Palantir (PLTR +2.31%) has had a banner year, with its shares doubling so far in 2025. However, it has had a rough few days recently, and its stock is now down by nearly 15% from its peak. Still, the first part of the year was so strong that it can fall by nearly 15% and still have more than doubled year to date. That's quite impressive. And some investors may be thinking this month's slide offers them a chance to get in on one of 2025's most successful stocks at a more reasonable price.

So, should you buy Palantir's stock on the dip? Or is there something else going on here?

Image source: Getty Images.

Palantir's customer base is rapidly expanding

Palantir provides artificial intelligence (AI)-driven data analytics solutions -- complex software tools that are being employed by governments and businesses worldwide. Essentially, they take in all of a client's data streams, process them using AI, and provide users with insights about their best possible courses of action. Palantir also provides AI automation with AI agents through its Artificial Intelligence Platform (AIP) product.

Initially, Palantir marketed its software to government entities, where it found great success. Eventually, it expanded into the commercial sphere, where it's also seeing strong adoption. Particularly in the U.S., Palantir is seeing massive growth in commercial use cases. In Q2, its U.S. commercial customer count rose 64% year over year to 485, and U.S. commercial revenue rose 93% to $306 million. Comparatively, its international commercial revenue hasn't been all that strong.

NASDAQ: PLTR

Key Data Points

This indicates a few things. First, Palantir has a ton of room to expand. Its base of just 485 clients isn't that large compared to its potential target market. Plenty more growth is possible. Second, Palantir's services are fairly expensive. When Q2's revenue is annualized, it indicates that those 485 customers spend an average of $2.5 million apiece annually. That limits the platform's audience to larger businesses. So, while Palantir may have a ton of room to grow, the reality is that not every business is a likely target for Palantir. Still, there are a massive number of businesses that could eventually become its clients.

Even though Palantir's government business is mature, it's doing phenomenally well. In Q2, government revenue rose 49% year over year to $553 million. That outpaced Palantir's global commercial business, which increased at a 47% clip to $451 million. So even though most onlookers may think the AI buildout is commercial-centric, the reality is that governments worldwide are also expanding their AI capabilities.

Palantir has a lot going for it, and it has lately been one of the fastest-growing stocks on the market. If that was all the information you had to go by, you might think it would be smart to buy Palantir's stock on the dip. However, there is one more important factor investors need to consider: its valuation.

Palantir's stock is priced at a premium

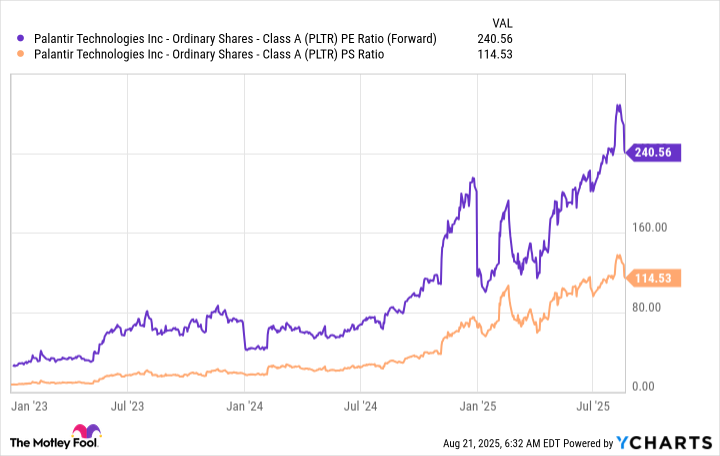

Even the best companies bought at the wrong prices can turn out to be lousy investments. Palantir falls into this category for me, as it trades at a lofty 241 times forward earnings and 115 times sales.

PLTR PE Ratio (Forward) data by YCharts.

It's rare to see any company trade for more than 50 times expected forward earnings, and even rarer for a software company to trade above 30 times sales. Yet Palantir is nowhere near these reasonable benchmarks.

This tells me that Palantir has years of anticipated growth baked into its current stock price. Even if Palantir grew its revenue over the next three years at a 50% compound annual rate, its P/S ratio would be 32 at today's stock price. It would be a tall order for Palantir to deliver that level of growth for that long, and even if it did, the stock would still be expensive.

As a result, I don't recommend buying Palantir stock on this dip. It still has a long way down to go before it would start to look attractively priced, and in the meantime, there are far better AI investing opportunities available.