Clean energy is a long-running growth trend in the industrial sector. Hydrogen fuel cells have promise due to their ability to produce electricity with heat and water vapor as their only by-product. Plug Power (PLUG +1.66%) provides end-to-end hydrogen fuel and infrastructure, with hopes of becoming a clean energy giant, on par with ExxonMobil or Chevron in the oil and gas business. But it has been a tumultuous journey thus far. The company went public in 1999 and has done little aside from destroying value for its shareholders over the years.

The stock surged again in late 2021, but has fallen a breathtaking 97% from its high that year.

What continues to go wrong, and does Plug Power have a comeback in store that could make investors rich, perhaps even millionaires, if it can regain its prior peaks? Here is what you need to know about this controversial clean energy giant.

Image source: Getty Images.

A pioneer in the hydrogen fuel business

A ton of infrastructure is involved in the energy industry. Take the oil and gas industry, for example. There are billions of dollars in equipment to extract it from the ground, facilities to refine and store it, and thousands of miles of pipelines to transport it to people's homes or gas stations, so that you can fuel your vehicle.

NASDAQ: PLUG

Key Data Points

It's a similar story for hydrogen if it were to become prevalent in society. Plug Power, one of the first companies to lean into commercializing hydrogen as a fuel source, understands this. That's why the company has invested so much in the equipment and facilities to produce, transport, and distribute hydrogen and hydrogen fuel cells.

To date, Plug Power has deployed over 69,000 fuel cell systems and 250 fueling stations, with ongoing plans to develop and construct facilities to produce hydrogen, hydrogen electrolyzers, and fuel cells over the coming years. Many of Plug Power's current customers use hydrogen cells to power forklifts to reduce their carbon footprint. The company aspires to build a clean highway system across North America and Europe that can power buses, trucks, and other vehicles that adopt hydrogen fuel technology.

Leading the way in hydrogen has come at a high cost, but there could be light at the end of the tunnel

So, why has the stock done so poorly? It's not that Plug Power can't find any customers. The company has generated $672 million in revenue over the past four quarters. The major problem is that Plug Power's journey to build out its hydrogen ecosystem has been very costly. The company has continually lost money, and those losses have only deepened as the business grows.

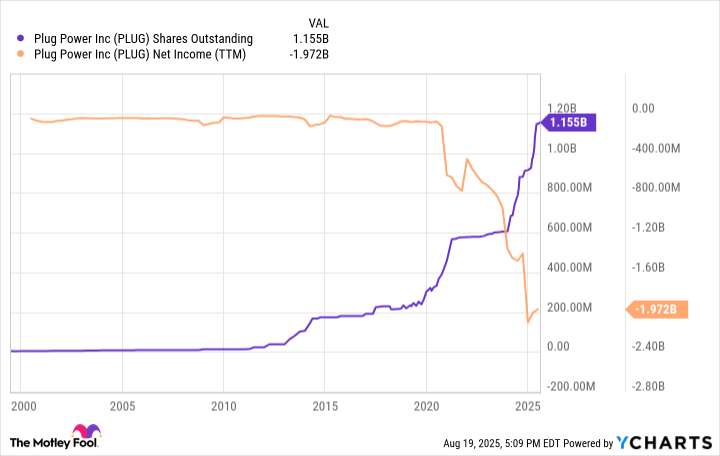

Management has had to issue more and more stock to raise funds, heavily diluting shareholders in the process. Plug Power's share count has roughly quadrupled since 2020 alone.

Data by YCharts.

The company is working to turn things around. It plans to cut $150 million to $200 million from its annual costs. Additionally, Plug Power will continue to grow as it completes ongoing projects and those investments level off. Management is targeting profitability on an operating basis by the end of 2027 and overall profitability by the end of 2028.

Can Plug Power go from nearly a zero to a millionaire maker?

Plug Power's market cap is just under $2 billion today. If it can emerge as a sustainable business and industry leader, there could be something here. The hydrogen market is worth an estimated $225 billion today and growing, and Plug Power's sprawling business operations could enable it to pursue much of that.

But before investors get too excited, there are some big hurdles ahead. The company only has $336 million in cash on its balance sheet, versus $991 million in debt. The business has burned over $819 million in cash over the past four quarters. It seems likely that Plug Power will need to raise quite a bit more money over the next few years, regardless of whether the company meets its profitability milestones on time.

The stock trades at just $1.50 per share, so any new stock offerings will continue to dilute investors. Even if Plug Power's business succeeds in the long run, I'm skeptical that investors will experience much prosperity after so much dilution. Unfortunately, Plug Power's poor returns from years past are likely an indicator of its future.