After a slow start to the year, the tech sector is rocketing higher again -- driven by Nvidia and Microsoft becoming the first companies to surpass $4 trillion in market capitalization.

There are many ways to invest in top tech stocks, such as buying them directly or going the route of an exchange-traded fund (ETF). If you scan the holdings of a low-cost growth-focused ETF, chances are it is anchored by tech stocks. Even the S&P 500 has a little over a third of its holdings in the tech sector.

Investors looking for outsized exposure to hardware, software, and semiconductor giants may want to go with a low-cost technology sector ETF over a general growth ETF or S&P 500 index fund. Here's why the Vanguard Information Technology ETF (VGT 1.69%) is worth a closer look, but may not be a good fit for your portfolio.

Image source: Getty Images.

Betting big on a handful of companies

Roughly half of the ETF is invested in just four companies -- Nvidia, Microsoft, Apple, and Broadcom. Notable companies missing from the ETF include Alphabet and Meta Platforms, which are in the communications sector, and Amazon and Tesla, which are in the consumer discretionary sector.

Microsoft is a major cloud computing player at the forefront of both consumer-facing and enterprise-level artificial intelligence (AI). Microsoft's high margins and accelerated growth rate help justify its expensive valuation.

Apple has been criticized for falling behind the AI train. But the company isn't sitting idly by and doing nothing. Apple has been rolling out new tools and design upgrades for users. And Apple should arguably take a slow and purposeful approach to AI -- prioritizing user-friendly features rather than raw power.

Nvidia's graphics processing units are the gold standard for AI data centers, while Broadcom is helping the major cloud computing companies design their own chips for specific applications. One major advantage for both companies is the quality of the customer base.

Nvidia and Broadcom are both capitalizing on big spending from the top hyperscale customers. Over half of Nvidia's revenue in its latest quarter came from just four companies -- which are most likely Microsoft, Amazon, Alphabet, and Meta Platforms.

On its second-quarter 2025 earnings call, Broadcom said that its latest Tomahawk 6 architecture flattens the AI cluster by packing more than 100,000 AI accelerators in two tiers instead of three. Combined with its networking portfolio, Broadcom expects three customers (likely the big cloud providers) to each deploy 1 million AI accelerator clusters in 2027, with a big portion of those deployments coming from custom XPUs.

Buying the Vanguard Tech ETF instead of choosing one of these four stocks over the others gives investors exposure to cloud infrastructure, application software, gaming, electronics, consumer services, the high-performance and versatility of GPUs for data centers, custom AI chips, and more. And that's just from the top four holdings. There are 319 total holdings in the ETF.

NYSEMKT: VGT

Key Data Points

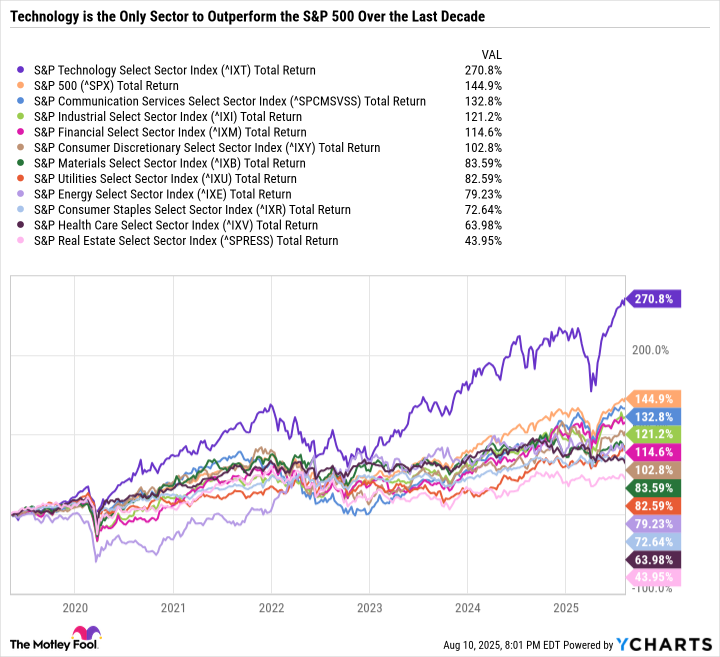

The technology sector has consistently justified its high valuation

The Vanguard Tech ETF is a great way to get more exposure to Microsoft, Apple, Nvidia, and Broadcom than you'll find in an S&P 500 index fund or a Nasdaq-focused ETF. But there are some risks worth considering before diving in headfirst.

The biggest one is valuation. The ETF sports a price-to-earnings ratio of 39.2 compared to 27.6 for the Vanguard S&P 500 ETF. Investors are willing to pay a premium for the tech sector compared to the S&P 500 because it is expected to grow earnings faster than the broader market. However, big tech companies must deliver on earnings expectations to justify the premium valuation.

Historically, the tech sector has done a phenomenal job exceeding expectations, as it is by far the best-performing sector over the last decade.

Another reason to avoid the ETF is if you've reached your maximum desired exposure to some of its largest holdings. For example, if you already have a sizable position in a company like Nvidia and you aren't looking to add more, then buying the tech ETF isn't going to be a good fit.

A high-octane ETF for investors who don't mind volatility

When approaching any stock or ETF, it's best to align investment opportunities with your financial goals. There are plenty of reasons to believe that the tech sector can continue carrying the major indexes to new heights, but that doesn't automatically mean it's a good buy for all investors.

The tech sector is expensive and doesn't offer a sizable amount of passive income. It can also be volatile. These downsides may outweigh the potential benefits of the sector for certain investors.

However, if you have a high risk tolerance, a long-term investment time horizon, and don't mind the concentration in just a handful of stocks, then the Vanguard Information Technology ETF could be right up your alley.