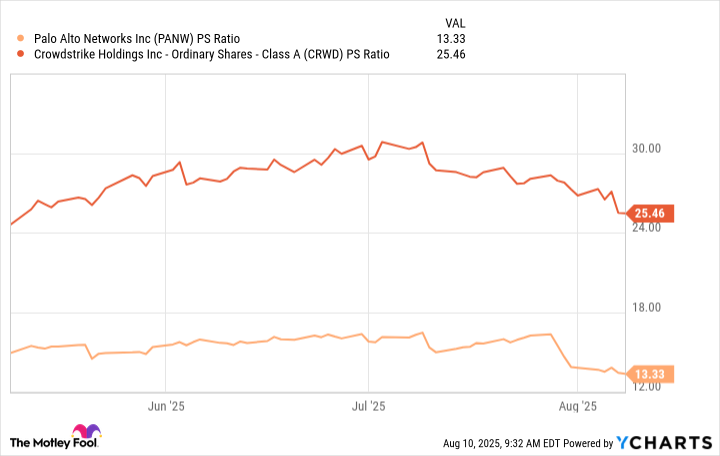

Despite Palo Alto's leadership position in the cybersecurity industry, its stock is actually much cheaper than that of its main rival, CrowdStrike. It's trading at a price-to-sales (P/S) ratio of 13.3, compared to CrowdStrike's 25.4:

Data by YCharts.

CrowdStrike's revenue grew by 20% during its recent quarter, so its business is expanding at a faster overall pace than Palo Alto's business, which means it would normally deserve a premium valuation. However, Palo Alto's NGS ARR of $5.1 billion amounts to more than CrowdStrike's total ARR, and it grew by 34% during the recent quarter. Therefore, I think Palo Alto stock might be too cheap relative to its main competitor.

One quarter is unlikely to change Palo Alto's positive long-term trajectory, so there probably isn't an urgent need to buy its stock ahead of Aug. 18. However, it's trading 20% below its record high right now, so this might be a great opportunity to scoop it up at a discount. As long as investors maintain a long-term view of five years or more, they could do well from here.