Amid competition in the cruise line industry, investors seem to have overlooked Royal Caribbean (RCL +6.28%). The larger market share of Carnival and the relatively recent IPO of Viking Holdings seem to have overshadowed it.

Nonetheless, Royal Caribbean stock has doubled over the last year, and given its strength and market positioning, it might be time for investors to take a closer look at the cruise line.

Image source: Getty Images.

Royal Caribbean's market positioning

Longtime investors might recall how the former General Electric CEO, Jack Welch, proposed the "number one or number two" strategy, meaning the largest and second-largest companies in an industry stood the strongest chances of success and profitability.

If one believes this, Royal Caribbean's No. 2 position in the market should fit this strategy. The owner of the Royal Caribbean, Celebrity, and Silversea cruise lines claims 27% of all cruise passengers, according to Cruise Market Watch. This is second only to Carnival, which holds a 41.5% market share.

Moreover, Royal Caribbean seems unaffected by the economic concerns that have cast doubt over other industries. Bookings continued to accelerate in the second quarter of 2025, taking occupancy to nearly 110% for the first half of the year. The industry defines 100% capacity as having two people in every cabin.

Amid these full cabins, the company has invested in adding ships to its fleet. In the second quarter of 2025, capacity grew by 5.8% compared to year-ago levels as it debuted a new ship. The company also plans to launch two additional ships later this year to help meet this higher demand.

NYSE: RCL

Key Data Points

Royal Caribbean's financial condition

Rising bookings also mean that it has to offer fewer discounts to fill cabins, boosting its top and bottom lines. In the first half of 2025, revenue of more than $8.5 billion rose 9% compared to the same period last year.

Additionally, the company kept cost and expense growth in check. With that, it earned more than $1.9 billion in net income attributable to shareholders in the first two quarters of 2025. During the same timeframe in 2024, it reported just over $1.2 billion in net profit.

This helps significantly in addressing Royal Caribbean's most daunting financial challenge -- total debt. During the pandemic, governments forced Royal Caribbean and its peers to lock down, forcing them to run up massive debts to stay in business.

As of the end of Q2, Royal Caribbean holds $19 billion in total debt, well above its $9.4 billion in shareholders' equity. Still, that is a significant improvement over the nearly $24 billion in total debt it held at the end of 2022.

Also, very little of that debt is due in 2025, lessening the likelihood Royal Caribbean will have to refinance maturing debt at higher interest rates. Furthermore, it paid off this debt while still adding ships to its fleet, meaning the company has handled its heavy debt burden well.

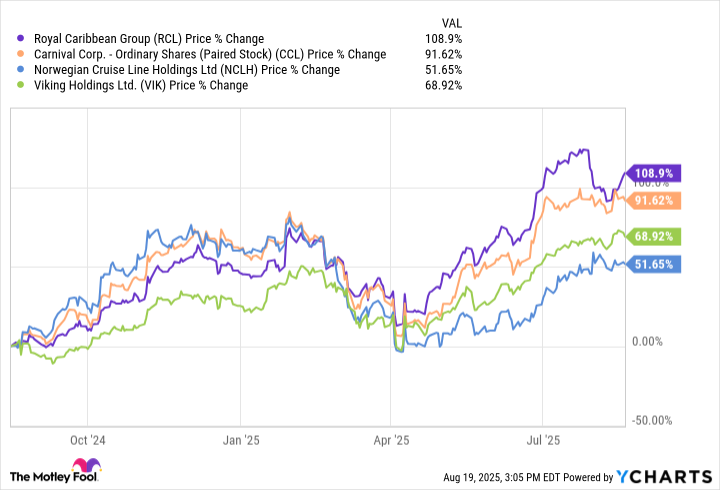

Investors have begun to take notice. Consequently, Royal Caribbean stock outperformed its peers over the last year, including Viking.

Still, with those higher returns, investors will pay a modest premium for this stock. Royal Caribbean's P/E ratio of 24 is the highest in the industry. Still, with an average P/E ratio of 30 for the S&P 500, it might be worth paying up to own this stock.

Moving forward with Royal Caribbean stock

If you invest in the cruise line industry, Royal Caribbean stock belongs on your watch list and arguably, your portfolio as well.

Indeed, Royal Caribbean carries considerable debt, and investors will pay a modest premium for this stock.

Nonetheless, despite an uncertain economy, it continues to book cruises at more than 100% capacity. Moreover, it has a proven ability to retire debt as it comes due, all while adding ships to help meet the robust demand for cruise vacations.

Thus, it benefits from a virtuous cycle of rising profits, higher stock prices, and an improving balance sheet. If one invests in the travel industry, these are all good reasons to talk about and possibly add Royal Caribbean stock to one's portfolio.