Plug Power (PLUG 4.83%) recently reported its second-quarter financial results, showing clear advances alongside ongoing challenges. The hydrogen company is making progress, but must continue to make significant improvements to achieve sustainable profitability.

Here's a closer look at Plug Power's second-quarter results and what they imply for long-term investors considering the hydrogen stock.

Image source: Getty Images.

Parsing out the positives

Plug Power booked $174 million in second-quarter revenue, up 21% year over year. Strong demand for its GenDrive fuel cells, GenFuel hydrogen infrastructure, and GenEco electrolyzer platforms drove the surge. Electrolyzer revenue tripled year over year to $45 million as the company expanded its global platform.

The company significantly improved in its gross margin, which went from -92% to -31%. A combination of rising revenue, service cost reductions, equipment cost improvements, and better hydrogen pricing drove the margin increase.

NASDAQ: PLUG

Key Data Points

Plug Power made significant progress on its Project Quantum Leap structural cost savings initiative over the past few months. The company optimized its workforce, consolidated facilities, cut professional services and software costs, and renegotiated supply contracts. A notable achievement was the recent extension of its strategic hydrogen supply agreement with a leading U.S. industrial gas company through 2030, securing a reliable, lower-cost hydrogen supply.

Higher revenue and improved margins reduced the company's cash burn rate by over 40% compared to last year. That's helping reduce the need for outside capital to fund its operations and expansion.

The long road ahead

Plug Power undoubtedly made progress in the second quarter, but challenges remain. The company still has a negative gross margin, meaning it spends more to make products than it earns in revenue. Plug aims to reach a break-even gross margin rate by the fourth quarter of this year.

Because Plug Power loses money on each sale, it burns through cash. Although net cash used in investing and operating activities has decreased by more than 40% over the past year, the company still consumed $385 million in cash during the past six months.

Plug Power's cash burn rate has forced it to secure outside capital to fund its operations and expansion. The hydrogen company sold another $280 million of stock in March and closed a $525 million secured credit facility in May to plug the hole in its balance sheet. It has already utilized some of that funding, ending the second quarter with $140 million in cash and access to more than $300 million of additional debt capacity under that credit facility.

At its current cash burn rate, it has only enough liquidity to operate for another couple of quarters. That suggests Plug Power will need to continue raising outside capital to fund its operations and expansion until it becomes profitable, which it doesn't expect will occur until 2028.

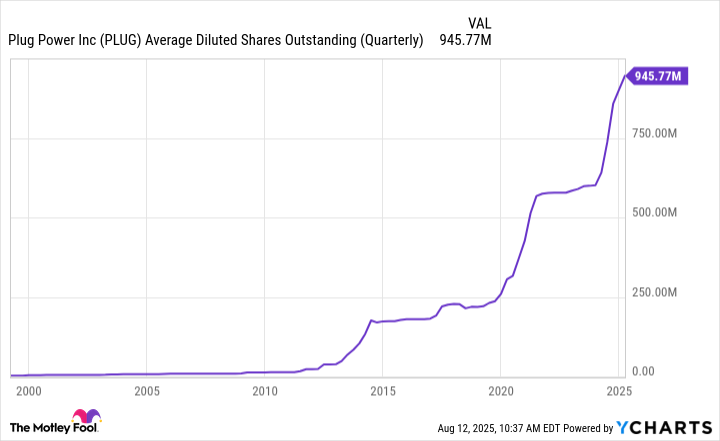

While Plug Power doesn't plan to sell more stock this year, it will likely need to issue equity in the coming years. These future sales will add to its rapidly rising outstanding shares:

PLUG Average Diluted Shares Outstanding (Quarterly) data by YCharts

The massive rise in the company's share count, resulting from dilutive equity issuances, has put tremendous downward pressure on the value of each share. Plug Power stock has lost a staggering 99% of its value since its IPO in 1999.

The company's share price could continue to head lower in the coming years as it sells more stock to bridge the gap between its revenue and costs. While that gap is narrowing, it will be a couple of years before the company starts generating positive operating income.

Plug has a long road ahead

Plug Power made tangible progress toward improving its profitability in the second quarter. However, the hydrogen company still has a long way to go. As a result, its share price could continue to decline in the coming years as the company sells more stock to fund its operations and growth. That makes it an unappealing long-term investment opportunity, despite the tremendous growth potential of the hydrogen sector.