One of famed investor Warren Buffett's principles is to buy shares of wonderful companies at fair prices to hold for the long term. Let's try to use it to decide whether Intuitive Surgical (ISRG 0.91%), a medical device specialist, is worth investing in today.

The healthcare giant certainly appears to be a wonderful company. Intuitive Surgical is helping revolutionize medicine through innovations in robotic surgery. The company's da Vinci system, the first robotic-assisted surgery (RAS) device to be cleared in the U.S., is the runaway market leader.

Intuitive Surgical generates consistent revenue, profits, and cash flow. It even benefits from a moat thanks to intangible assets (patents that grant it some degree of pricing power) and switching costs -- its devices are expensive to buy and to train medical staff on, making the prospects of switching to a competitor almost prohibitively expensive. Strong cash generation and a moat are two key attributes that Buffett loves.

However, bears might point out several other aspects that make the stock appear less attractive.

Image source: Getty Images.

Why Intuitive Surgical's shares could fall

Intuitive Surgical is facing several headwinds. First, tariffs are already affecting its financial results. We can't be sure that President Donald Trump's aggressive trade policies will remain in place even after he leaves office, but currently, they pose a threat to the company's prospects.

Second, Intuitive Surgical will face increased competition in the years to come. Medtronic is close to launching its RAS device, the Hugo system, in the U.S., and it will compete directly with the da Vinci system in urologic procedures. Johnson & Johnson is testing its Ottava system in gastric bypass, another indication where the da Vinci system is already cleared.

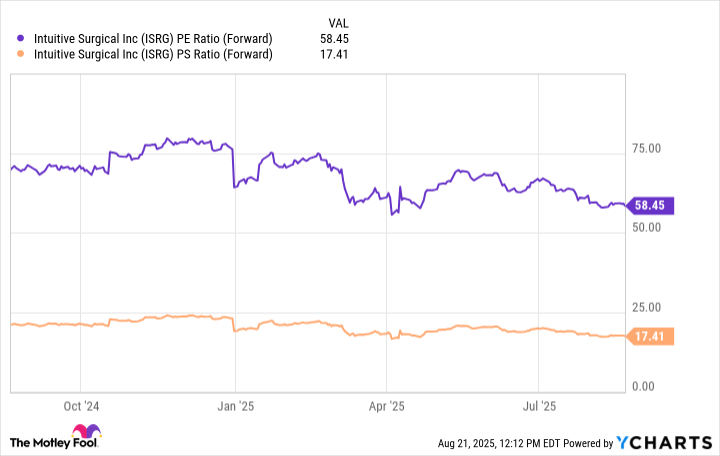

Third, despite the company's underperformance this year, Intuitive Surgical's shares appear expensive based on some traditional valuation metrics:

ISRG PE Ratio (Forward) data by YCharts.

For context, the average forward price-to-earnings (P/E) ratio for the healthcare sector is 16.6. Also, I often look for a forward price-to-sales (P/S) of 2 or below to consider a healthcare stock undervalued. At these levels, and given the challenges Intuitive Surgical is currently facing and may face in the future, can the company still deliver superior returns to investors who initiate positions today?

Is the stock worth the premium?

It's worth noting that Intuitive Surgical's valuation seems more reasonable when considering its price-to-earnings-to-growth (PEG) ratio of approximately 2.2. While it's still above the S&P 500's average of 1.5, a stock performing as well as Intuitive Surgical deserves a premium.

And despite the threat of tariffs, the company continues to post excellent financial results. In the second quarter, revenue increased by 21% year over year to $2.44 billion. Non-GAAP (adjusted) earnings per share came in at $2.19, 23% higher than the year-ago period. Trailing-12-month free cash flow soared by 240% to almost $2 billion. Intuitive Surgical delivered second-quarter results of this caliber, and should also post strong earnings for the full calendar year despite an expected 1% impact from tariffs on its top line.

NASDAQ: ISRG

Key Data Points

What about the company's other challenges? While competition will become more fierce, there's more than enough room for multiple winners in the RAS market; the industry is severely underpenetrated. Thanks to RAS devices, surgeons can perform minimally invasive procedures that benefit everyone. For patients, this means less skin cutting, less bleeding, and fewer scars. For both patients and hospital systems, this can translate into shorter hospital stays.

Despite these advantages, robotic procedures are still far from achieving widespread adoption for eligible indications. This means there's massive long-term growth potential. Intuitive Surgical's moat should allow it to remain the leader here. Its first-mover advantage counts for something: The company already has a long list of approved uses for its devices -- which competing RAS systems will take time to catch up to, even after they hit the market -- and a large installed base of more than 10,000 da Vinci systems.

So what's the verdict? Intuitive Surgical's shares aren't exactly cheap. But the stock is worth the premium and can still deliver above-average returns, so long as investors stay the course for at least five years.