One of Berkshire Hathaway (BRK.A 0.03%) (BRK.B +0.14%) CEO Warren Buffett's best investments of all time was Apple (AAPL 1.81%). At one point, Apple stock made up about 50% of Berkshire's investment portfolio. However, Buffett started selling off Apple stock in fourth-quarter 2023, and he has steadily decreased his position ever since.

He didn't sell any from third-quarter 2024 until now, so this further selling is noteworthy for Berkshire and Buffett. The question is, does Buffett know something that we don't, or is there something else going on here?

Image source: The Motley Fool.

Apple's stock is no longer cheap

Apple is the leading consumer tech brand in the U.S., and it has a strong customer base outside the U.S. as well. When Buffett first took a position in first-quarter 2016, Apple was an undervalued company despite its broad audience. That call turned out to be one of the best investments of Buffett's career, but to label Apple undervalued now is ignorant.

Apple's trailing price-to-earnings (P/E) ratio has climbed steadily over the past decade and is currently near its highest level.

AAPL PE Ratio data by YCharts.

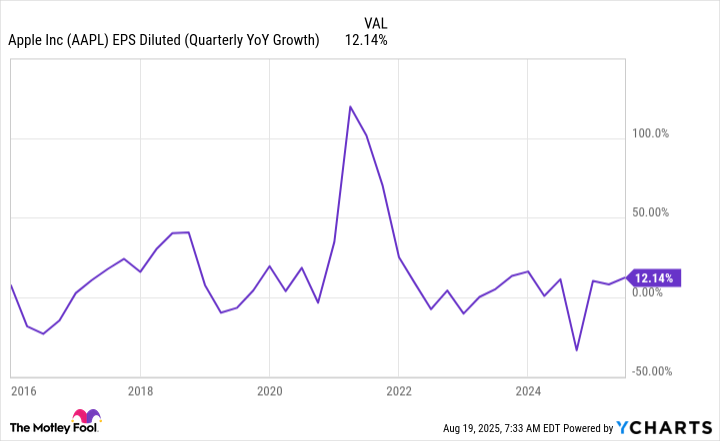

Over that same timeframe, Apple experienced some healthy growth, but it's currently growing at the same pace it was when it had a far more reasonable valuation.

AAPL EPS Diluted (Quarterly YoY Growth) data by YCharts.

Apple's stock is trading at a premium without the growth to back it up, and this is likely part of the reason Buffett is selling Apple stock. It's also telling that Buffett hasn't made any big purchases with the proceeds of his Apple stock sales, as it indicates that he likely sees most stocks trading at too expensive a premium to warrant buying now.

But there's also the thought that Buffett is setting up the portfolio for his successor.

Buffett may be freeing up more cash for the incoming CEO

At the end of the year, Warren Buffett will step down as Berkshire's CEO, and Greg Abel will succeed him. If Buffett gets the investment portfolio to a more balanced position and leaves him with a ton of cash, Abel will be able to run things as he sees fit without needing to undo a bunch of decisions that he may not have agreed with.

NASDAQ: AAPL

Key Data Points

With Berkshire's cash and short-term investments totaling $344 billion, Abel will have a massive cash pile to use to make investments.

Time will tell whether Abel follows in Buffett's footsteps or makes more aggressive or conservative decisions, but it's hard to imagine being more conservative than Buffett is with how much cash is on the balance sheet.

Apple is still a massive chunk of Berkshire's portfolio, making up about 22% of the total value. But its second-largest holding, American Express, makes up 19% of the total value, and it's not far off from overtaking Apple as Berkshire's largest investment.

Considering how expensive Apple is for its relatively slow growth, I wouldn't be surprised if there are a few more sales announced in the coming quarter. But we'll have to wait for another three months to find out about that. If you're an Apple investor sitting on huge gains, I think taking heed of Buffett's action is a smart idea, as there are far more attractive investment opportunities out there than Apple.