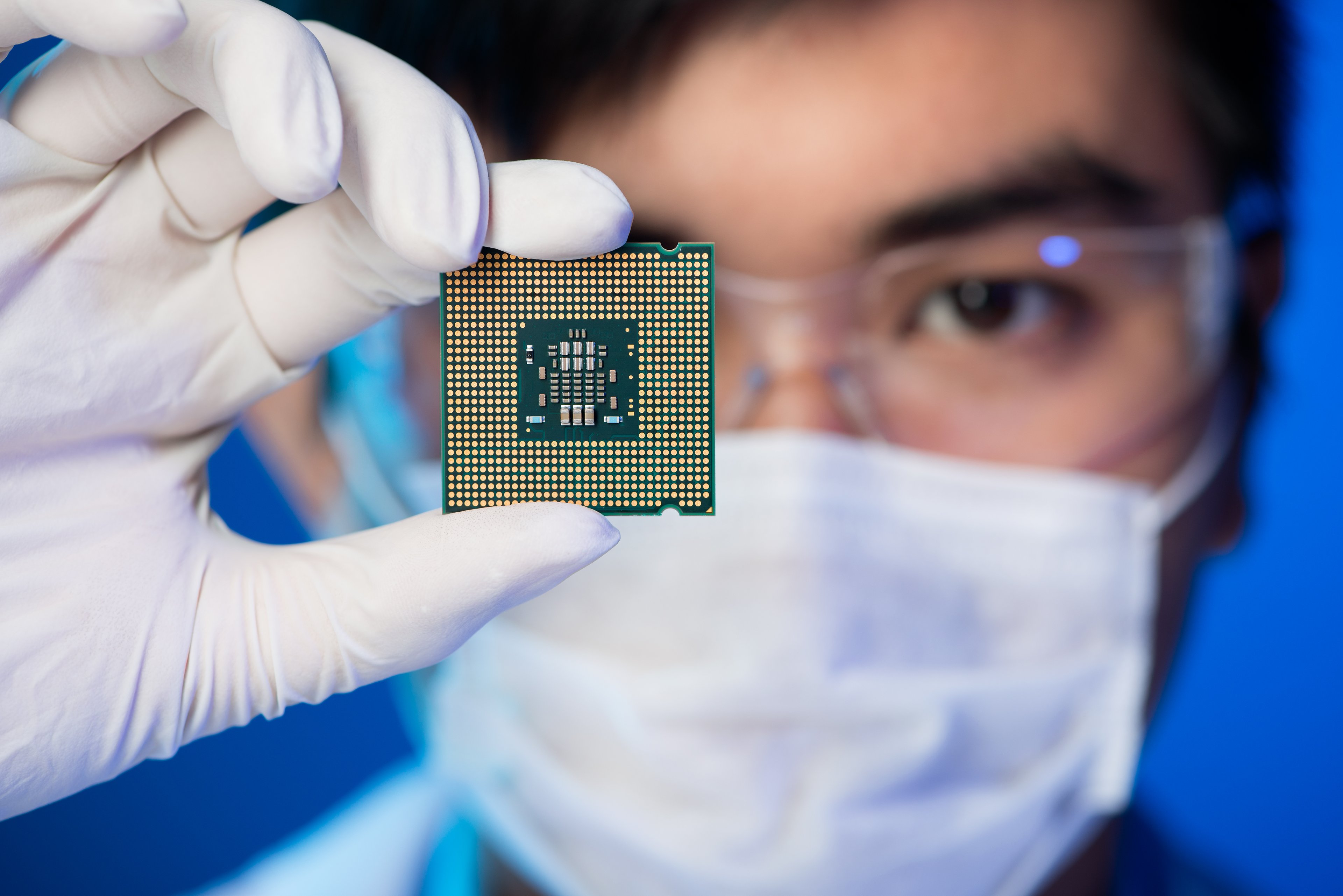

The average person may not be well-versed in what a semiconductor does, but there's a good chance that they unknowingly interact with them daily. Present in everything from smartphones to household appliances to cars to graphics processing units (GPUs), semiconductors (or "chips") are the unsung heroes of the tech world, acting as the brains in many technologies.

When it comes to semiconductor manufacturing, there's the appropriately named Taiwan Semiconductor Manufacturing (TSM +1.17%) -- also known as TSMC -- and then there's everyone else. TSMC pioneered the foundry model, where companies come to them with semiconductor designs and it brings them to life.

The one reason Wall Street has been obsessed with TSMC's stock, which has more than doubled the S&P 500 index's returns this year (through Aug. 15), is because of the stronghold it has on producing artificial intelligence (AI)-related chips.

NYSE: TSM

Key Data Points

If you think of end-use AI products that people interact with, such as finished cars, then the AI chips that TSMC produces would be like the engine. It's where the ecosystem all starts. And without TSMC's manufacturing ability, these cars would be about as effective as square wheels on a bicycle.

TSMC is by far the most effective chip manufacturer in the world, and it's not even close. That's why it has become the go-to manufacturer. As AI demand grows, so does the demand for data centers, which increases the demand for TSMC's advanced chips because they provide the necessary power needed to train and scale AI at the levels we're seeing today.

The company's market share in AI chip production is well into the 90 percent range. If you're looking to benefit from AI growth with a company that's operating in a virtual monopoly, TSMC should be your go-to as well.