Amazon is the fifth-largest company in the world, as of this writing. It reached this ranking thanks to its dominant position in the e-commerce market. It's also the largest player in the cloud computing market but gets a massive chunk of its revenue from the e-commerce business.

The company controls an estimated 38% share of the U.S. e-commerce market. Additionally, it enjoys a solid position in other key markets, such as Europe and India. Amazon's e-commerce marketplace is used by millions of sellers to sell their items, thanks to its solid presence across the globe.

In a similar fashion, companies looking to train and deploy artificial intelligence (AI) applications are flocking toward Oracle (ORCL +0.75%). The company's cloud infrastructure platform is in hot demand, and it won't be surprising to see it become the Amazon of the AI infrastructure market in the long run. Let's see why that may be the case.

Image source: Getty Images

Oracle is becoming the go-to choice for AI companies

Just like Amazon provides a platform to sellers to sell their goods, Oracle is giving its customers access to its cloud infrastructure for AI model training and inference applications. Its customers can choose from a wide range of chips, including both graphics cards and server processors, from the likes of Nvidia and Advanced Micro Devices.

NYSE: ORCL

Key Data Points

Customers can rent Oracle's cloud infrastructure, run generative AI models, and build agentic AI applications, among other things. The company offers a host of AI services to help developers apply AI to applications and business operations. Their clients can customize the prebuilt AI models as per their needs, which means they have the flexibility to increase or decrease the usage of Oracle's infrastructure, based on their needs.

Additionally, Oracle claims that it can offer huge cost savings while running AI workloads on its infrastructure, as compared to competitors. All this explains why the demand for the company's cloud infrastructure has been going through the roof.

Oracle's remaining performance obligations (RPO), which refers to the total value of its unfulfilled contracts at the end of a period, stood at a whopping $138 billion at the end of the fourth quarter of fiscal 2025 (which ended on May 31). The metric jumped an impressive 41% year over year in the previous quarter.

Even better, Oracle is expecting its RPO to more than double in the current fiscal year, due to the company's focus on quickly expanding its data center regions across the globe. Chairman Larry Ellison remarked on the company's June earnings press release that the company has "23 MultiCloud data centers live with 47 more being built over the next 12 months."

The company also has 29 Oracle Cloud Customer dedicated data centers live, with 30 more being built in 2026. This rapid buildout of data centers to meet the terrific end-market demand for training and running AI applications in the cloud explains why the company is expecting faster consumption of its cloud infrastructure services in the current fiscal year.

Moreover, the huge improvement that Oracle is forecasting in its revenue pipeline this year indicates that it's on track to deliver years of solid growth. The company's focus on expanding its infrastructure should allow it to corner a bigger share of the cloud infrastructure-service-as-a-service (IaaS) market, which is expected to generate a whopping $580 billion in revenue in 2030. That would be a big jump from last year's estimate of $172 billion.

The good part is that Oracle's projected jump in RPO suggests that it's already growing at a faster pace than the cloud IaaS market. So there's a good chance of Oracle becoming the Amazon of the AI infrastructure market in the long run, thanks to its growing dominance in this space. That's precisely why investors would do well to buy the stock before it soars further.

Investors can still buy this AI stock at a reasonable valuation

Oracle stock shot up an impressive 50% so far in 2025. As a result, it's now trading at an expensive 58 times earnings. However, analysts are expecting its bottom-line growth to accelerate substantially in the future following an estimated increase of 12% in the current fiscal year.

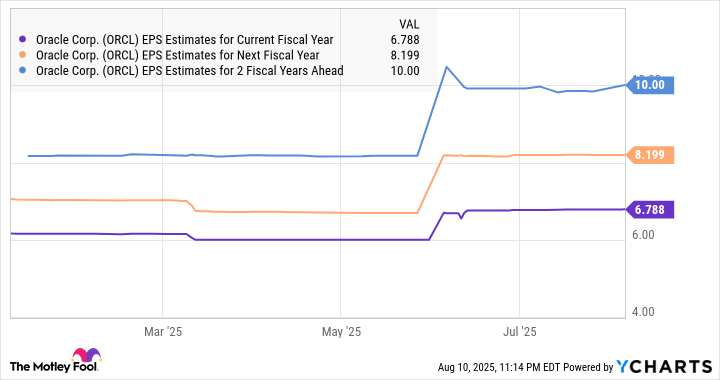

ORCL Eearniings-Per-Share Estimates for Current Fiscal Year data by YCharts.

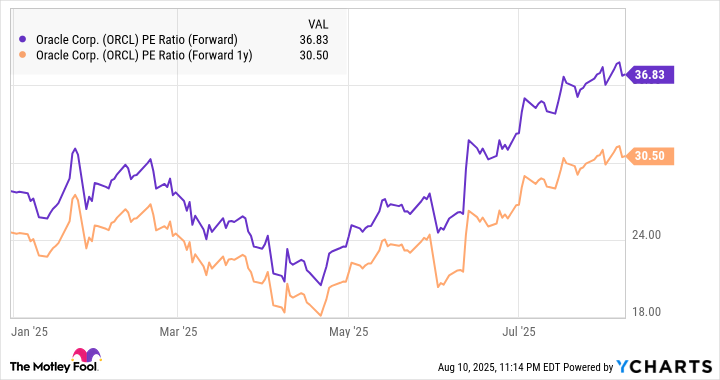

As such, Oracle's forward earnings multiples are significantly lower than its trailing price-to-earnings ratio.

ORCL Price-to-Earnings Ratio (Forward) data by YCharts

Additionally, there's a strong possibility that Oracle's growth will substantially outpace estimates, thanks to the healthy demand for its cloud AI infrastructure, which is allowing it to build a huge revenue pipeline. The potential outperformance could pave the way for significant long-term upside in the stock, which is why buying it looks like the smart thing to do right now.