Investing in the stock market is one of the most effective ways to build wealth, and exchange-traded funds (ETFs) can often be a safer and simpler alternative to investing in individual stocks.

An ETF is a basket of securities grouped together into a single fund. Rather than researching dozens of individual stocks to build a well-diversified portfolio, you can invest in just one share of an ETF to gain exposure to hundreds or even thousands of stocks across multiple sectors of the market.

When it comes to where, exactly, you should invest, everyone will have different needs. However, an S&P 500 ETF is a reliable option for those seeking a way to build life-changing wealth with minimal effort.

Image source: Getty Images.

Why invest in an S&P 500 ETF?

As the name implies, an S&P 500 ETF tracks the S&P 500 (^GSPC 0.24%) itself. From tech behemoths such as Apple and Nvidia to century-old brands such as Coca-Cola and Procter & Gamble, the companies within the S&P 500 are among the largest and strongest in the United States.

Because the S&P 500 includes only large stocks with a long track record of success, an S&P 500 ETF is more likely to survive periods of economic instability. While this fund may take a hit in the short term during a bear market or recession, the S&P 500 has managed to recover from every single downturn it's ever faced throughout history -- and chances are good it will continue that streak.

In fact, with a long-term outlook, research shows that you're all but guaranteed to make money with this investment. Analysts at Crestmont Research examined the S&P 500's long-term performance, and they found that every single 20-year period in the index's history has ended in positive total returns.

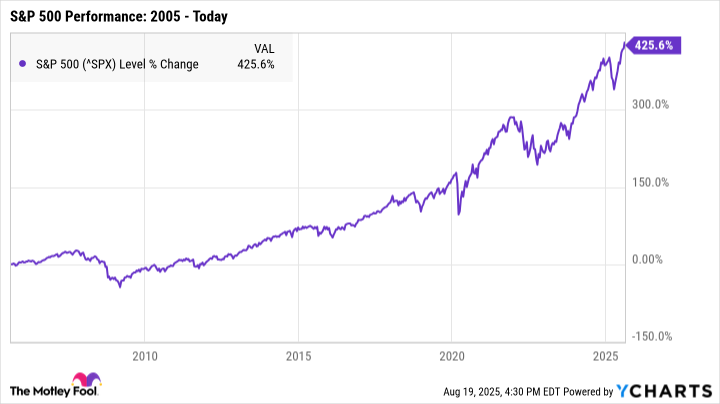

In other words, if you'd invested in an S&P 500-tracking fund at any point and held it for 20 years, you'd have made money. Over the past 20 years, the S&P 500 has generated returns of more than 425%. If you'd invested $10,000 exactly 20 years ago and made no additional contributions, you'd have more than $52,000 by today.

While all S&P 500 ETFs are similar in that they track the same index, there are some differences between funds. The Vanguard S&P 500 ETF (VOO 0.23%) is a particularly good choice because of Vanguard's long-standing track record of success, as well as the fund's low fees.

This ETF has an expense ratio of just 0.03%, meaning you'll pay $3 per year in fees for every $10,000 in your account. For comparison, the SPDR S&P 500 ETF Trust, a very similar fund, has an expense ratio of 0.0945%. While that may not seem like a significant difference, it could add up to thousands of dollars in fees over time.

How to build a $1 million portfolio

Although the Vanguard S&P 500 ETF is a relatively safe investment, it can still supercharge your savings with next to no effort on your part.

Index funds and ETFs are passive investments, meaning you never need to choose the stocks within the fund. They also perform best when given as much time as possible to grow, so it's ideal to start investing early to give your investment at least a couple of decades to build.

By getting started sooner, not only can you accumulate more over time, but you also won't need to invest nearly as much each month to see substantial results.

For example, say you have $300 per month to invest. Let's also say you're earning a 10% average annual rate of return on your investment, which is in line with the S&P 500's historic average. At that rate, here's approximately how much you could accumulate depending on how many years you have to invest.

| Number of Years | Total Portfolio Value |

|---|---|

| 20 | $206,000 |

| 25 | $354,000 |

| 30 | $592,000 |

| 35 | $976,000 |

| 40 | $1,593,000 |

Data source: author's calculations via investor.gov.

Time and consistency are your most valuable assets when investing in the stock market. The earlier in life you can get started, the easier it will be to generate wealth that will last a lifetime.

The Vanguard S&P 500 is an excellent investment option for those seeking a lower-risk approach to building long-term wealth. By getting started now and staying in the market for the long haul, this investment could set you up for life with minimal effort.