AbbVie (ABBV 0.54%) became a stand-alone, publicly traded company when it split from its former parent, Abbott Laboratories, in 2013. The reason for the split was for each company to generate greater shareholder value by focusing on its main area of expertise, which, for AbbVie, is the development and marketing of pharmaceutical products.

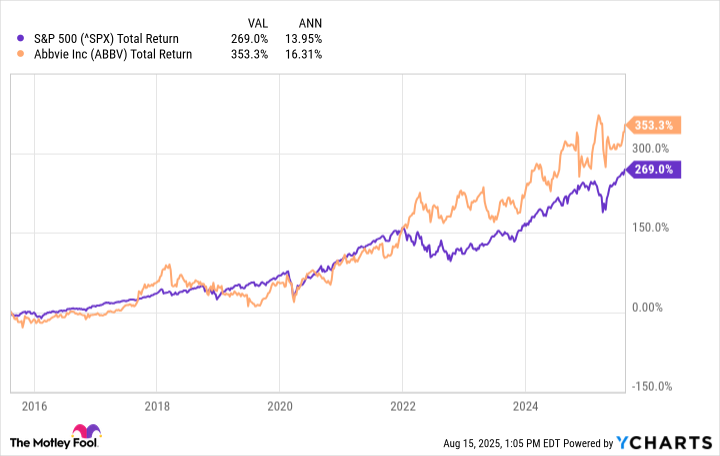

Did the move produce the desired effect? One way to determine whether it has is to check AbbVie's performance over the past decade against that of the broader market. Let's look into that, and also try to determine if AbbVie is a worthwhile investment.

Image source: Getty Images.

It's been a terrific investment

Over the past decade, AbbVie's shares have increased by 353.3%, or 16.3% annually, with dividends reinvested. That's significantly better than the performance of the S&P 500. If you had invested $1,000 in AbbVie 10 years ago, you'd have $4,530.75, compared to just $3,690.99 for the S&P 500.

How did AbbVie manage to pull that off? The most important asset the company had through this period was its immunology drug Humira. In the U.S. alone, it has been approved for 12 indications, including Crohn's disease, psoriatic arthritis, and plaque psoriasis. The medicine's sales consistently grew at a good clip, helping AbbVie generate stable financial results.

The drugmaker hit a speed bump in 2018, when Humira's patent expired in Europe and the company faced biosimilar competition there. Revenue from the blockbuster medicine dropped slightly, but due to continued momentum in the U.S., its sales began moving in the right direction again. Humira went on to become the best-selling medicine in the history of the industry, hitting a peak of $22.1 billion before losing patent protection in the U.S. in 2023.

The future is still bright

What's next for AbbVie, now that it's effectively lost the most important asset that allowed it to perform so well after splitting from Abbott?

The company is moving on thanks to two other immunology products, Skyrizi and Rinvoq. Both were first approved in the U.S. in 2019 and have since won various label expansions. Together, Skyrizi and Rinvoq significantly overlap with Humira's indications; in some cases, they're more effective than their predecessor. For instance, one study found that Skyrizi was more effective than Humira in plaque psoriasis.

Between them, Skyrizi and Rinvoq should more than fill Humira's shoes. Management predicts that the two will combine for $31 billion in sales by 2027, significantly surpassing the $22.1 billion Humira achieved at its peak. And AbbVie's next-generation immunology superstars should continue growing their sales for a long time after that -- they haven't even been on the market for a decade yet.

NYSE: ABBV

Key Data Points

That all paints a bright picture for the company's future, especially when considering the rest of its business. AbbVie closed its acquisition of Allergan for $63 billion in 2020, gaining access to key products, including its Botox franchise and schizophrenia treatment Vraylar. AbbVie's lineup features a range of other medicines that are helping drive top-line growth, such as Qulipta for migraine, and cancer drug Venclexta.

The company also has a deep pipeline and routinely expands it thanks to acquisitions or licensing deals. In March, it announced an agreement with Denmark-based Gubra A/S for the development of GUB014295, for weight management, an area of the pharmaceutical industry that's catching fire. This move may or may not pan out, but AbbVie's extensive pipeline should allow it to replenish its lineup before it has to deal with patent cliffs for Skyrizi and Rinvoq.

Lastly, AbbVie is an excellent dividend payer. The company has increased its payouts by 221.6% over the past decade and stands as one of the Dividend Kings, with 53 consecutive years of payout increases, including the time it spent under the wing of its former parent company. AbbVie also offers a juicy forward yield of 3.2%, much higher than the S&P 500's average of 1.3%.

AbbVie isn't done beating the market: The stock could still deliver over the next decade, especially for those who opt to reinvest the dividend.