Fast-casual Mexican chain Chipotle (CMG +1.71%) reported its quarterly financials in July, and the report was a stunner -- not in a good way. The perennial winner in restaurant dining saw a sudden collapse in customer traffic and same-store restaurant sales growth, which hurt the company's profitability. Chipotle stock sank big time on the news and was down 37% from all-time highs.

Short-term blips in business performance can provide buying opportunities for long-term stock winners. Does this drawdown make Chipotle stock a can't-miss buy today?

Image source: Getty Images.

Losing customer traffic

Either due to macroeconomic factors or losing customer loyalty, Chipotle's store traffic declined last quarter, causing its per-restaurant revenue -- what's known as comparable store sales growth -- to decline 4% year over year. This is a huge change from Chipotle's post-pandemic same-store sales growth, which has ranged from positive 5% to 10% depending on the quarter.

One quarter of weak traffic is not the end of the world for a restaurant brand, but it is indicative of changing customer habits. After years of dominating market share gains, the fast-casual category has hit a speed bump and lost share to traditional fast food and casual dining brands, which are posting better traffic and comparable store figures than Chipotle.

NYSE: CMG

Key Data Points

What's more, for years shoppers in the United States have shifted from spending money on groceries to spending money at restaurants on pre-made food away from home. This trend has stalled due to inflation in recent quarters. A confluence of factors may have finally caused Chipotle to hit a growth wall. Now, its profit margins have begun to decline, as its comparable store sales growth is declining while input costs like food and labor are increasing due to inflation.

International expansion plans

Investors should keep a close eye on Chipotle's same-store sales figures. The metric may struggle for a few quarters due to macroeconomic factors, but it should -- and needs to -- recover eventually to help Chipotle get back to earnings growth.

As long as same-store sales growth recovers, what matters most for Chipotle over the long run is expanding the store count. Management believes it can eventually hit 7,000 stores in North America, which it is well over halfway to achieving. In the longer term, it plans to bring the Chipotle brand to new regions around the world. This includes Western Europe, the Middle East, and a new location in Mexico starting this year. One Mexican location is not going to revolutionize Chipotle's financials, but if an American-Mexican restaurant chain can succeed in Mexico, it can likely succeed in any country.

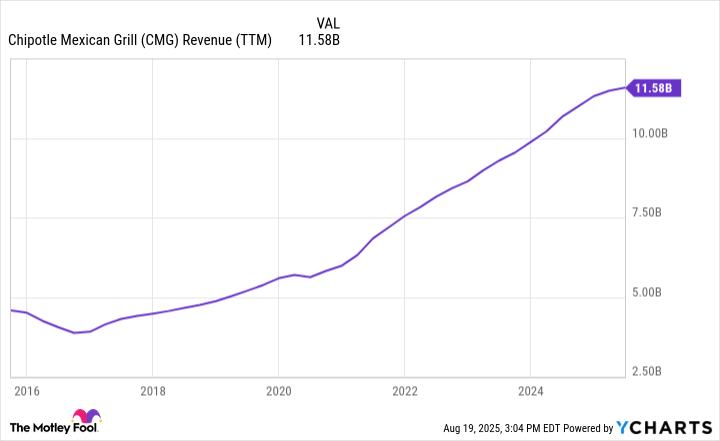

Pure global expansion could unlock a huge runway for Chipotle to keep growing in the years to come. Assuming its average restaurant volume can grow from $3.1 million to $3.5 million, 10,000 restaurants would equate to $35 billion in annual sales for the brand, or more than 3x today's levels.

CMG Revenue (TTM) data by YCharts.

Is Chipotle a can't-miss stock?

Chipotle trades at a market cap of $58 billion and a price-to-earnings ratio (P/E) of 38.5, which is not overly cheap even after this recent drawdown.

Assuming that the brand can maintain a 15% net income margin, Chipotle will eventually hit $5.25 billion in net income if annual sales through its locations hit my estimate of $35 billion. This will likely take 10 to 15 years to achieve, if not longer.

$5.25 billion in earnings would bring Chipotle's P/E ratio down to around 10, which is a cheap level for a high-quality restaurant concept that has historically managed to grow at or above inflation. However, that P/E ratio will not arrive for many years, which should keep investors nervous about buying the stock. Despite this latest stock drop, Chipotle is not a home-run buy for investors at today's stock price.