Nvidia (NVDA 0.32%) has been one of the must-own artificial intelligence (AI) stocks since the arms race kicked off in 2023. It produced incredible returns in both 2023 and 2024, although 2025 has been a bit of a "slow" year for Nvidia's stock, rising around 35% so far.

However, all of that could change on Aug. 27 when Nvidia reports Q2 results. There is going to be some interesting commentary made regarding exports to China that could send shares soaring, especially with news of Nvidia paying a 15% export tax on its products. Still, the return of the Chinese markets for Nvidia cannot be understated, and I think it will be a massive catalyst for the stock following the results.

Image source: Getty Images.

Nvidia's domestic demand is growing

Nvidia makes graphics processing units (GPUs), which are the most popular computing units for performing difficult tasks, such as engineering simulations, mining cryptocurrency, and training AI models. Nvidia's dominance in the data center market share is incredible, with many estimates setting its market share at 90% or greater.

The data center market has been booming thanks to rising demand from AI hyperscalers, like Meta Platforms (META +0.47%) and Alphabet (GOOG +0.00%) (GOOGL 0.08%). During each company's Q2 earnings call, each told investors to expect capital expenditure growth for 2026, mainly focused on data center buildout. These data centers are being filled with high-powered computing units, with many of them coming from Nvidia.

NASDAQ: NVDA

Key Data Points

With this outlook rising, it bodes well for Nvidia's stock in the near and short-term, encouraging investors that domestic GPU demand is still strong.

But it's also looking strong overseas.

A unique deal to gain access to China could mean huge growth for Nvidia

In April, the Trump administration revoked Nvidia's export license for H20 chips, which were specifically designed to meet export restrictions to China. That caused Nvidia to miss out on $2.5 billion in revenue for Q1, but also required Nvidia to pull revenue guidance from H20 chips for Q2. Still, management projected 50% revenue growth to $45 billion for Q2, but that figure would have been 77% to $53 billion if projected H20 sales were included.

However, it seems like China's market is back in play with Nvidia's export license set to be approved, and the company likely needs to pay a 15% export tax on the GPUs it sells. This would eat into the margins Nvidia has on these chips, but some sales are better than no sales. Nvidia is well positioned to profit from the increased business in China, which will provide a boost for Nvidia.

We'll have to see what CEO Jensen Huang says regarding the progress of these deals and how they affect the company moving forward. Nvidia's Q3 has already started, so it won't be able to enjoy a full quarter of H20 sales, but it could still be a positive benefit to the company in the back half of the quarter.

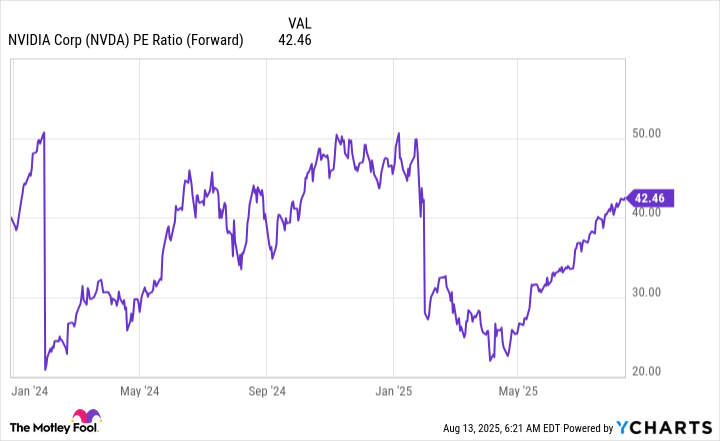

Nvidia has two positive growth catalysts going for it right now, and none working against it. This could cause management to guide for revenue reacceleration, which would likely send shares soaring. Additionally, Nvidia's stock may not be cheap, but it's still valued at a lower level than it was at this point last year.

NVDA PE Ratio (Forward) data by YCharts

This could open up the door to the stock popping following its earnings announcement, and buying shares today ensures that you get in on that action. However, I still think there's an excellent long-term investing opportunity here, and even if you wait until after the earnings announcement, Nvidia will likely maintain its status as one of the top stocks to buy.