It's been quite a memorable year for Wall Street, with the broad-based S&P 500 (^GSPC 0.84%), growth stock-propelled Nasdaq Composite (^IXIC 1.43%), and ageless Dow Jones Industrial Average (^DJI 0.34%) navigating their way through historical bouts of volatility.

For example, during a one-week stretch in April, the S&P 500 endured its fifth-biggest two-day percentage decline in 75 years, as well as logged its largest single-day point gain since its inception. The benchmark index has also delivered one of its strongest three-month returns since 1950.

With the S&P 500 and Nasdaq Composite rocketing to fresh all-time highs, and the Dow Jones just a stone's throw away from surpassing its record close set in December, it would appear nothing can slow down this bona fide wealth-creating machine. But things may not be as unbreakable as they seem.

While a lot of attention is currently being paid to President Donald Trump's tariff and trade policy and how it could adversely impact Wall Street, a far more sinister worry lies in wait that can act as a significant drag on stocks.

President Trump discussing tariffs with reporters in the Oval Office. Image source: Official White House Photo.

President Trump's tariffs bring uncertainty and inflation to the forefront

On April 2, following the close of trading, Donald Trump unveiled his long-touted tariff and trade policy. It included a sweeping 10% global tariff, as well as introduced higher "reciprocal tariff rates" on dozens of countries that have historically had adverse trade imbalances with America.

The president's primary goals with his tariff and trade policy are to promote domestic manufacturing, keep American goods price-competitive with those being brought in from foreign markets, and to pad the federal government's pocketbooks with tariff revenue. Though tariff revenue is undeniably climbing, so is the level of uncertainty associated with these tariffs.

One of the more prominent issues with President Trump's tariff and trade policy is there's been little follow-through or consistency. There have been two separate 90-day pauses on reciprocal tariffs with the world's No. 2 economy by gross domestic product, China, and the president has adjusted the effective date, reciprocal tariff rate, and/or goods subject to tariffs for other countries on a variety of occasions. Wall Street demands predictability, and this administration hasn't been providing it.

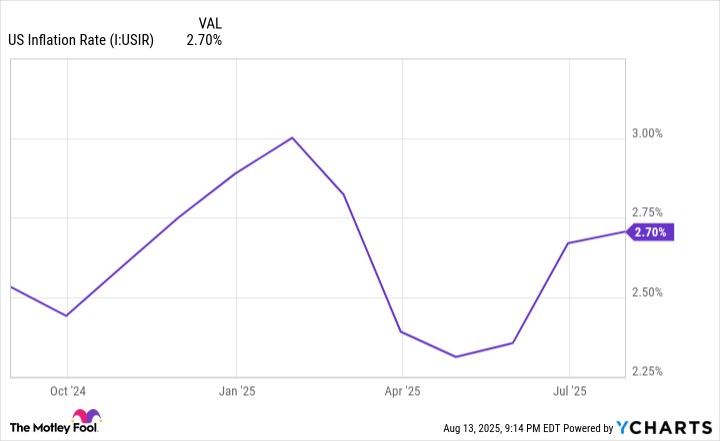

Investors are also worried about the potential inflationary impact of the president's tariff policies.

Trump's tariff policies have provided modest upward pressure on prices over the previous two months. US Inflation Rate data by YCharts.

A report ("Do Import Tariffs Protect U.S. Firms?") issued in December by four New York Federal Reserve economists working for Liberty Street Economics raised a good point about the lack of clarity Trump's tariffs have offered between input and output tariffs. Output tariffs are duties placed on finished products imported into the U.S., while input tariffs are duties applied to goods used to complete a finished product domestically.

Ideally, tariffs are being applied to finished products, which can allow domestic manufacturers to be more price-competitive with imported goods. However, some of Trump's tariffs are being directed at goods used to complete the manufacture of products in the U.S. Input tariffs often end up increasing domestic manufacturing costs and can drive the prevailing rate of inflation higher.

The other concern, which builds on the report from the four New York Fed economists, is historical precedent. The authors examined the performance of public companies whose stock struggled when Trump's China tariffs were introduced in 2018-2019. On average, companies directly impacted by Trump's China tariffs during his first term in the Oval Office saw their sales, profits, employment, and labor productivity all decline from 2019 through 2021.

While there are ample reasons to believe President Trump's tariffs are a genuine concern for stocks, a far bigger threat to upend the bull market exists.

Image source: Getty Images.

Wall Street has a serious earnings quality problem

As of the closing bell on Aug. 13, the S&P 500's Shiller P/E Ratio closed at a multiple of almost 39. With the exception of the dot-com bubble and the first week of 2022, this is the third-priciest stock market in history, when back-tested 154 years.

Although historical precedent portends trouble for the stock market, valuations have the ability to remain extended if companies are delivering strong earnings growth and offering analyst-topping guidance.

While many of the stock market's leading businesses have made a habit out of surpassing consensus profit expectations, a dive beneath the headline figures uncovers just how poor the earnings quality truly is on Wall Street.

Ideally, the companies responsible for pushing the broader market higher should be letting their operating performance do the talking. But quite a few prominent businesses have been buoyed by unsustainable and/or non-innovative income sources that partially mask their true operating performance.

NASDAQ: TSLA

Key Data Points

One of the more prominent examples of a high-flying stock with abysmal earnings quality is Tesla (TSLA +0.00%). This member of the "Magnificent Seven" is North America's leading electric vehicle (EV) manufacturer and a business valued at $1.1 trillion, as of this writing.

Through the first half of 2025, Tesla generated $2.138 billion in pre-tax income. However, $1.649 billion (77.1%) traced back to automotive regulatory credits given to the company for free by federal governments and net interest income (interest earned on cash less interest paid on debt). President Trump's "Big, Beautiful Bill" will eliminate Tesla's automotive regulatory credits in the U.S.

For a company expected to be a market leader, Tesla has been consistently reliant on income sources that have absolutely nothing to do with selling EVs and its energy generation and storage operations. To boot, earnings-per-share (EPS) estimates for future years have been falling with some level of consistency for nearly three years.

NASDAQ: PLTR

Key Data Points

It's a somewhat similar story for red-hot artificial intelligence (AI) stock Palantir Technologies (PLTR +6.75%). Palantir's sought-after AI-driven software-as-a-service Gotham and Foundry platforms are delivering sizzling growth, with full-year sales now projected to climb by 45% in 2025.

But one of the interesting quirks about Palantir is that it generates a sizable percentage of its pre-tax income from interest earned on its cash. Though I'm not faulting Palantir for bringing in $106.7 million in interest income through the first six months of 2025, it's worth noting that this represents more than 19% of its pre-tax income.

A company that's valued at a completely unjustifiable price-to-sales ratio of 135 should be doing all the talking with its operating performance. Instead, Palantir's trailing-12-month P/E ratio of more than 610 is being partially propped up by non-innovative interest income earned from its cash.

Tesla and Palantir aren't unique examples -- they just happen to be some of the most prominent businesses. If earnings quality remains poor or suspect, premium valuations can easily become the stock market's downfall.