Micron Technology (MU 4.80%) is playing a central role in the adoption of artificial intelligence (AI) technology: Its memory chips are being used by top chip designers such as Nvidia and Advanced Micro Devices in their data center graphics cards.

Micron's high-bandwidth memory (HBM) suits the technical needs of AI accelerator graphics processing units (GPUs) because they are capable of moving huge amounts of data with low lag, and are more energy efficient than conventional memory chips. And given the high demand for AI chips, demand for Micron's HBM chips has also been robust, which explains why its growth has been remarkable in recent quarters.

Importantly, it appears Micron's terrific growth will persist thanks to its lucrative opportunity in the HBM space -- and its latest guidance update provides further evidence to that effect.

Image source: Getty Images

Micron Technology's AI-fueled growth is just getting started

On Monday, Micron increased its guidance for its fiscal 2025 fourth quarter. For the period, which will end Aug. 28, it now expects revenues of $11.1 billion to $11.3 billion, up from a range of $10.4 billion to $11 billion previously. At the midpoint, that's a boost of $500 million. Additionally, management bumped up its non-GAAP earnings guidance from $2.50 per share to $2.85 per share. Those figures would equate to a year-over-year increase of 44% in revenue and a 141% jump in adjusted earnings per share.

NASDAQ: MU

Key Data Points

Micron management says that "improved pricing, particularly in DRAM, and strong execution" are the reasons behind its improved guidance. Booming demand for HBM is a key factor that's allowing memory makers to increase prices. According to one estimate, the HBM market's revenue could double in 2024 to $34 billion, driven by a combination of higher shipments and increased pricing.

Specifically, production capacity constraints are expected to push up the price of HBM by 15% to 20% in the calendar third quarter, which would be sharper than the 5% to 10% growth seen in the previous quarter. At the same time, the next iterations of AI graphics cards designed by Nvidia and AMD will be equipped with bigger HBM chips.

Nvidia, for instance, is packing 288 gigabytes (GB) of HBM into its Blackwell Ultra B300 GPU, up from the 192GB configuration of the B200. Similarly, AMD is bumping up the HBM capacity of its MI355X and MI350X accelerators to 288GB; the previous generation MI325X had 256GB.

What's more, AMD is planning to increase the HBM capacity of its next-generation MI400X GPUs to a whopping 432GB.

Given all that, demand for HBM is likely to remain solid. Micron's peer SK Hynix is forecasting annualized increases of 30% in the HBM market through 2030. AI, therefore, can be expected to remain a solid long-term growth driver for Micron, especially considering the company's improving share of this market.

The memory specialist says it's supplying HBM chips "in high volume" to four major customers, which indicates that custom AI chipmakers such as Broadcom and Marvell Technology are also among its big clients. Not surprisingly, Micron's HBM market share is expected to jump to 24% by the end of 2025 as compared to around 20% earlier this year.

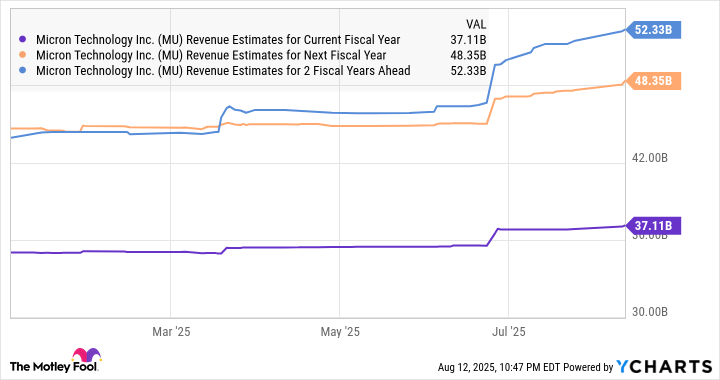

That potential improvement in Micron's market share, along with the outstanding growth of the HBM market, explains why analysts have increased their revenue growth expectations from the company.

MU Revenue Estimates for Current Fiscal Year data by YCharts.

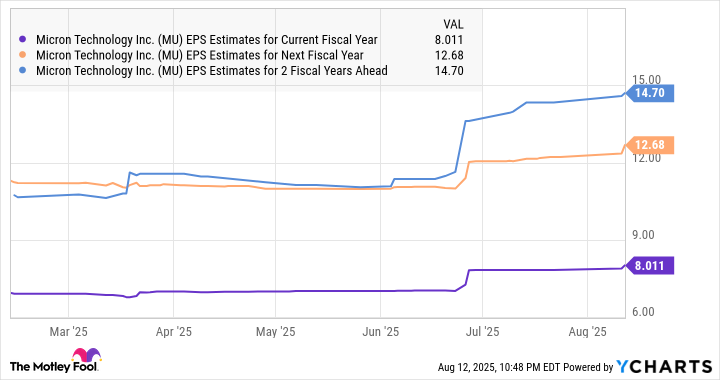

Even better, Micron's healthy top-line growth will drive a big jump in the company's bottom line since demand for HBM is outpacing supply. The favorable supply-and-demand dynamic should lift memory prices and supercharge Micron's earnings, which is why buying the stock right now is a no-brainer.

Micron stock is too cheap to ignore

Micron reported $1.30 per share in earnings in its fiscal 2024. The following chart makes it clear that its earnings are on track to grow significantly in the current fiscal year and beyond.

MU EPS Estimates for Current Fiscal Year data by YCharts.

The best part for investors is that Micron stock is trading at just 10 times forward earnings, which is dirt cheap considering the earnings growth that it's projected to deliver. Its forward earnings multiple is significantly lower than the tech-laden Nasdaq-100 index's multiple of 30.

Ideally, the market will reward the AI-fueled growth that this chipmaker is set to deliver with a higher earnings multiple. For instance, an earnings multiple of even 20 after a year could send its stock price to $244 (based on its fiscal 2026 earnings estimate of $12.22 per share). That would be nearly double its current stock price.

So, investors should consider buying this AI stock hand over fist as it has the potential to fly higher, even after recording a 52% gain so far in 2025.