At first glance, investors have cause to dismiss Advanced Micro Devices (AMD +4.35%) stock as expensive. Its trailing price-to-earnings (P/E) ratio stands at 102, far above rival and market leader Nvidia's 58 earnings multiple.

Nonetheless, the buy case for AMD stock becomes more solid upon closer inspection. Two charts show why one might want to consider AMD instead.

Image source: Getty Images.

Revenue growth and forward P/E hold the key for AMD

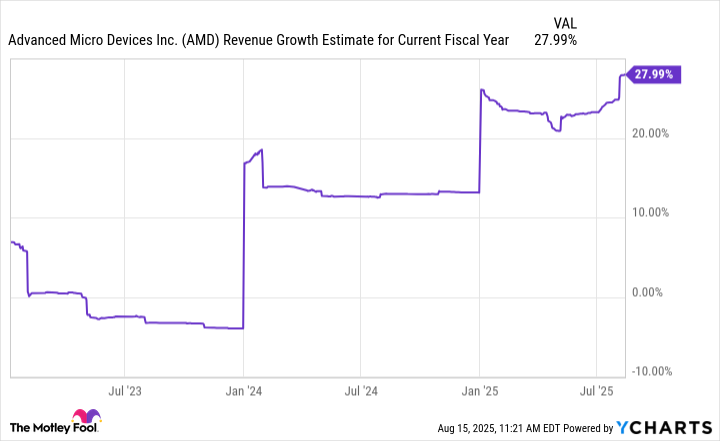

The first chart shows AMD's improving revenue growth. AMD, like other semiconductor stocks, operates in a highly cyclical business. Additionally, its four segments operate on different cycles.

Until recently, that dynamic hampered AMD's growth as its gaming and embedded segments continued to suffer through declining revenue growth. However, in the second quarter of 2025, gaming was the company's fastest-growing segment. Also, with embedded segment revenue falling by only 3%, it looks poised to recover.

This reflects favorably on its overall annual revenue growth. After being in decline as recently as 2023, revenue growth began moving higher in the following year. Now, analysts expect yearly revenue growth to come in at 28% for 2025, well above the 14% reported in 2024.

Data by YCharts.

Moreover, that revenue growth affects the second key chart, AMD's forward P/E ratio. Admittedly, that metric has shot higher since the stock has risen 125% from its April low. Still, AMD's forward multiple of 45 is more palatable amid the acceleration in revenue growth.

NASDAQ: AMD

Key Data Points

Data by YCharts. PE Ratio = price-to-earnings ratio.

Furthermore, AMD's MI400 artificial intelligence (AI) accelerator, which the company will release next year, has led industry insiders to believe it is a competitive threat to Nvidia's upcoming Vera Rubin platform. This is critical since Nvidia has dominated the AI chip industry, which is expected to grow at a compound annual growth rate (CAGR) of 29% through 2030, according to Grand View Research.

Thus, if the MI400 lives up to expectations, that not only makes AMD stock a bargain but also potentially sets it up for massive gains in the coming years.