Shares of Block (XYZ +1.59%) seem to be stuck in neutral. After a pandemic-fueled surge, when the world raced toward digital payments and Block rode the wave of skyrocketing adoption, the stock has cooled considerably. Today, it remains 74% below its all-time high of $289 per share in 2021.

The excitement around Block's growth has faded, but don't count it out just yet. The company is streamlining operations, reigniting growth, and has recently earned a coveted spot in the S&P 500 index. Here are five compelling reasons why now might be a good time to buy Block.

1. Block's Square segment provides a strong foundation for steady growth

Block's flagship product, the Square reader system, empowers businesses to easily accept card payments. In the early days, smaller vendors often struggled with expensive and complicated point-of-sale systems. Square stepped in to modernize this experience, providing a seamless solution that opened doors for countless sellers.

The Square segment has since evolved into a dynamic commerce system, with a lineup of 30 products and services to support sellers in launching and growing their businesses. In the second quarter, the segment achieved a gross profit of $1.03 billion, or an 11% increase compared to the previous year, contributing to a total segment gross profit of $2.54 billion.

2. The Cash App is popular among younger users

Another pillar of Block's business is its Cash App, the peer-to-peer payment network that allows users to store, send, receive, invest, borrow, save, and use buy now, pay later (BNPL) services. This comprehensive app aims to be a one-stop shop for all customer needs. In the second quarter of 2025, Cash App generated $1.5 billion in gross profit, representing a 16% increase year over year.

Image source: Getty Images.

One of Block's strengths is that Cash App is the most popular investment app across all generations, according to The Motley Fool's Generational Investing Tools survey.

As of June 2025, Cash App had 57 million monthly active users in the U.S. Customers younger than 25 are particularly engaged with features like Paycheck Deposit and the Cash App Card. And there were 5 million active sponsored teen accounts on Cash App, with nearly 80% of them being active Cash App Card users.

3. Block is laser-focused on efficient growth

In recent years, CEO Jack Dorsey has placed a strong emphasis on achieving efficient growth, using the "Rule of 40" as a key financial framework to balance growth and profitability. Achieving this goal requires strategic cost management, disciplined investments, and a focus on high-return initiatives within its segments Square and Cash App.

NYSE: XYZ

Key Data Points

The Rule of 40 is defined by Block as the sum of its gross profit growth rate and adjusted operating income margin (expressed as a percentage of gross profit). The company aims to reach a Rule of 40 run rate by the end of 2025 and believes it is on track to achieve this goal in 2026.

In the second quarter, Block reported strong financial performance, with gross profit growth accelerating to 14% year over year and adjusted operating income margins expanding to 22%, putting the sum at 36, very close to its Rule of 40 goal.

4. Block forecasts strong growth later this year

The company delivered a strong second quarter. Gross profit rose by the aforementioned 14% year over year to $2.54 billion, which came in ahead of analysts' expectations. On top of that, management raised its full-year gross profit forecast to $10.17 billion, up from $9.96 billion.

A few factors drive management's anticipated growth, but one stands out in particular. Earlier this year, the Federal Deposit Insurance Corporation approved the use of Square Financial Services to issue consumer loans for Cash App Borrow nationwide. The company believes this could double the number of Cash App active users eligible for loans, while enabling better unit economics through in-house loan origination and servicing.

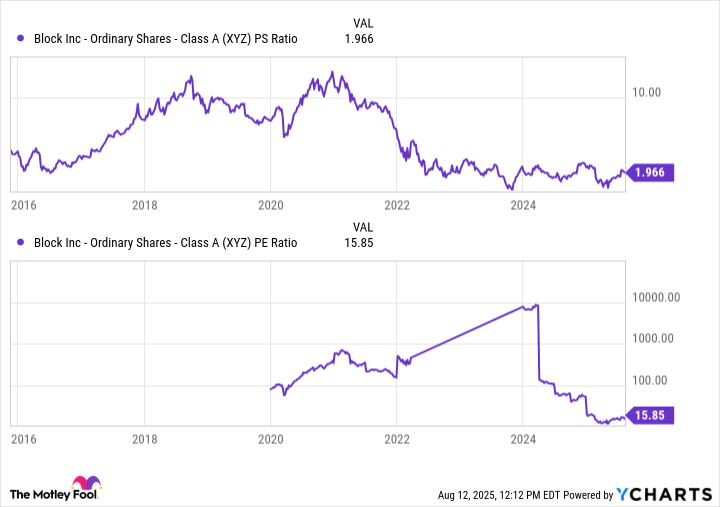

5. It's priced cheaply in an expensive market

Block is currently priced at 1.97 times sales and 15.9 times earnings, making it cheap relative to its recent history. Given the high valuation on the S&P 500 on a historical basis, Block's valuation and stable businesses give investors some margin of safety.

XYZ PS Ratio data by YCharts; PS = price to sales; PE = price to earnings.

Block is making good progress on its efficiency initiatives and continues to see strong growth for its Cash App, while also making inroads with younger generations. With growth expected to pick up later this year, I think now is a great time to buy shares of Block.